Compound Interest Explained in One Minute

Summary

TLDRThe script compares the investment strategies of John and Lisa, who both invest $1,000 at a 10% annual interest rate. John withdraws his $100 interest each year, leaving him with $4,000 after 30 years. Lisa reinvests her interest, earning compound interest, and accumulates $17,449.40, illustrating the power of compounding over time.

Takeaways

- 🏦 John and Lisa both invest $1,000 in a bank offering a 10% annual return.

- 💸 John withdraws the interest each year, leaving his principal intact.

- 💰 Lisa reinvests her interest, allowing it to compound over 30 years.

- 🔢 After one year, John has $1,100, taking out $100 interest, leaving $1,000 principal.

- 📈 Lisa's account grows to $1,100 after one year, without withdrawing interest.

- 📊 In subsequent years, Lisa earns interest on the accumulated amount, not just the initial principal.

- 💲 By the 30th year, Lisa's account has grown to $17,449.40, significantly more than John's.

- 📉 John's account remains at $1,100 each year, taking out $100 interest, ending with $4,000 total after 30 years.

- 📚 The power of compounding is evident as Lisa's investment grows four times more than John's.

- 💡 The example illustrates the importance of reinvesting interest for long-term financial growth.

Q & A

What is the annual interest rate offered by the bank in the script?

-The bank offers an annual interest rate of 10%.

How much does John invest in the bank?

-John invests $1,000, which is referred to as the principal.

What does John choose to do with the interest earned each year?

-John chooses to spend the interest each year and keeps only the principal in the bank.

How much interest does John earn in the first year?

-John earns $100 in interest in the first year, which is 10% of his $1,000 principal.

How much money does John have in his account after 30 years if he withdraws the interest each year?

-After 30 years, John will have $4,000 in total, which includes his initial principal of $1,000 and the interest of $100 per year for 30 years.

What is Lisa's investment strategy compared to John's?

-Lisa chooses to save for 30 years without withdrawing the interest, allowing it to compound annually.

How does the interest earned by Lisa differ from John's after the first year?

-After the first year, Lisa earns interest not only on her initial $1,000 but also on the interest earned in the first year, resulting in more than $100 for the second year.

What is the formula for calculating the amount in Lisa's account after each year?

-The amount in Lisa's account after each year is calculated by taking the previous year's total and adding 10% of that total.

How much does Lisa have in her account after 30 years?

-After 30 years, Lisa has $17,449.40 in her account.

What is the difference in the final amount between John and Lisa after 30 years?

-After 30 years, Lisa has over four times more money than John, with $17,449.40 compared to John's $4,000.

What is the key concept illustrated by the difference in the final amounts between John and Lisa?

-The key concept illustrated is the power of compound interest, where reinvesting the interest can lead to significantly higher returns over time compared to withdrawing it annually.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.2

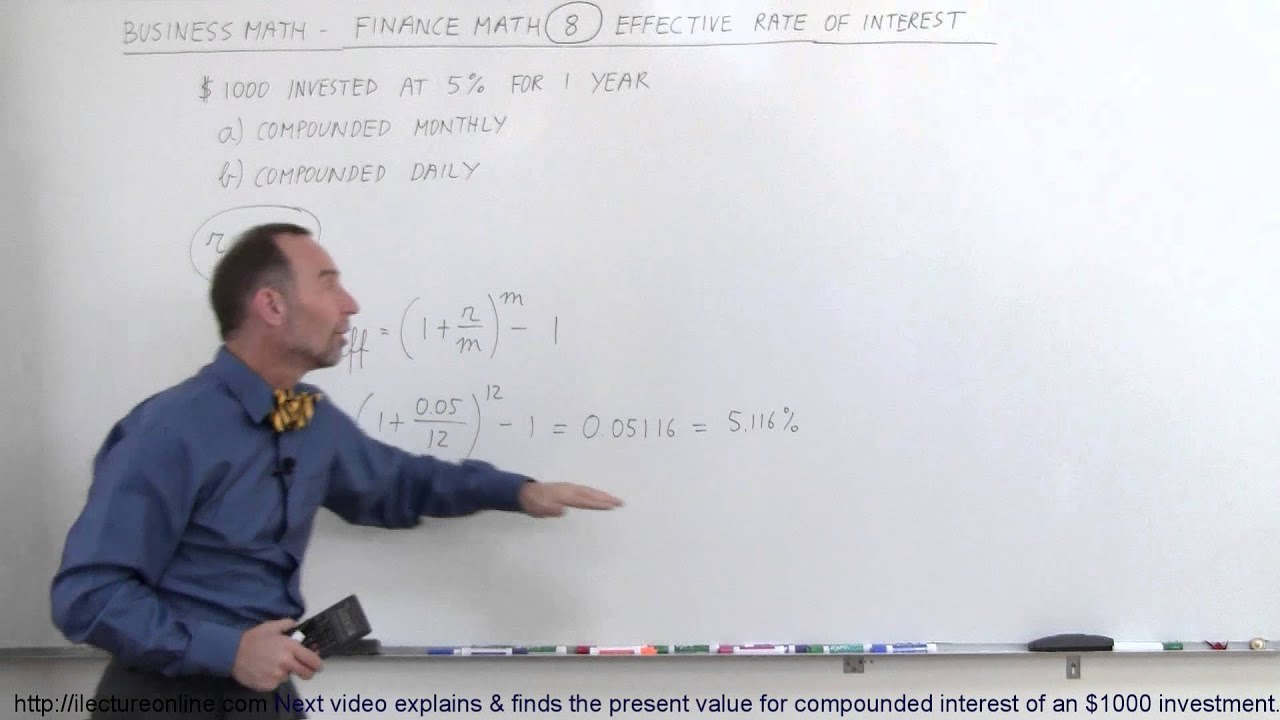

Business Math - Finance Math (8 of 30) Effective Rate of Interest

GCSE Maths - How to Calculate Simple Interest

Compound Interest (Higher & Foundation) | GCSE Maths Revision | GCSE Maths Tutor

This Is The Power Of Compound Interest (And How It Works)

BUNGA TUNGGAL DAN BUNGA MAJEMUK

5.0 / 5 (0 votes)