CRYPTO ALERT: IT'S OVER?

Summary

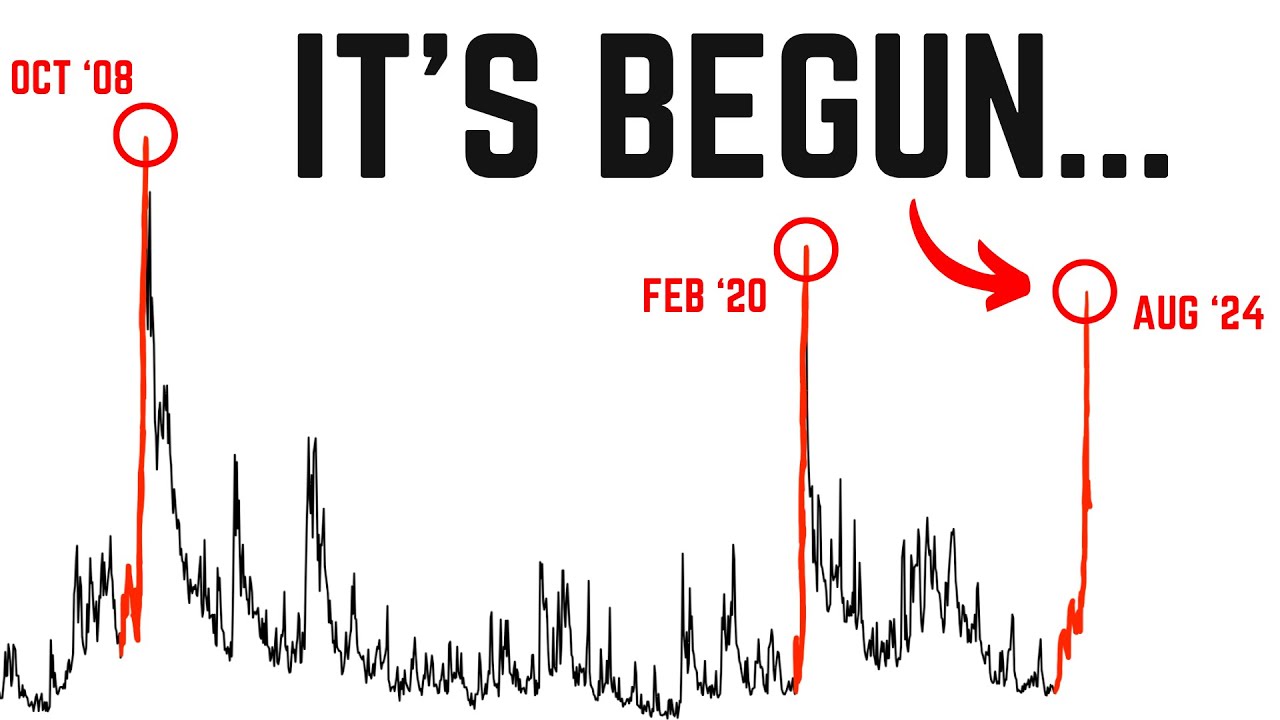

TLDRIn this market update, the speaker expresses concern over the rising unemployment rate, which historically precedes significant market impacts. They discuss Bitcoin's current downtrend, suggesting it will continue until late Autumn, influenced by economic factors like unemployment and fiscal stimulus. The speaker contemplates scenarios where asset prices rise instead of crashing, leading to wealth inequality as the cost of living increases faster than wages. They emphasize Bitcoin as a hedge against inflation and fiat currency devaluation, advocating for long-term investment in Bitcoin to preserve purchasing power.

Takeaways

- 📈 The unemployment rate is a significant concern as it has bottomed and is trending upwards, which historically has led to higher rates and affected markets, including Bitcoin and cryptocurrencies.

- 📉 Bitcoin is currently in a downtrend, with the 50-period moving average being defended, but the overall market sentiment suggests a continued downtrend until later in the year.

- 💹 The on-chain support level for Bitcoin is around $47,000, which is considered the true market mean and a stronger support level than the current price.

- 🔍 The market is in a holding pattern due to uncertainties such as potential surprises in unemployment data or election outcomes, which could significantly impact asset prices.

- 🚀 The possibility of a 'melt-up' scenario is discussed, where asset prices rise due to factors like increased unemployment, fiscal deficits, and easier central bank policies, rather than a market crash.

- 💸 The script highlights the erosion of purchasing power as a form of 'crash,' where the cost of living increases faster than wage growth, leading to wealth inequality.

- 🌐 The global economy's reliance on fiscal stimulus and monetary policy easing is seen as a precursor to potential future market bubbles and subsequent corrections.

- 💡 The speaker suggests that Bitcoin is a hedge against inflation and currency devaluation, as it can potentially appreciate faster than the purchasing power of fiat currencies.

- 📉 The script contemplates the likelihood of a market crash and the subsequent stimulus measures, which historically have led to even more stimulus and inflation.

- 📊 The discussion points to the current bull market in assets, despite economic challenges, as a reflection of the stimulus measures in place to maintain economic growth and inflation targets.

Q & A

What is the current trend of the unemployment rate as discussed in the script?

-The unemployment rate is currently inflecting to the upside, which is a worrying trend as it has historically led to higher rates in the past.

How does the unemployment rate impact the markets according to the video?

-The unemployment rate can significantly affect markets, including Bitcoin and cryptocurrencies, as it is an indicator of economic health and can influence investor sentiment.

What is the current state of the Bitcoin price as mentioned in the script?

-The Bitcoin price has had a decent week with the bulls trying to defend the 50-period moving average, but the overall trend is still considered a downtrend.

What is the significance of the 50-period moving average for Bitcoin?

-The 50-period moving average is a technical indicator that the bulls are trying to defend, indicating a level of support in the market.

What is the onchain support level for the bull market in Bitcoin as discussed?

-The onchain support level for the bull market in Bitcoin is around 47,000, which is considered the true market mean and a cost basis for many investors.

What are the potential scenarios for the market after the election according to the script?

-The potential scenarios include a continued holding pattern, a melt-up over time of assets, or a crash followed by even more stimulus, leading to a potential increase in asset prices.

What is the role of fiscal stimulus in the current economic situation as per the video?

-Fiscal stimulus is playing a significant role by pouring money into the economy, which can lead to inflation and an increase in asset prices, potentially causing wealth inequality.

How does the script suggest Bitcoin could be affected by the current economic policies?

-Bitcoin could potentially benefit from the current economic policies as it is seen as a hedge against inflation and currency devaluation, especially if fiscal deficits continue to rise.

What is the script's perspective on the likelihood of a significant market crash?

-The script suggests that a significant market crash may not occur as expected, due to the various economic stimulus measures in place to support the economy and asset prices.

What is the importance of the real federal funds rate in the current economic context according to the video?

-The real federal funds rate, adjusted for inflation, is historically high, suggesting that monetary policy may need to ease, which could impact asset prices and the economy.

What is the script's advice for investors regarding Bitcoin and other assets?

-The script advises investors to focus on the relative purchasing power of assets over time, suggesting that Bitcoin can offer a hedge against currency devaluation and potential wealth preservation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

September 2024 - Market Update

Ratusan Ribu Sarjana di Indonesia Menganggur

The 2024 Recession Just Started... (Do THIS Now)

Gran reporte de empleos, a la luna 📈🚀📈

🔥 July 18 Premarket Movers: SOFI, LAWR, KMRK, SRPT, LCID | Market HIGHER Highs Coming

Share Market In Red | गिरते बाजार में क्या करें निवेशक? | Share Market Crash | Nifty | Sensex

5.0 / 5 (0 votes)