【補足給付金と定減: まずココだけ!!】給付金と定額減税/ 給与所得者・公的年金等の受給者・事業所得者の場合/ 給付金の算定/ 住宅ローン控除の場合/ 厚労省の支援策/ 詐欺にご注意ください

Summary

TLDRIn this video, a small business consultant breaks down the latest government measures, focusing on low-income tax reductions and supplemental benefit payments. The video covers details of financial relief for individuals, freelancers, and small business owners, highlighting eligibility criteria and potential benefits such as 10,000 yen in direct payments for qualifying households. Additionally, it discusses how tax reductions will be applied, especially for low-income groups and those unable to fully benefit from these reductions. The video also addresses common questions and concerns about how these programs will be administered in 2024.

Takeaways

- 😀 The video focuses on low-income prefectural taxes, supplemental benefits, and points regarding tax reductions and payouts that individuals, freelancers, and small business owners should be aware of.

- 😀 The government is providing various benefits based on income levels, including subsidies for households with low income, and an additional payout for families with children under 18.

- 😀 In addition to tax reductions, there are supplementary payments for people who cannot fully benefit from the low-income tax reduction, and these payments are based on the difference between the tax reduction amount and the actual tax payable.

- 😀 The key feature of the low-income tax reduction is that individuals who fall below the required threshold will receive a direct payout to make up the difference in their taxes.

- 😀 For households that qualify for the low-income tax reduction, a 10,000 yen subsidy is being offered. If the household has children under 18, an additional 5,000 yen per child will be granted.

- 😀 A new addition for the fiscal year 2026 includes further payments for households that will fall under the new tax reductions, with children still qualifying for the extra payment.

- 😀 The government aims to implement these benefits starting from June 2026, with local municipalities handling the payout distribution after verifying the recipient’s eligibility.

- 😀 Some common questions included concerns over who qualifies for these benefits, such as salary earners, pension recipients, and self-employed individuals.

- 😀 Specific details of how tax reductions will be applied depend on the individual’s income source (salary, pension, or business income), and reductions will apply accordingly.

- 😀 The video warns viewers to be cautious of scams related to government payouts, stressing that no legitimate government representative will ask for payment via ATM or parcel services.

Q & A

What is the main focus of the video script?

-The video script primarily focuses on providing information about low-income tax reductions and supplemental benefits for individuals, freelancers, and small businesses in Japan, particularly those available as of March 2024.

What are the two main types of benefits discussed in the video?

-The two main types of benefits discussed are 'low-income tax reductions' and 'supplemental benefits', which include cash payments for low-income households and families with children.

Who are the main beneficiaries of these tax reductions and benefits?

-The main beneficiaries are individuals with low incomes, families with children, freelancers, small business owners, and pensioners who fall under specific tax categories.

What is the eligibility requirement for the supplemental benefits?

-Eligibility for the supplemental benefits depends on factors such as household income, whether the individual is paying resident taxes, and whether they have children under 18. Specific thresholds are set for income levels.

How are the low-income tax reductions applied to different groups of people?

-For employees, tax reductions are applied through income tax withholding. For pensioners, the reductions are applied to public pension income starting in June 2024. For self-employed individuals, reductions are applied during the next tax filing period (January 2025).

What are the conditions for the adjustment payment for individuals who cannot fully use the tax reduction?

-Individuals who cannot fully utilize the low-income tax reduction will receive an adjustment payment. This payment will be made in 1,000 yen increments based on the amount they cannot offset with tax reductions.

When can recipients expect to receive the benefits or payments?

-Recipients can expect to receive the benefits and payments starting in June 2024, after local municipalities verify eligibility and begin processing the disbursements.

How will individuals be notified about their eligibility for the benefits?

-Eligible individuals will receive notifications directly from their local municipalities, which will outline the amount of the benefit and how to apply for it.

What warning does the video provide about potential scams?

-The video warns against scams where individuals may receive fraudulent calls or emails from people pretending to be government officials. These scammers may request money for supposed benefit disbursements or ask for personal information, which is not the practice of legitimate government representatives.

How are the benefits calculated for individuals who have received a tax reduction but still have unused amounts?

-The benefits are calculated by adding up the underused amounts from income tax and individual resident tax, rounding up to the nearest 1,000 yen, and issuing payments on a monthly basis.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

[BREAKING NEWS] Resmi 1 Januari PPN Naik 12%, Berikut Daftar Barangnya | tvOne

200. MSME Payment within 15 or 45 days Compulsory | Sec. 43B(h) of Income Tax Act

'Kado' Prabowo Untuk Masyarakat di 2025

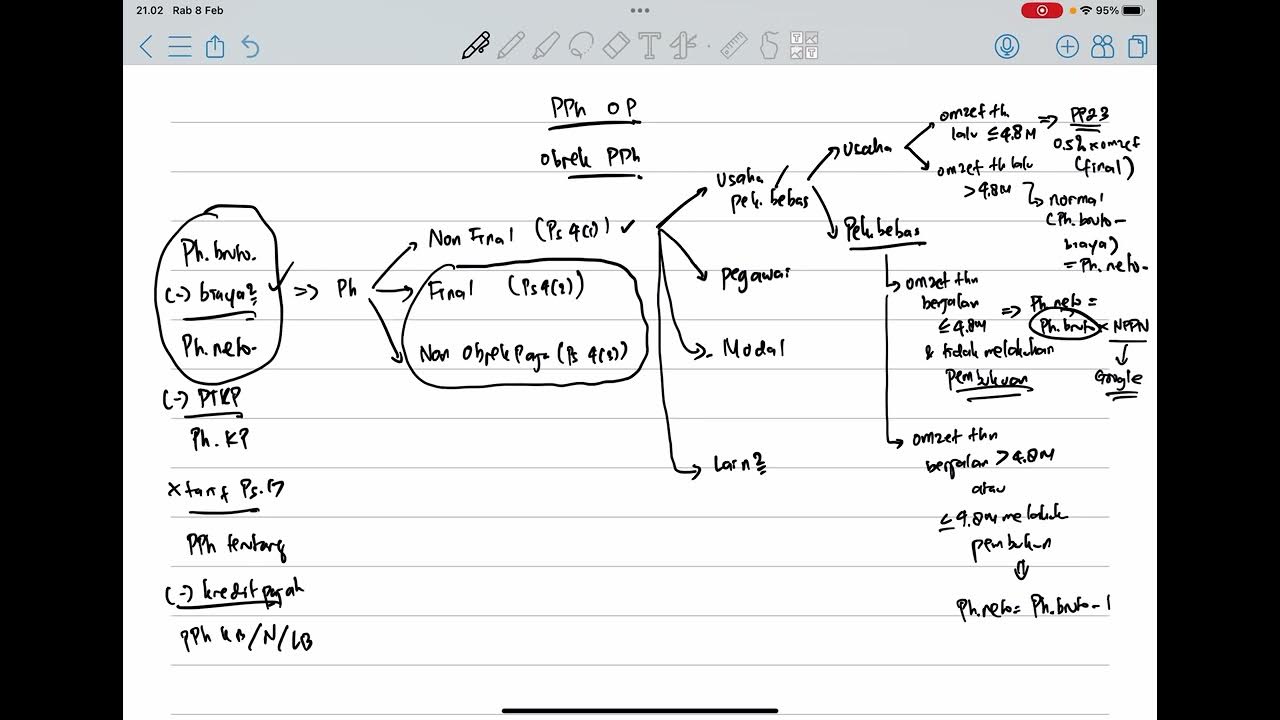

PPH Orang Pribadi (Update 2023) - 2. Objek Pajak

How Taxes Work in Canada 🍁 - Learn to Lower Your Tax Bill

Why Indonesia Keeps Raising Taxes | Value Added Tax (VAT)

5.0 / 5 (0 votes)