Accounting Standards I AS - 1 I Disclosure of Accounting Policies I Hasham Ali Khan I

Summary

TLDRIn this educational video, Hashem Ali Khan delves into Accounting Standard 1, focusing on the critical aspect of disclosing accounting policies. He explains the significance of these policies in shaping financial statements and their impact on an organization's financial presentation. Khan emphasizes the necessity for transparency to enable accurate financial statement interpretation and comparison across different entities. He outlines the fundamental accounting assumptions, such as the going concern, consistency, and accrual, which underpin financial reporting. The video also touches on the selection criteria for accounting policies, influenced by prudence, substance over form, and materiality, concluding with guidelines for the disclosure of accounting policies in financial statements.

Takeaways

- 😀 The video is part of a series on accounting standards, specifically focusing on unit two which delves into the details of accounting standard one (AS1) - Disclosure of Accounting Policies.

- 📚 AS1 is crucial for understanding the financial statements as it outlines the specific accounting principles and methods applied by an enterprise.

- 🔍 The purpose of AS1 is twofold: to enhance the comprehensibility of financial statements and to enable meaningful comparison across different organizations' financial statements.

- 🏢 Fundamental accounting assumptions such as the going concern, consistency, and accrual are underlying principles that do not require explicit disclosure unless not followed.

- 📈 Accounting policies can vary widely and are influenced by the nature of the business, its transactions, and specific circumstances, necessitating management's prudent selection.

- 🛠️ Different methods for accounting treatments, like depreciation, inventory valuation, and goodwill calculation, are examples where enterprises might adopt varying policies.

- 📋 Disclosure of accounting policies is mandatory for all significant ones used in financial statement preparation and should be clearly stated in the notes to the accounts.

- 🔄 If a change in accounting policy occurs, its material impact on the current or future financial periods must be discussed, or if uncertain, this uncertainty should be disclosed.

- 📝 The video emphasizes the importance of a careful and concentrated viewing to grasp the intricacies of accounting standards, suggesting the audience to take screenshots of key points for reference.

- 🔮 The next video in the series will continue the exploration of accounting standards, moving on to accounting standard two.

Q & A

What is the main focus of the video by Hashem Ali Khan?

-The main focus of the video is to explain Accounting Standard 1, which deals with the disclosure of accounting policies.

Why is the disclosure of accounting policies important according to the video?

-The disclosure of accounting policies is important because it promotes a better understanding of the financial statements and facilitates meaningful comparison of financial statements between different organizations.

What are the three fundamental accounting assumptions that every business organization must follow?

-The three fundamental accounting assumptions are the going concern, consistency, and accrual.

What does the 'going concern' assumption imply in accounting?

-The 'going concern' assumption implies that the business is expected to continue operating for the foreseeable future and is not expected to be liquidated or cease operations in the near term.

What is the significance of the 'consistency' principle in accounting?

-The 'consistency' principle in accounting requires that once an accounting method is adopted, it should be consistently applied from one period to another, ensuring uniformity in financial reporting.

How does the 'accrual' concept affect the preparation of financial statements?

-The 'accrual' concept requires that all incomes and expenses related to the current period be recognized, regardless of whether the income is received or the expense is paid, ensuring that financial statements reflect the true financial performance of the period.

What are some examples of different accounting policies that can be adopted by an enterprise?

-Examples of different accounting policies include methods of depreciation, valuation of inventories, calculation of goodwill, and treatment of contingent liabilities.

What are the factors that influence the selection of an accounting policy according to the video?

-The factors that influence the selection of an accounting policy include the need to present a true and fair view of the financial statements, prudence, substance over form, and materiality.

What should be done if a business needs to change its accounting policy?

-If a business needs to change its accounting policy, the impact of the change on the current period's income or expected future periods should be disclosed.

What is the purpose of disclosing accounting policies in the notes to the accounts?

-The purpose of disclosing accounting policies in the notes to the accounts is to provide transparency and allow users of the financial statements to understand the basis on which the financial statements are prepared.

Why might a business not need to disclose certain fundamental accounting assumptions?

-A business might not need to disclose certain fundamental accounting assumptions like going concern, consistency, and accrual if they are being followed; disclosure is only required if these assumptions are not followed.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

IFRS 16 Leases summary - applies in 2024

Issue of Shares for consideration other than cash | Shares | Class 12 | Accounts | Part 4

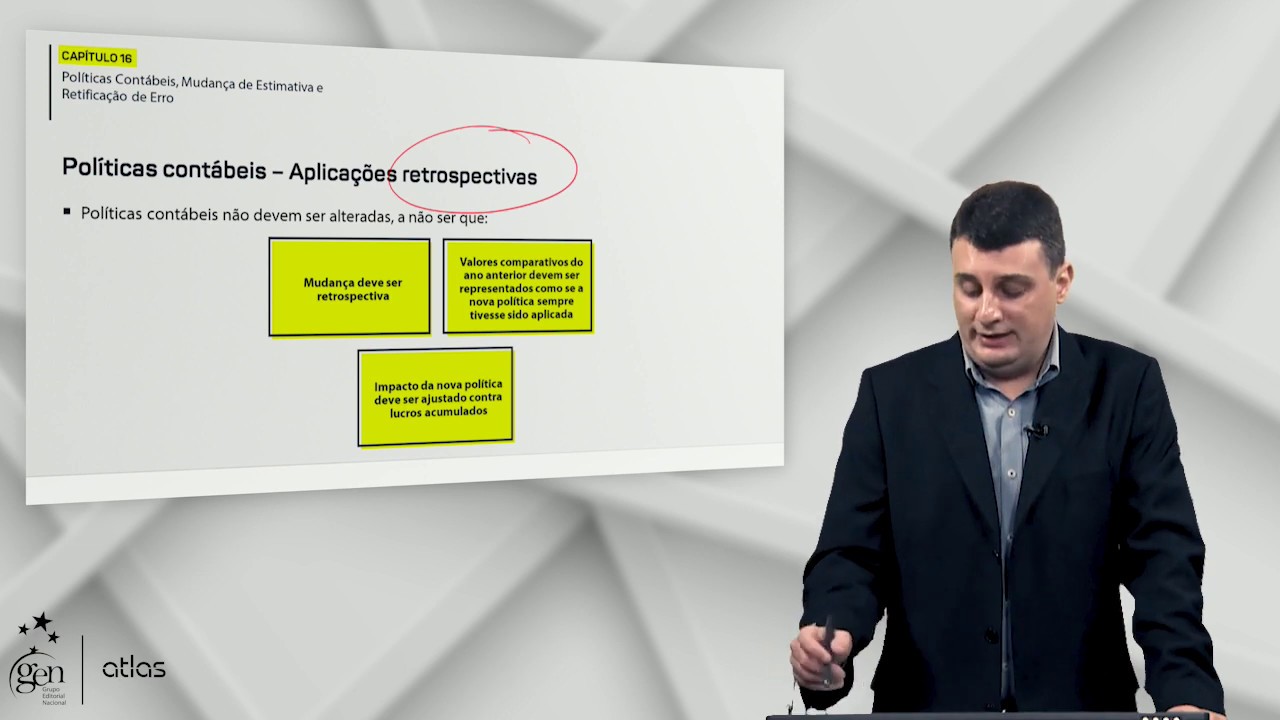

Políticas Contábeis, Mudança de Estimativa e Retificação de Erro | Contabilidade Avançada | 2ª ed.

Accounting Principles | Class 11 | Accountancy | Chapter 3 | Part 2

#part1 Ch 17 Investment - Akuntansi Keuangan Menengah 2

The Accounting System (Revision)

5.0 / 5 (0 votes)