StockPro | EXPECT A GOOD MOVE IN THESE STOCKS TILL DIWALI

Summary

TLDRThe video script is a financial market analysis discussing the performance of various sectors and stocks. The host reviews market trends, focusing on metals and energy sectors, and highlights stocks with potential breakouts. They discuss specific stocks like HDFC Life and Hindustan Zinc, providing technical analysis and future price predictions. The host also emphasizes the importance of understanding market dynamics and staying updated with live market movements for successful trading.

Takeaways

- 📈 The speaker discusses the performance of various sectors in the market, highlighting the metal sector as the leading sector with a breakthrough past barrier.

- 🔋 The energy sector, particularly Tata Power, is noted for reaching a lifetime high, indicating a significant breakout.

- 💻 The IT sector is described as slightly slow, but there is a possibility of support and breakout, suggesting potential movement in IT stocks.

- 📊 The Nifty and Bank Nifty are mentioned to be at a lifetime high, cautioning about divergence and the importance of being aware of market movements.

- 🚀 The speaker shares their radar with specific stocks, emphasizing that these are not recommendations but rather observations from their study.

- ✏️ The speaker emphasizes the importance of daily study and not relying on luck or quick decisions when it comes to trading stocks.

- 💡 The metal sector is discussed in detail, with a focus on how it has broken past resistance and closed near a past resistance level.

- 📉 There is a mention of a divergence level in the IT sector, indicating a potential area for breakout or support.

- 💹 Stocks like ADFCL and Bush are highlighted for their breakout potential, with specific price levels and targets provided for trading.

- 📝 The fundamentals of NLC India and Enthanol Warehousing Limited are discussed, including their business operations, growth, and financial performance.

- 📈 The speaker provides a price study for NLC India, suggesting potential targets if certain price levels are breached.

Q & A

What is the primary topic discussed in the script?

-The primary topic discussed in the script is stock market trading, focusing on various sectors, stocks, and trading strategies.

What does the speaker suggest for traders who have made profits?

-The speaker suggests that traders who have made profits should like, share, and subscribe to the channel for more content.

What sectors are mentioned as leaders in the script?

-The script mentions the Metal sector and the Energy sector, with Tata Power hitting a lifetime high, as leaders.

What is the speaker's approach to recommending stocks?

-The speaker emphasizes that she studies daily and shares what she sees without guarantee, focusing on providing insights rather than specific recommendations.

What is the significance of the 'study' mentioned by the speaker?

-The 'study' refers to the speaker's daily analysis of the market, prices, and trends to identify potential opportunities or risks in stocks.

What is the speaker's view on the NIFTY index?

-The speaker discusses the NIFTY index, noting its gap-up opening, touching 26,000, and suggesting a cautious approach due to the high level reached.

What are the two stocks the speaker has picked for potential breakouts?

-The two stocks picked for potential breakouts are ADFCL (ADFC Life) and HUL (Hindustan Unilever).

What is the significance of the 'double top' and 'open interest' mentioned in the script?

-A 'double top' is a technical analysis term indicating a potential reversal pattern, while 'open interest' refers to the number of outstanding derivatives contracts, which can signal market sentiment.

What advice does the speaker give regarding the IT sector?

-The speaker suggests being cautious about the IT sector, mentioning potential support levels and the possibility of a breakout if certain levels are breached.

What is the speaker's strategy for selecting stocks to discuss?

-The speaker selects stocks based on their study, looking for stocks that have shown promise or have reached significant levels, such as lifetime highs or support levels.

What is the importance of 'diversification' in the context of the script?

-Diversification is implied as a prudent strategy when the speaker discusses various sectors and stocks, suggesting that spreading investments across different sectors can mitigate risk.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Bazaar Aaj Aur Kal |Tomorrow's Market Mood: Where Are the Profits Hidden?

5 வருஷமா consolidation-ல் உள்ள பங்கு இன்னிக்கு நடந்த பெரிய deal | Wipro-dell IT index 1000 pts ஏற்றம

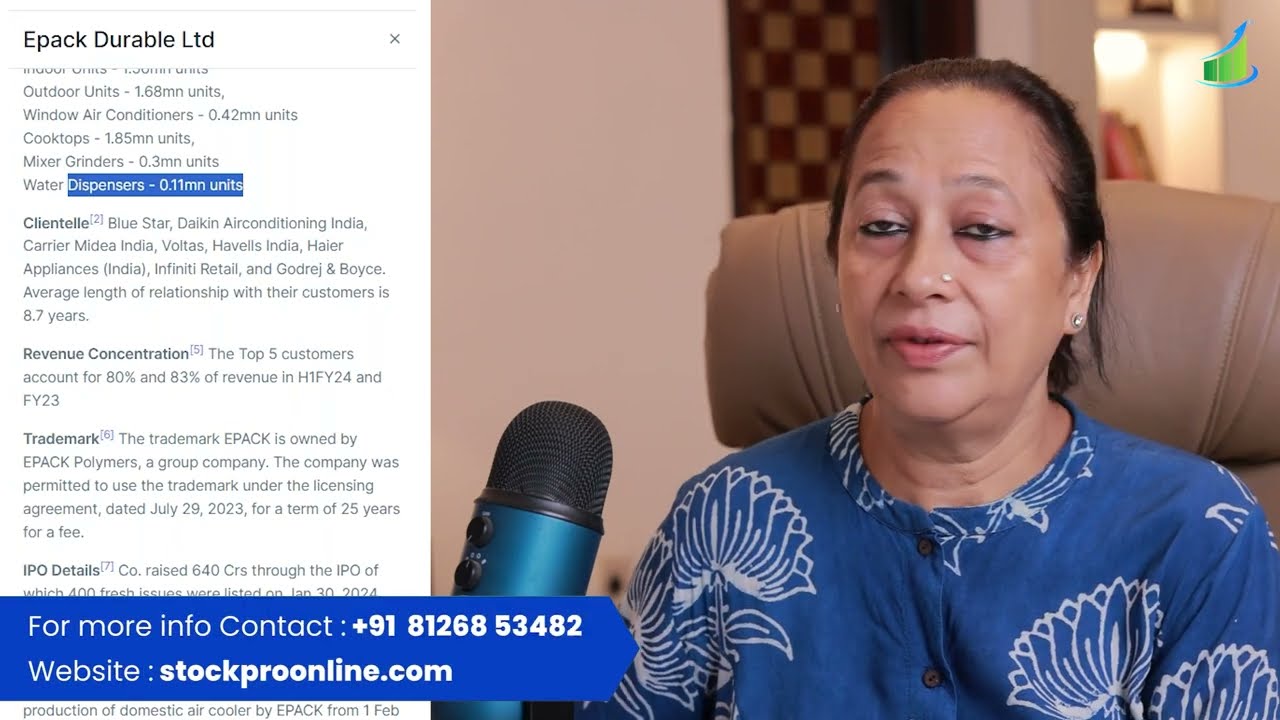

StockPro | 4 IPO STOCKS WITH STRONG BUILDUP'S ON RADAR

जो HOLD करेगा, पैसा बनायेगा! 🔴🔴 BEST LARGE CAP STOCKS 🔴 BEST LOW RISKY HIGH REWARDING STOCKS 🔴

Top 4 Undervalued Stocks | Top 4 Stocks at 52 Week Low | Best 4 Stocks at 200 DMA | Strong Portfolio

BEST STOCKS FOR SHORT TERM? 🔴 HIGH GROWTH STOCKS TO BUY NOW? 🔴 BEST PORTFOLIO STOCKS TO BUY NOW? 🇮🇳

5.0 / 5 (0 votes)