Estate Tax Exemption Sunset 2026: Portability and IDGT Explained

Summary

TLDRThe video script discusses the impending expiration of Trump-era tax cuts, particularly the halving of the gift and estate tax exemption from $13.61 million to an estimated $7 million after January 1, 2026. It emphasizes the importance of estate planning, with a focus on strategies like portability, community property laws, and the use of trusts to mitigate death taxes. The speaker, a legal expert, also touches on generation-skipping transfer tax and the benefits of an 'A team' approach involving a CPA, financial advisor, and attorney for effective wealth management.

Takeaways

- 📅 On January 1, 2026, the Trump-era tax cuts will expire, significantly impacting estate tax exemptions and rates.

- 💰 Currently, in 2024, the gift and estate tax exemption is $13.61 million, which is expected to be halved to around $7 million in 2026, adjusted for inflation.

- 🔝 The federal estate tax rate is set to increase from 40% to 45% after the expiration of the Trump-era tax cuts.

- ⏰ There is a sense of urgency as the expanded exemption amount is only available until December 31, 2025, prompting estate planning considerations.

- 👨💼 The speaker, a partner at Cunningham Legal with 30 years of experience, emphasizes the importance of a multidisciplinary team approach involving CPAs, financial advisors, and attorneys for effective estate planning.

- 💡 Basic estate hygiene, akin to washing hands before eating, is crucial for avoiding death taxes and involves strategies that take time to implement.

- 🔄 The concept of 'cake and frosting' is used to illustrate how gift taxes work with the current exemption levels, with the 'Obama cake' and 'Trump frosting' being distinct layers of exemption that will be affected differently post-2026.

- 🔄 Portability is a key strategy that allows a surviving spouse to inherit the unused estate and gift tax exemption of the deceased spouse, which can save millions in federal estate taxes.

- 🏡 Community property laws in states like California provide significant tax benefits, such as step-up in basis, which can be crucial for estate and tax planning.

- 🔗 The use of trusts, such as Community Property Trusts and Intentionally Defective Grantor Trusts, can be instrumental in managing tax liabilities and creating multigenerational wealth.

Q & A

What is the significance of January 1, 2026, in relation to the tax exemption amount?

-January 1, 2026, is significant because it is when the Trump-era tax cuts expire, which means the current gift tax exemption amount of $13.61 million will be reduced, likely to around $7 million after adjustment for inflation.

How does the federal estate tax rate change after January 21, 2026?

-After January 21, 2026, the federal estate tax rate, also known as the death tax rate, is expected to increase from 40% to 45%.

What is the role of a certified specialist in state planning trust and probate law?

-A certified specialist in state planning trust and probate law, like the speaker, is an expert who advises on legal matters related to estate planning, trusts, and probate, helping clients navigate complex tax and legal issues.

What is the importance of 'basic estate hygiene' in the context of the script?

-In the context of the script, 'basic estate hygiene' refers to fundamental estate planning practices that help avoid unnecessary tax burdens and legal complications, similar to the importance of washing hands before eating or delivering a baby.

What is meant by the 'A team' in estate planning?

-The 'A team' in estate planning refers to a group of professionals including a CPA, financial adviser, and attorney who collaborate to develop and execute comprehensive estate planning strategies.

Why is it crucial to file for portability in estate planning?

-Filing for portability allows a surviving spouse to inherit the unused portion of a deceased spouse's estate and gift tax exemption, which can significantly reduce the estate tax liability.

How does community property status affect estate and gift tax planning?

-In community property states, assets included in a spouse's gross estate receive an adjusted cost basis upon the spouse's death, which can help avoid capital gains tax and foster the creation of intergenerational wealth.

What is the purpose of a Community Property Trust in non-community property states?

-A Community Property Trust in non-community property states allows couples to utilize a trust structure that provides a full adjusted cost basis upon the death of one spouse, similar to community property rules, to potentially reduce capital gains tax.

How does an 'Intentionally Defective Irrevocable Grantor Trust' (IDGIT) help in estate planning?

-An IDGIT allows a person to transfer assets to a trust, avoiding capital gains tax, and pay the income tax liability during their lifetime, which can reduce the taxable estate's value and potentially create multigenerational wealth.

What is the impact of remarriage on portability in estate planning?

-Remarriage by a surviving spouse can result in the loss of portability, as the unused estate and gift tax exemption of the deceased spouse may not be inherited by the new spouse.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The $2.3T Gap Between Trump’s and Harris’s Tax Plans | WSJ

상속세 바뀝니다! 핵폭탄급 비상입니다. 전가족 세무조사! 통합 공제 삭제! (Feat. 기획재정부 유산취득세 추진 발표!)

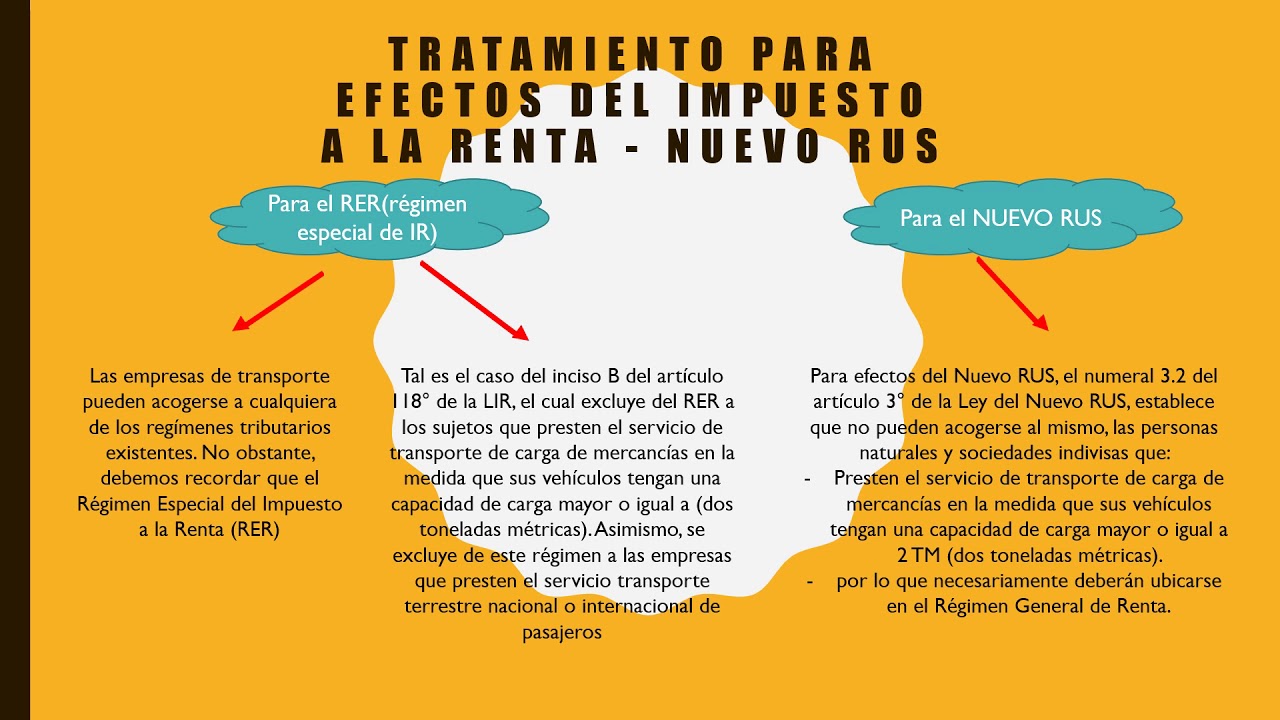

Aspecto tributario de las empresas de transporte

Tax Amnesty, Tax Exemption, Situs of Taxation

Can You Really Pay Less Taxes in Puerto Rico? ( tax strategy explained)

Personal Tax Simplified...

5.0 / 5 (0 votes)