What is Currency option?

Summary

TLDRThis Federal Bank Treasury Knowledge Series video explains the fundamentals of currency options, a financial derivative that allows investors to hedge or speculate on exchange rate movements. The video covers key concepts such as call and put options, illustrating how buyers have the right—but not the obligation—to buy or sell currency at a predetermined rate, while sellers must honor the contract if exercised. It highlights real-world applications, including importers managing future payments, and emphasizes benefits like unlimited profit potential for buyers with limited risk. The video also mentions tailored hedging solutions, combining options and forwards, empowering businesses to make informed currency management decisions.

Takeaways

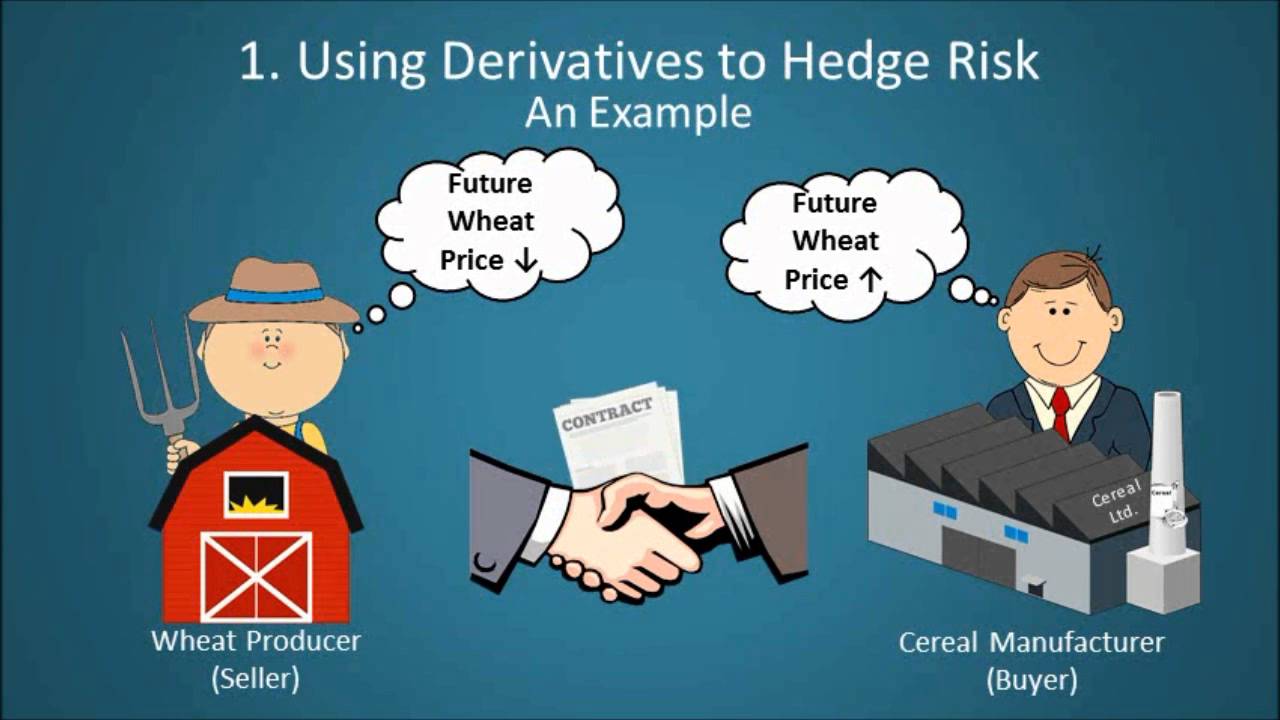

- 💱 Currency options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a predetermined price on a specific date.

- 📈 The seller of a currency option is obligated to fulfill the contract if the buyer chooses to exercise it.

- 🔹 There are two main types of currency options: call options (right to buy) and put options (right to sell).

- 💡 Call options allow buyers to lock in a purchase price for a currency, providing protection against currency appreciation.

- 💡 Put options allow buyers to lock in a selling price for a currency, protecting against currency depreciation.

- 🏦 Example: An importer can book a call option to pay USD/INR at a fixed rate in the future, benefiting if the market rate rises above the strike price.

- ⚖️ If the market rate is favorable compared to the strike price, the option may not be exercised, and the transaction occurs at the market rate.

- 💰 Buyers of currency options have unlimited profit potential while their loss is limited to the premium paid.

- 🛠️ Professional structuring desks offer customized hedging solutions combining options and forwards based on business requirements.

- 📚 Knowledge of currency options empowers businesses to make informed decisions and manage currency risk effectively.

- 🤝 Federal Bank positions itself as a partner for smart hedging solutions and treasury management.

Q & A

What is a currency option?

-A currency option is a derivative contract that gives the buyer the right, but not the obligation, to buy or sell a currency at a predetermined price on a specified date.

Who is obligated when a currency option is exercised?

-The seller (writer) of the currency option contract is obligated to honor the contract when the buyer chooses to exercise it.

What are the two main types of currency options?

-The two main types of currency options are call options, which give the right to buy a currency, and put options, which give the right to sell a currency.

Can you give an example of how a call option works for an importer?

-For example, if an importer needs to pay in 6 months, they can book a call option with a strike price of ₹75. If the USD/INR rate rises to ₹77, the importer exercises the option and pays ₹75. If the rate falls to ₹73, they do not exercise the option and pay the market rate.

What is the maximum loss a buyer of a currency option can face?

-The maximum loss for the buyer of a currency option is limited to the premium paid for the option.

What is the potential profit for a buyer of a currency option?

-The buyer of a currency option has unlimited profit potential, depending on favorable movements in the currency exchange rate.

How can companies use currency options for risk management?

-Companies can use currency options to hedge against foreign exchange risk by locking in favorable rates for future transactions, thereby protecting themselves from adverse currency movements.

What kind of support does Federal Bank provide for currency options?

-Federal Bank offers professional structuring desks that provide customized hedging solutions and smart strategies combining options and forwards based on business requirements.

Why is it beneficial to combine options and forwards in hedging strategies?

-Combining options and forwards allows businesses to balance risk management and cost-effectiveness, offering protection while optimizing potential gains and losses.

What is the main takeaway message from the Federal Bank Treasury Knowledge Series on currency options?

-The main message is that knowledge of currency options empowers investors and businesses to manage foreign exchange exposure effectively, offering flexibility, potential profit, and limited loss.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)