URGENT: Once in a LIFETIME Stock Market Event IS HERE

Summary

TLDRThe video highlights a unique stock market opportunity during the Q4 2024 election cycle. The speaker discusses the potential for volatility and uncertainty leading up to the election, but remains optimistic about a bull market in the short term. He suggests strategies like selling 30 Delta covered calls to capitalize on moderate market rises of 3-5%. Additionally, he emphasizes the importance of investing in high-quality stocks like Nvidia, Apple, and Walmart, while avoiding holding too much cash. The speaker also offers one-on-one coaching for portfolio growth, targeting determined individuals with substantial capital.

Takeaways

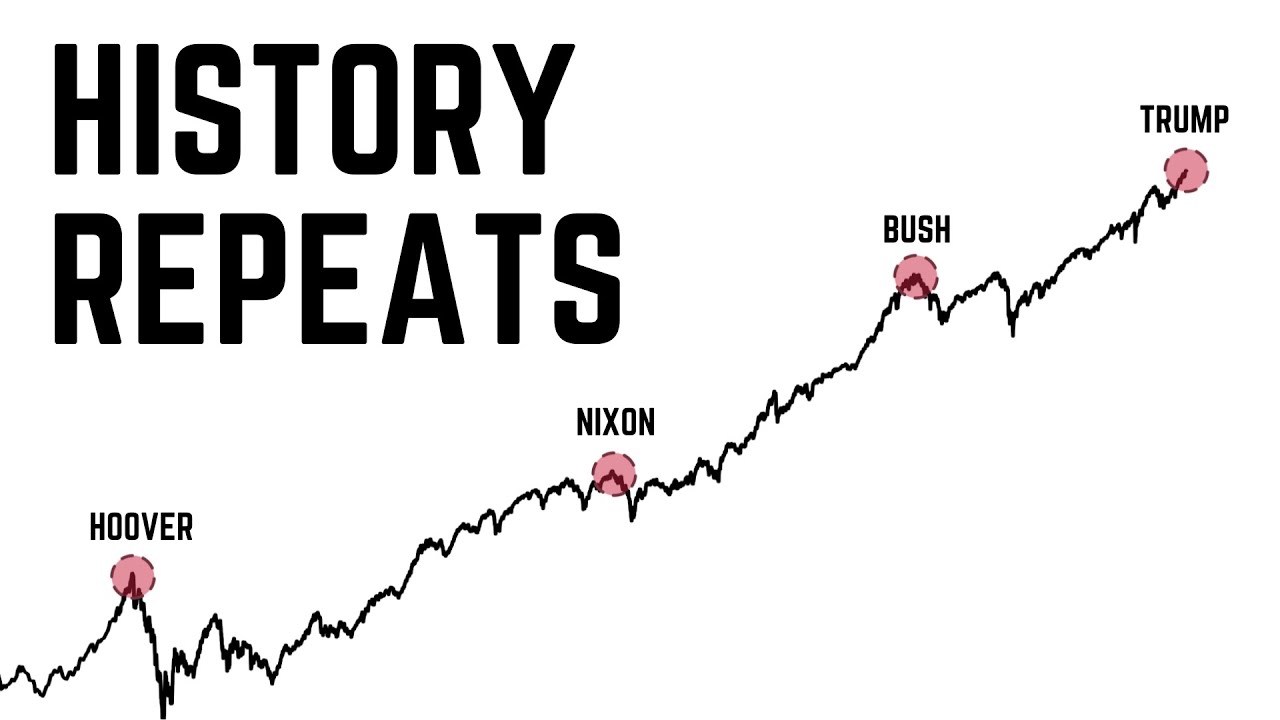

- 💡 The stock market presents a unique opportunity due to the upcoming election, with a potential bull market in Q4 2024 and into 2025.

- 📈 While the market has been volatile, data shows a positive trend historically for post-election rallies, especially in November and December.

- 🤔 Tom Lee of Fundstrat describes the short-term market direction as a coin flip, but the speaker believes the market will rise by 3-5% in Q4.

- 💰 A recommended strategy is selling 30 Delta covered calls to capitalize on moderate market gains and collect premiums, maximizing returns.

- 📉 Inflation is no longer a front-line concern, though the government may be manipulating CPI data, creating perceived stability in prices.

- 🚀 Despite short-term volatility, the overall sentiment suggests a bull market. High-quality stocks like Nvidia, Palantir, and Apple are top picks.

- 🧠 Many hedge fund managers are cautious due to fears of a recession, but the market's strength indicates resilience and potential growth.

- 🎯 The speaker emphasizes keeping portfolios simple, with 10-15 high-quality stocks and moderate bullish strategies like covered calls and leaps.

- ✈️ American Airlines is highlighted as an overlooked stock with strong returns, suggesting investors focus on trends and undervalued stocks.

- 📊 Diversification and focusing on long-term, high-quality investments rather than chasing quick profits are key to steady portfolio growth.

Q & A

What is the unique opportunity in the stock market mentioned in the transcript?

-The unique opportunity is related to the upcoming election and its potential impact on the stock market, suggesting a bull market in Q4 2024 and leading into 2025.

What is Tom Lee's opinion on the short-term stock market performance after the Fed's jumbo cut?

-Tom Lee believes that the market's performance in the next month is uncertain, likening it to a coin flip, due to repositioning and the upcoming election.

Why do wealth managers and family offices hesitate to commit capital until after the election?

-They want to wait for the election event to pass, regardless of who wins, to avoid the uncertainty and volatility it brings to the market.

What is the typical market behavior after election day according to the transcript?

-The transcript suggests that there is often a 'dash to the finish' after election day, with November and December typically seeing strong market rallies.

What is the suggested investment strategy for the current market conditions?

-The suggested strategy is to sell covered call options, particularly 30 Delta covered calls, to take advantage of the expected bull market while also collecting premiums.

What does the term 'Poor Man's Covered Call' refer to in the context of the transcript?

-It refers to buying a cheaper leap option that mimics the effect of owning shares, which is another strategy suggested for the current market.

Why does the speaker believe that inflation is not accurately represented in the CPI basket?

-The speaker argues that the government is manipulating the CPI basket by substituting goods like beef with cheaper alternatives like chicken to artificially lower inflation figures.

What is the speaker's prediction for the stock market rise in Q4?

-The speaker predicts a moderate rise of between 3 to 5% in the stock market in Q4.

What are the three moderately bullish strategies recommended in the transcript?

-The three strategies are selling covered calls, buying leap options (Poor Man's Covered Call), and investing in high-quality companies.

Why does the speaker advise against holding cash during this period?

-The speaker advises against holding cash because they believe it's a once-in-a-lifetime opportunity in the market and that there is significant money to be made by investing.

What is the speaker's view on the importance of portfolio diversification?

-The speaker emphasizes the importance of having a diverse portfolio of 10 to 15 stocks to avoid over-concentration and to take advantage of various market opportunities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

It’s Happening Again.

拜登連任機會大跌,特朗普再做總統。美國大選如何影響股市? [ENG+中文CC]

Snowflake Is PLUNGING | Did the AI Bubble Just POP?

How do elections impact stock market? | Elections 2024

Bad News for the Next US President (my final thoughts on the US Election)

Down 23% & 4.5% Dividend Yield | This Dividend Stock is ON SALE!

5.0 / 5 (0 votes)