ONE MORE 30% FALL IN BITCOIN

Summary

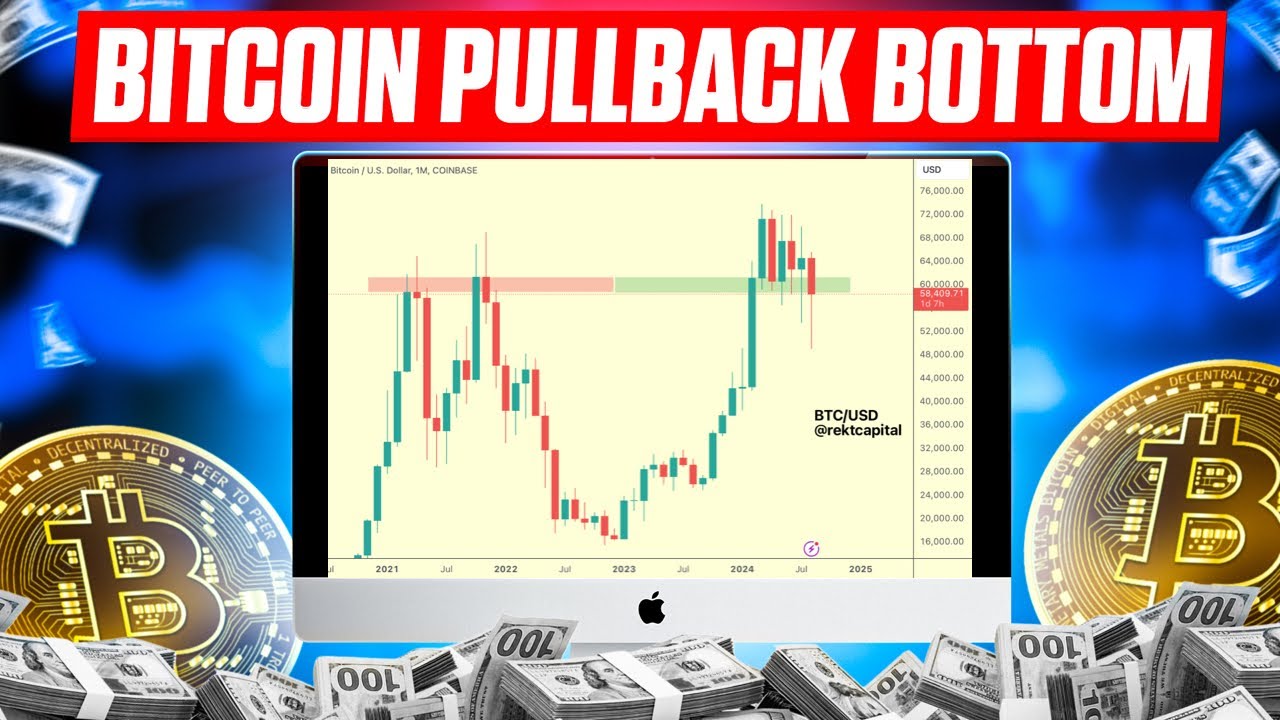

TLDRIn this video, the host discusses the current state of Bitcoin's price and anticipates a significant pullback before a potential rise to new all-time highs. They compare Bitcoin's current market cycle with its previous one, using moving averages as a key indicator. The host also briefly touches on marijuana stocks, traditional markets, and the correlation between them and Bitcoin. They express a short-term bearish outlook on Bitcoin and Ethereum, with a focus on the 50-day moving average as a critical support level. The video concludes with the host's predictions for Bitcoin's future price movements and a reminder that the content is not financial advice.

Takeaways

- 📉 The speaker anticipates a final major pullback for Bitcoin before it reaches new all-time highs.

- 📊 The video reflects on the previous market cycle to make predictions for Bitcoin's future.

- 🔢 Bitcoin's price at the time of the video is $26,000 after a significant pullback.

- 📈 The speaker uses moving averages (12-day and 50-day) as a trading strategy for Bitcoin.

- 🔄 Bitcoin is currently trapped between the 50, 100, and 200-day moving averages.

- 📌 The speaker is short-term bearish on Bitcoin, not excited about the current daily chart.

- 🔮 Ethereum's weekly chart appears weaker than Bitcoin's, suggesting more downside potential.

- 🚫 The speaker advises against buying Ethereum due to its bearish outlook across various timeframes.

- 📅 The speaker expects a buying opportunity for Bitcoin in the next month, similar to past cycles.

- 📉 A potential 25-30% pullback from the current price is anticipated, targeting a price around $20,000.

- ⚠️ The speaker emphasizes that the content is not financial advice and encourages viewers to make their own decisions.

Q & A

What is the speaker's general sentiment about the current Bitcoin market cycle?

-The speaker believes that there will be one final major pullback before Bitcoin reaches new all-time highs, and they are anticipating a buying opportunity similar to previous market cycles.

How does the speaker use moving averages to analyze Bitcoin's price?

-The speaker uses the 12-day (red) and 5-day (green) moving averages to determine potential buy and sell points, suggesting that selling when the green crosses below the red and buying when it crosses above has historically been a successful strategy.

What is the speaker's short-term outlook for Bitcoin?

-The speaker is short-term bearish, noting that Bitcoin is currently trapped between moving averages and there is not a lot of certainty on the 7-Day chart.

How does Ethereum's price chart compare to Bitcoin's according to the speaker?

-The speaker observes that Ethereum's weekly chart looks much weaker than Bitcoin's, suggesting that there will be more downside for Ethereum and potentially leading to a similar trend for Bitcoin.

What is the speaker's strategy for buying Bitcoin in the current market conditions?

-The speaker has buy orders set just below $20,000 and is hoping for a pullback to around $13,000, believing that a significant drop would be the last buying opportunity before Bitcoin takes off.

How does the speaker compare the correlation between Bitcoin and traditional markets like stocks?

-The speaker notes that while there is still some correlation between Bitcoin and traditional markets, it is not as strong as it used to be, citing Tesla and S&P 500 (SPY) as examples of stocks that are performing differently from Bitcoin.

What historical pattern is the speaker looking for in the Bitcoin market cycle?

-The speaker is looking for a pattern similar to previous market cycles where Bitcoin experienced a significant pullback before reaching new all-time highs, and they believe this could happen within the next 30 to 60 days.

What is the speaker's prediction for Bitcoin's price after a potential pullback?

-The speaker predicts a 25 to 30% pullback from the current price, which would put Bitcoin in the range of $20,000 to $18,000, and they believe this would be the best time to buy.

How does the speaker address the unpredictability of the cryptocurrency market?

-The speaker acknowledges that no one can accurately predict what will happen next in the market, and they emphasize that their analysis and predictions are based on patterns and should not be taken as financial advice.

What does the speaker suggest about the timing of the next Bitcoin all-time high?

-The speaker suggests that, based on historical patterns, Bitcoin typically reaches a new all-time high about 9 to 12 months after the halving event, and they anticipate this could happen by the end of the year.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)