What is a general ledger? A guide for small businesses | Run your business

Summary

TLDRIn this Quickbooks video, Astrid Danniella Galvez discusses the importance of the General Ledger for small business owners. She explains how it records all financial transactions and categorizes them into assets, liabilities, capital, expenses, and income. The General Ledger is crucial for making informed business decisions, as it provides clarity on financial health and facilitates the preparation of financial statements. Quickbooks' online platform simplifies this process by tracking business activity in real time, offering immediate access to financial insights and statements.

Takeaways

- 📚 The general ledger is crucial for small business accounting, recording all financial transactions.

- 🔍 It is a tool for tracking money in and out, aiding in business decision-making.

- ✅ Accounting software like Quickbooks simplifies the process of managing a general ledger.

- 🗂️ The journal records transactions chronologically, while the general ledger categorizes them by account.

- 📊 General ledger accounts are itemized, providing clarity on the net result of each account.

- 🔑 It facilitates easy location and identification of transactions, which is essential for financial reporting.

- 💼 There are five main categories of general ledger accounts: assets, liabilities, capital, expenses, and income.

- 🚗 Asset accounts include tangible items like vehicles, inventory, equipment, and property.

- 💵 Liabilities accounts cover debts such as bank loans, creditors, and accounts payable.

- 💼 Capital accounts reflect the capital introduced into or withdrawn from the business by the owner.

- 💸 Expense accounts encompass the costs of running the business, including rent, payroll, and advertising.

- 💹 Income accounts track revenue from sales, interest, and other business activities.

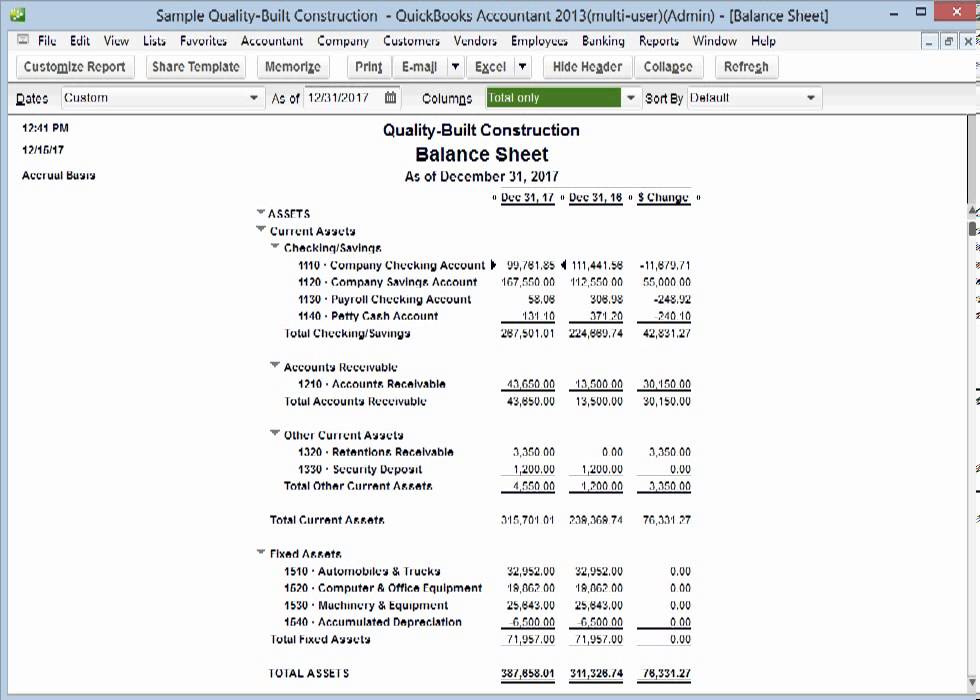

- 📈 Quickbooks online offers real-time tracking and easy access to financial statements like the balance sheet.

Q & A

What is the main focus of the video presented by Astrid Danniella Galvez?

-The video focuses on the importance of the general ledger in accounting and how it helps small business owners track their finances using Quickbooks.

What does Astrid use to track her day-to-day activities?

-Astrid tracks her daily activities, such as the miles she runs during her morning jog, similar to how business owners track their finances.

What is a general ledger, and why is it important?

-A general ledger is a record where each financial transaction is categorized and duplicated for specific accounts. It helps business owners better manage their accounts and improve decision-making by offering a detailed financial overview.

What is the role of the journal in accounting?

-The journal records all financial transactions in chronological order. However, it can be hard to locate specific transactions, which is why the general ledger is used to categorize each transaction for better tracking.

How does the general ledger differ from the journal?

-While the journal records transactions in chronological order, the general ledger categorizes them based on accounts, making it easier to find specific information and compile financial reports.

What are the five categories of general ledger accounts?

-The five categories are: asset ledger, liabilities ledger, capital ledger, expense ledger, and income ledger.

What does the asset ledger account track?

-The asset ledger tracks a business’s assets, including vehicles, inventory, equipment, and property.

What is recorded in the liabilities ledger?

-The liabilities ledger records the business's debt obligations, such as bank loans, creditors, and accounts payable.

What does the capital ledger account represent?

-The capital ledger account outlines the capital brought into or withdrawn from the business, including owner contributions.

How does Quickbooks help with general ledger accounting?

-Quickbooks tracks business activities in real-time and provides easy access to financial insights, including financial statements and balance sheets, making it easier for business owners to manage their accounts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How to use QuickBooks Online - Beginner Walkthrough & Tutorial

How To Pick a Niche For Your Bookkeeping Business

Where Did My Profit Go?

How To Record a Bounced Check in QuickBooks Online | QBO Tutorial | The Home Bookkeeper

How to Start Bookkeeping for Free (Easy Google Sheets Tutorial)

Non SBA Deal Financing

5.0 / 5 (0 votes)