Australia's RIGGED Housing System: Can the USA help us Fix it? | Punters Politics

Summary

TLDRThe video script discusses the Australian banking system's shortcomings, particularly the lack of 30-year fixed-rate mortgages like in the US, which leaves homeowners vulnerable to interest rate fluctuations. It highlights how Australian banks profit immensely from this system, with minimal competition allowing them to pass on increased costs to customers without offering corresponding benefits. The script calls for more competition and regulation to protect consumers and suggests looking to the US model for potential solutions.

Takeaways

- 🏦 The Australian banking system is criticized for not offering 30-year fixed mortgages, unlike the US, which can lead to unstable repayments for homeowners.

- 📈 Australian interest rates can significantly increase mortgage repayments, with no fixed-rate option for long-term stability.

- 💸 Australian households have high debt relative to their GDP, with a large portion being mortgage debt.

- 📉 The US system provides the option to refinance a 30-year fixed mortgage if interest rates drop, offering protection in both high and low-rate environments.

- 💼 Australian banks are highly profitable, with profits increasing dramatically in recent times, suggesting a system rigged in their favor.

- 📊 Market concentration in Australia is high, with four major banks controlling 80% of the market, leading to less competition and higher costs for consumers.

- 💰 Banks profit from the difference between what they charge borrowers and what they pay savers, especially when interest rates rise.

- 🚫 Lack of competition and regulatory failure contribute to the banking sector's ability to maintain high profits at the expense of consumers.

- 🌐 Market concentration is linked to higher prices, worse services, and more frequent rule-breaking by financial institutions.

- 🔍 The video script suggests looking for political solutions that increase competition and considers the US 30-year fixed-rate mortgage as a potential model for Australia.

Q & A

What is the main issue discussed in the video script regarding housing and banking systems?

-The video script discusses the perceived scam in both housing and banking systems, particularly focusing on the variable interest rates on home loans in Australia that can significantly increase without a fixed rate option, unlike in the US where 30-year fixed mortgages are common.

How does the video script describe the impact of variable interest rates on Australian home loans?

-The script illustrates that when interest rates increase, Australian home loan repayments can go up substantially, leading to financial stress for homeowners who may not have the flexibility to accommodate these increases in their budgets.

What is the difference between Australian and US mortgage systems as presented in the script?

-In the US, the script mentions that most mortgages have a fixed interest rate for 30 years, providing stability and predictability. In contrast, Australian mortgages often have variable rates that can fluctuate, leading to uncertainty and potential financial hardship for borrowers.

Why does the video script suggest that refinancing a mortgage in the US can be beneficial?

-The script suggests that refinancing a mortgage in the US is beneficial because if long-term rates drop, homeowners can refinance their 30-year fixed mortgage to take advantage of the lower rates, thus benefiting when rates go down and being protected when rates go up.

What role does the lack of competition play in the Australian banking system according to the script?

-The script argues that the lack of competition in the Australian banking system leads to market concentration, where the big four banks control a large portion of the market, resulting in higher costs for customers and less incentive for banks to offer better services or rates.

How does the script link the profits of Australian banks to the financial stress of everyday people?

-The script implies that the high profits of Australian banks are at the expense of everyday people, as the banks pass on increased borrowing costs to customers without correspondingly increasing savings rates, leading to a wealth transfer from the general public to the banks and their shareholders.

What is the script's stance on the idea that corporate power has increased in Australia over the last 20 years?

-The script challenges the notion that corporate power has not increased in Australia, citing market concentration data and arguing that certain industries, including banking, have become more concentrated and thus more powerful over time.

Why does the video script criticize the role of certain financial journalists in Australia?

-The script criticizes certain financial journalists for allegedly downplaying the issue of market concentration and corporate power in Australia, suggesting that they are protecting the status quo that benefits the wealthy and powerful at the expense of the average person.

What solutions does the script propose to address the issues in the Australian banking and housing systems?

-The script proposes increasing competition in the banking sector and introducing 30-year fixed interest mortgages as potential solutions to provide more stability and better services for consumers.

How does the script use the term 'punters' and what does it signify?

-The term 'punters' is used in the script to refer to everyday people or average Australians who are affected by the banking and housing systems. It signifies the ordinary individuals who are at a disadvantage due to the current system.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Mentorship Core Content - Month 04 - Interest Rate Effects On Currency Trades

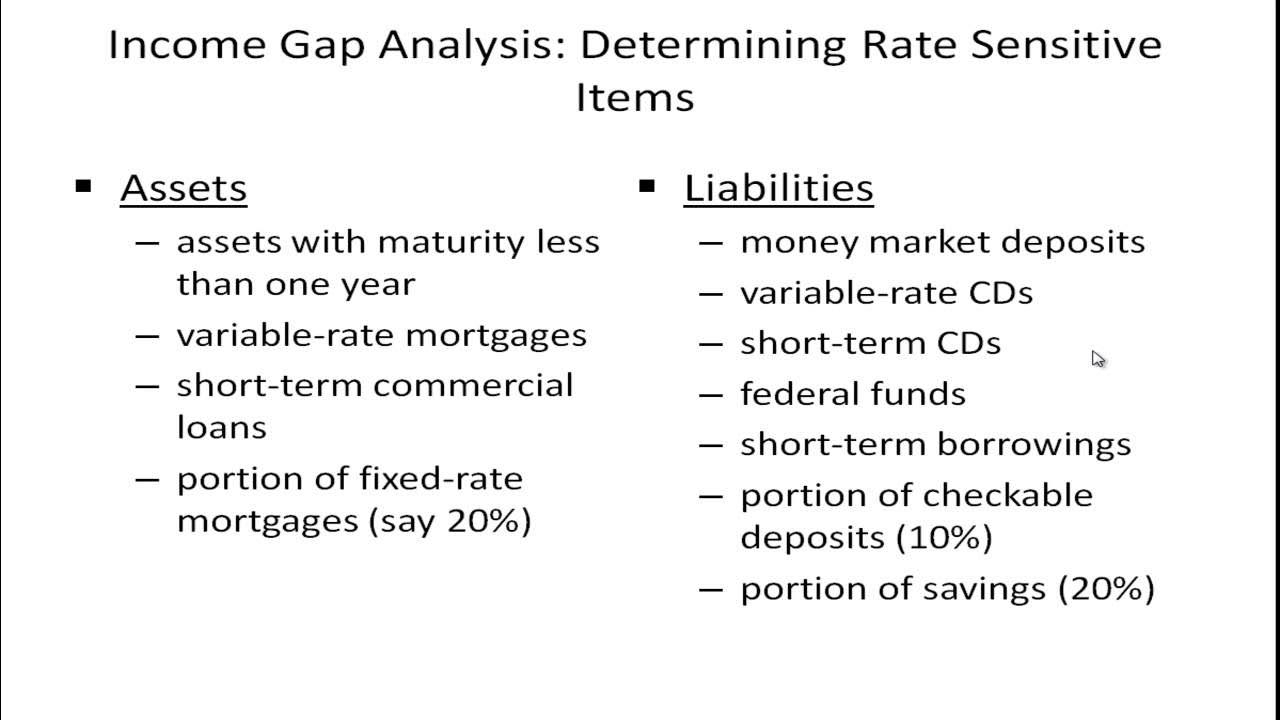

Managing Interest Rate Risk - Income Gap Analysis

Foreclosure Skyrocket In Greater Toronto Area

Canada’s $30,000,000,000 Purchase is Crazy

How does raising interest rates control inflation?

It's a Money Thing: Demystifying Mortgages

5.0 / 5 (0 votes)