The Decline of Dunzo!... What Happened? | Startup Case Study

Summary

TLDRDunzo, an early player in India's hyperlocal delivery market, raised significant funds and was on the brink of becoming a unicorn. However, the startup's rapid expansion into quick commerce, marked by the launch of Dunzo Daily, led to financial strain. Despite initial growth, Dunzo faced stiff competition from well-funded rivals like Swiggy's Instamart and Zomato's Blinkit. The company's pivot cost it its unique value proposition and operational profitability, leading to a cash crunch and potential shutdown. The story serves as a cautionary tale about maintaining a sustainable business model and the importance of strategic investment alignment.

Takeaways

- 🚀 Dunzo was a pioneer in India's hyperlocal delivery market and achieved significant growth and popularity.

- 💸 The startup raised nearly half a billion dollars in funding and was on the path to becoming a unicorn.

- 📉 Despite rapid growth, Dunzo faced financial struggles, losing 7.5 rupees for every rupee earned in revenue.

- 🔄 The pivot to quick commerce and the 'Dark Store' model required substantial investment in infrastructure, straining the company's resources.

- 🏢 Competition from well-funded players like Swiggy’s Instamart and Zomato’s Blinkit made it difficult for Dunzo to maintain market share.

- 💼 The acceptance of a large funding round from Reliance led to a loss of decision-making autonomy for Dunzo.

- 📉 Dunzo's market share in the quick commerce segment remained negligible despite the investment in dark stores.

- 🏦 Financial mismanagement and a high monthly burn rate led to a severe cash crunch, impacting the company's operations.

- 👨💼 The departure of co-founders signaled a crisis in the company's leadership and direction.

- 🔙 Dunzo has had to scale back operations, returning to its hyperlocal roots and closing down its quick commerce business in most cities.

Q & A

What were the key factors that contributed to Dunzo's initial success?

-Dunzo's initial success was attributed to being an early entrant in India's hyperlocal delivery market, raising significant funding, and becoming a popular service among customers to the extent that it became a verb.

How much funding did Dunzo raise, and what was its valuation trajectory?

-Dunzo raised close to half a billion dollars in funding and was on its way to becoming a unicorn, indicating a billion-dollar valuation.

What was the business model of Dunzo in its early stages?

-In its early stages, Dunzo started as a WhatsApp group where people would text their needs, and co-founder Kabeer Biswas would fulfill them personally, often working from early morning to late night.

How did Dunzo's financial performance look between 2018 and 2021?

-Between 2018 and 2021, Dunzo made just 88 crore rupees in revenue but incurred losses exceeding 750 crore rupees, indicating a significant financial strain.

What was the impact of the year 2020 on Dunzo's user base and financials?

-The year 2020 saw Dunzo's active users nearly double from 2.7 million in 2019 to 5.1 million in 2020, and for the first time since 2018, their losses shrank while revenue continued to grow.

Why did Dunzo decide to venture into the quick commerce model?

-Dunzo ventured into the quick commerce model because it saw a billion-dollar opportunity and believed it was well-positioned to adopt this new delivery model due to its existing customer base and delivery partners.

What were the challenges Dunzo faced when entering the quick commerce market?

-Dunzo faced challenges such as the need for a different infrastructure involving 'dark stores', intense competition from well-funded players like Swiggy’s Instamart, Zomato’s Blinkit, Tata’s BigBasket, and Zepto, and a lack of sufficient funds to compete effectively.

How did Reliance's investment impact Dunzo's operations and decision-making?

-Reliance's investment of 200 million dollars for a 26% stake gave them veto powers over major decisions, which later restricted Dunzo's ability to raise additional funds when needed, exacerbating their financial crisis.

What steps is Dunzo taking to survive its current crisis?

-Dunzo is trying to survive by shutting down its quick commerce business in all major cities except Bengaluru, where it still operates a few dark stores, and reverting to its hyperlocal delivery model. It has also given up its Bengaluru office to cut costs.

What are the key lessons that can be learned from Dunzo's journey?

-The key lessons from Dunzo's journey include the importance of not losing one's unique value proposition, achieving operational profitability in the core business before venturing into new segments, and ensuring alignment of interests with investors, especially when competing against heavily funded companies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How Delhivery DISRUPTED India’s 1800 Crore Logistics Market | GrowthX Wireframe

IHSG Anjlok, Perdagangan Saham Disetop! - [Prioritas Indonesia]

How TATA motors' GENIUS STRATEGY is racing it past Hyundai & Suzuki in India? : Business Case study

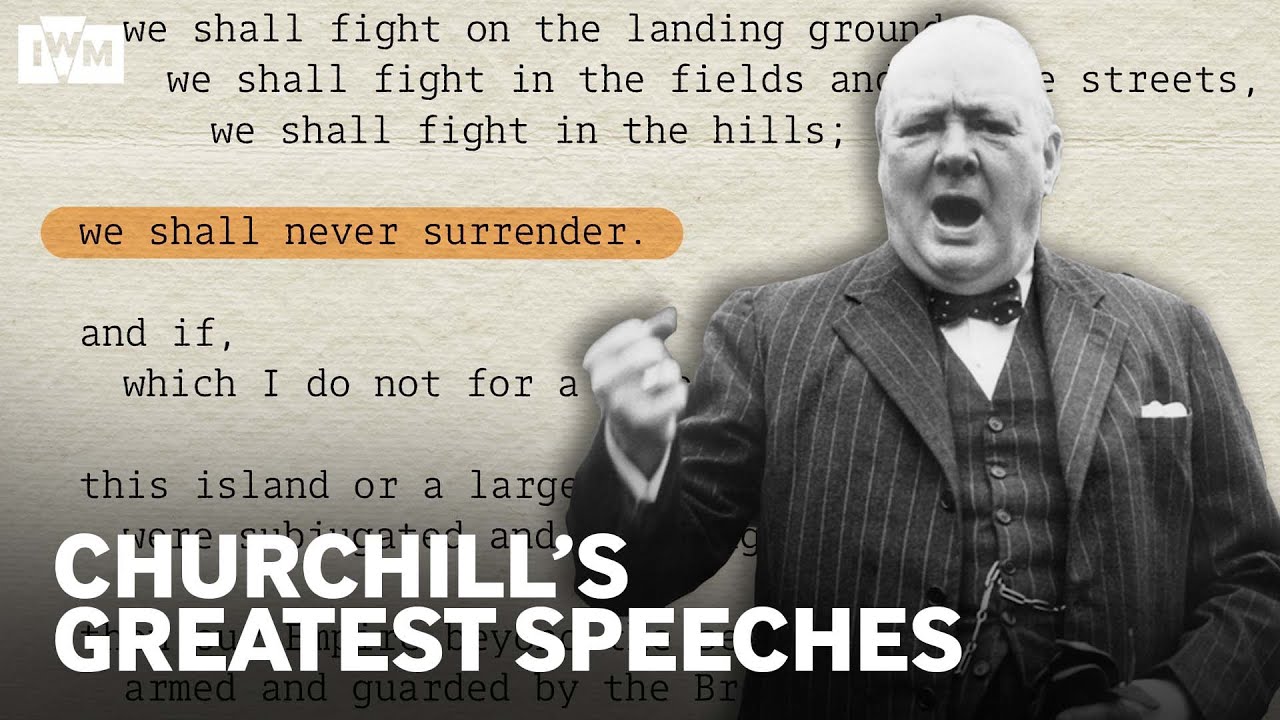

How Winston Churchill's Speeches helped to win WW2

What Led To The Fall Of Byju's? | Story Of The Edtech Giant's Billion-Dollar Loss

Why everyone in India is buying iPhones now!

5.0 / 5 (0 votes)