Ekonomi Kelas XII Bab 2: Persamaan Dasar Akuntansi (Part 1)

Summary

TLDRIn this 12th-grade economics lesson, the topic of basic accounting equations is introduced. The video explains how the basic accounting equation represents the relationship between a company's assets, liabilities, and equity. Key concepts include examples of assets such as cash, vehicles, and computers, and the sources of funds (owner’s equity and liabilities). The lesson also covers different types of assets—current, fixed, and intangible—and the distinction between short-term and long-term liabilities. The video emphasizes the importance of balancing assets with their corresponding funding sources through practical examples.

Takeaways

- 📚 This lesson is about the basics of accounting equations, which are fundamental for understanding the financial cycle in accounting.

- 💡 The basic accounting equation is essential to grasp before creating financial journals and reports, as it explains how financial transactions affect a company's financial position.

- 🏢 The equation relates assets (what a company owns) to liabilities (what a company owes) and equity (the owner's investment in the company).

- 💼 Assets are categorized into current assets (short-term), fixed assets (long-term), and intangible assets (non-physical assets like copyrights).

- 💵 Current assets are those expected to be used or consumed within a year, such as cash and accounts receivable.

- 🏠 Fixed assets are long-term assets like buildings and vehicles that are not expected to be consumed within a year.

- 📝 Intangible assets are non-physical assets like patents and trademarks, which have value but no physical form.

- 💳 Liabilities are obligations or debts that a company has to pay, divided into current liabilities (due within a year) and long-term liabilities (due after a year).

- 💹 Equity represents the owner's stake in the company and is influenced by income and expenses, with revenue increasing equity and expenses decreasing it.

- 📊 The accounting equation can be expressed as Assets = Liabilities + Equity, showing that the value of what a company owns is equal to what it owes plus what it is worth to its owners.

- 🔍 There are two types of accounts: real accounts (assets, liabilities, and equity, recorded in the balance sheet) and nominal accounts (revenue and expenses, recorded in the income statement).

Q & A

What is the basic accounting equation?

-The basic accounting equation is: Assets = Liabilities + Equity. This equation shows that the value of the company's assets must be equal to the total of its liabilities and equity.

Why is it important to understand the basic accounting equation?

-Understanding the basic accounting equation is important because it forms the foundation of the accounting cycle. Before preparing journals or financial statements, it is essential to know how transactions affect the financial position of a company.

What does the basic accounting equation illustrate?

-The basic accounting equation illustrates the impact of financial transactions on a company's financial position, specifically the relationship between assets, liabilities, and equity.

What are examples of company assets?

-Examples of company assets include cash, vehicles, and computers. These are owned by the company and can be valued in monetary terms.

How is a company's cash asset typically funded?

-A company's cash asset is typically funded by the owner’s capital or contributions. For instance, if a business has Rp200 million in cash, it could come from the owner's private funds.

What are the main components of the basic accounting equation?

-The main components of the basic accounting equation are assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the owner's contribution to the company.

What are current and fixed assets, and how do they differ?

-Current assets are assets that are used up or converted to cash within one year, like cash or inventory. Fixed assets, on the other hand, are long-term assets that last more than one year, such as buildings or equipment.

What are intangible assets?

-Intangible assets are non-monetary assets without physical form. Examples include copyrights, patents, and the company's reputation.

How are liabilities classified in accounting?

-Liabilities are classified as either current liabilities (due within one year, such as accounts payable) or long-term liabilities (due in more than one year, like a bank loan).

What is the difference between revenue and expenses in terms of their impact on equity?

-Revenue increases equity, as it is generated from selling goods or services. Expenses decrease equity, as they are the costs incurred in generating revenue, such as employee salaries.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

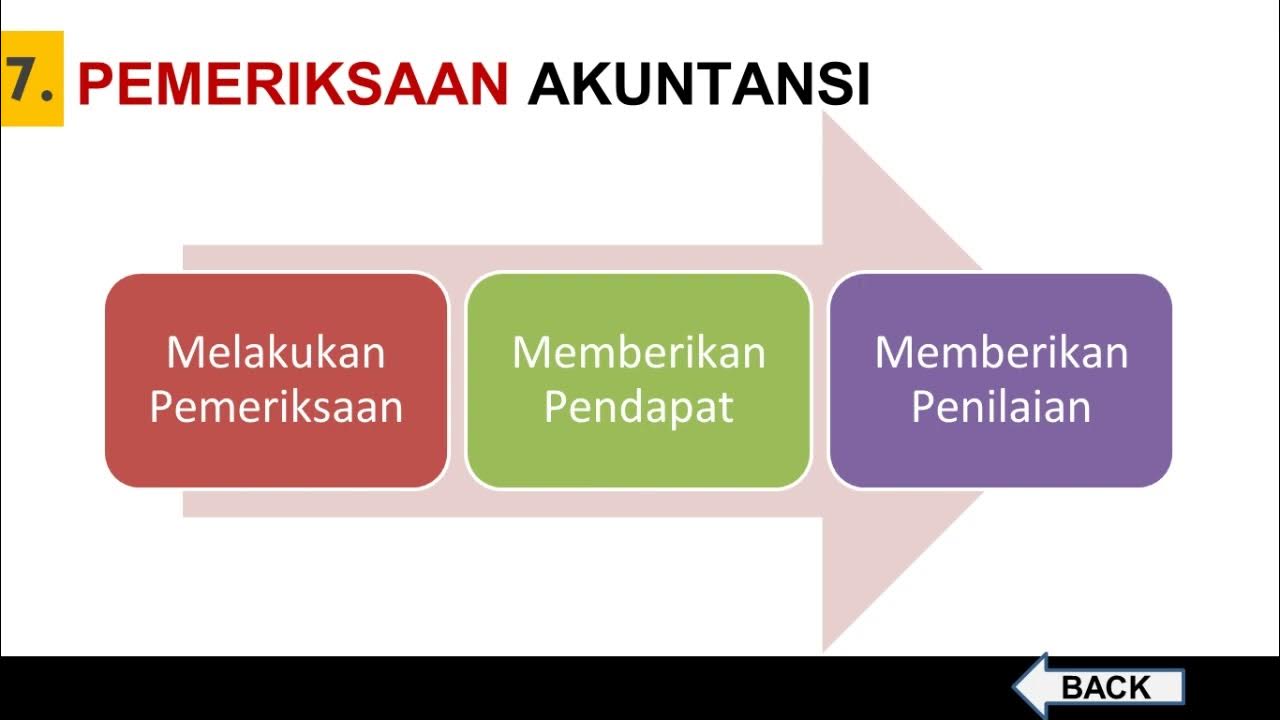

Bidang Bidang Akuntansi

Nature and significance of management | Class 12 Business studies. Chapter 1 Part 1 | In Easiest way

Pengertian & Sejarah Akuntansi (Pengantar Akuntansi)

PERTEMUAN 1 PRAKTIKUM AKUNTANSI KEUANGAN LEMBAGA XI

Matematika tingkat lanjut kelas XII (12) SMA /MA Kurikulum merdeka @GUcilchaNEL1964

Eksponen • Part 1: Definisi, Operasi, dan Sifat Eksponen / Pangkat

5.0 / 5 (0 votes)