What is a Nonprofit Corporation - 501c3 Status

Summary

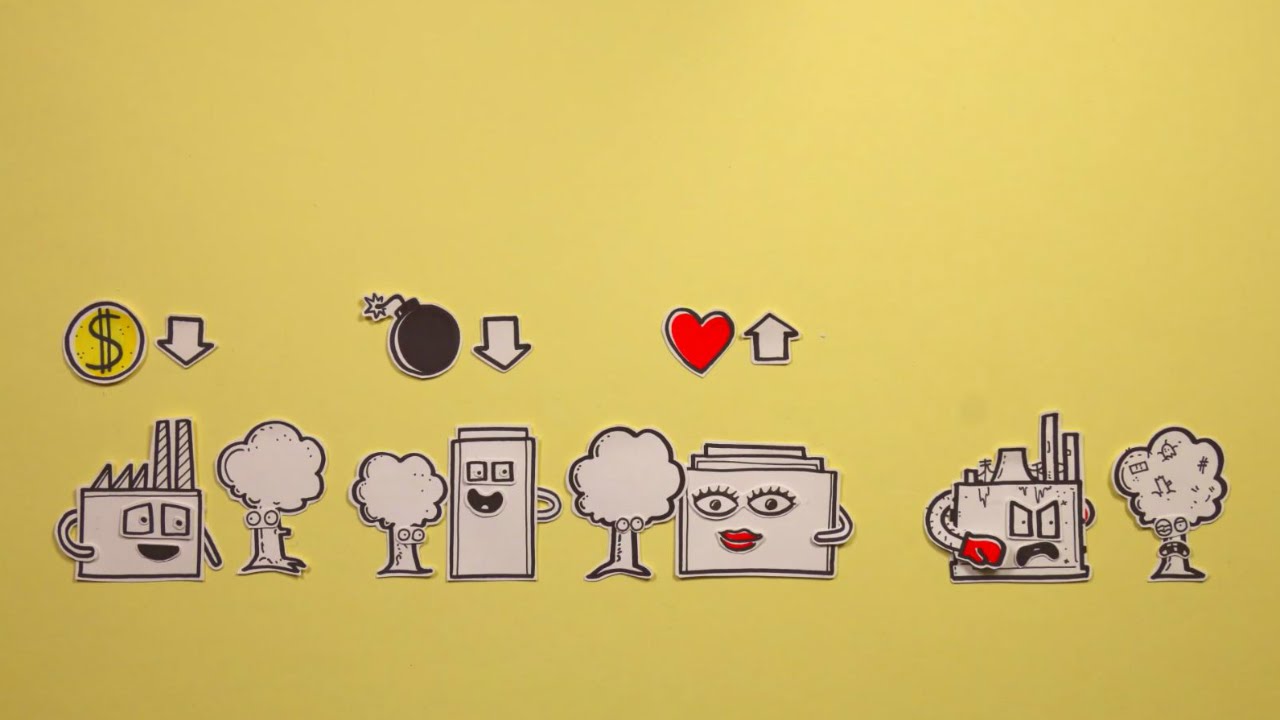

TLDRThis video script explores the concept of non-profit corporations, distinguishing them from profit-driven businesses by their purpose to support social causes. It explains the organizational structure, including bylaws, directors, and officers, and clarifies misconceptions about non-profits. Highlighting the benefits of tax-exempt status and the importance of financial responsibility, the script also discusses when forming a non-profit might be necessary and the advantages it offers, such as limited liability, fundraising capabilities, and tax deductions for donors.

Takeaways

- 📜 A non-profit corporation is a legal entity that exists for a defined purpose, not to make a profit, unlike LLCs and regular corporations.

- 🎯 Non-profits are purpose-driven, often including charities, churches, and social advocacy groups, aiming to support social causes or provide public benefits.

- 💼 After covering operating costs, any excess funds in a non-profit go towards the cause they support, rather than being distributed as profits.

- 📝 Non-profits have bylaws, a board of directors, and officers, similar to regular corporations, which define governance and operational rules.

- 👥 The board of directors oversees the organization's operations and creates policies, while officers execute responsibilities based on their roles.

- 🔄 Officers can also be board members, serving dual roles if permitted by the non-profit's bylaws.

- 💼 Non-profits can apply for 501c3 tax-exempt status, which, if granted, allows them to avoid paying taxes on their income, directing more funds to their cause.

- 👩💼 Contrary to a common misconception, most non-profits employ staff and may use volunteers, but must balance salaries with the needs of their cause.

- 💰 Non-profits must operate fiscally responsibly, managing income and expenses to ensure they remain viable, despite not aiming to maximize profits.

- 🏆 Forming a non-profit is not mandatory for raising money for a cause; one-time charity events can also be effective without this structure.

- 🌐 Becoming a non-profit offers benefits like limited liability, enhanced fundraising capabilities, tax exemptions, and donor tax deductions, which can encourage donations.

Q & A

What is a non-profit corporation?

-A non-profit corporation is a legal entity that exists for a defined purpose without seeking to make a profit, unlike LLCs and corporations which aim to generate profit. It is purpose-driven, often involved in charitable, religious, or social advocacy activities.

How do non-profits differ from other business structures?

-Non-profits differ primarily in their ability to apply for tax-exempt status, which allows them to avoid paying taxes on their income. Their primary goal is to support a social cause or public benefit rather than maximizing profits.

What is the role of bylaws in a non-profit corporation?

-Bylaws in a non-profit corporation serve as a 'constitution', outlining the rules and governance structure of the organization, making the rules and priorities clear for all involved.

Who are the directors in a non-profit corporation and what is their responsibility?

-Directors in a non-profit corporation form the board of directors and are responsible for overseeing the organization's operations. They create policies and oversee management-level hiring, but they do not have individual authority outside of the board.

Can a non-profit officer also be on the board of directors?

-Yes, an officer of a non-profit, such as the president or secretary, may also serve on the board of directors, provided the organizational bylaws allow for it.

What is the 501c3 tax-exempt status and why is it significant for non-profits?

-The 501c3 tax-exempt status is a designation that, if accepted, allows non-profit organizations to avoid paying taxes on their income. This is significant as it enables more funds to be directed towards the social benefit or cause they support.

Are non-profits only run by volunteers?

-No, while volunteers may be involved, most non-profits have paid staff to perform various roles within the organization. However, they must balance employee salaries with the amount provided to the people or groups they aim to help.

Do non-profit organizations make a profit?

-Non-profits are not focused on maximizing profits, but they may generate income from grants, donations, and services. They must manage this income and expenses responsibly to remain fiscally viable.

Is it necessary to form a non-profit corporation to raise money for a social cause?

-No, one-time charity events or informal fundraising can be conducted without forming a non-profit corporation. However, forming a non-profit may be more suitable for long-term goals due to benefits like limited liability, enhanced fundraising capabilities, and tax exemptions.

What are the benefits of operating as a non-profit for donors?

-Donors to a non-profit corporation can claim tax deductions for their donations, which may incentivize giving. This is a benefit not typically available for donations made through one-time charity events.

What additional benefits come with forming a non-profit corporation?

-Forming a non-profit corporation provides benefits such as limited liability protection, an enhanced ability to raise funds and apply for grants, discounted rates on certain services, and the ability to offer tax deductions to donors.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

STPM l PENGAJIAN PERNIAGAAN SEM 1 BAB 1 (PART 1-PERNIAGAAN VS BUKAN PERNIAGAAN)

Michael Porter: Creating Shared Value

THE CORPORATION - by Mark Achbar and Jennifer Abbott

Little Green Bags: True Business Sustainability

What Is the Triple Bottom Line? | Business: Explained

Direito Civil - Aula #21 - Fundação (É isso!)

5.0 / 5 (0 votes)