Interest Rates Falling Soon - Here’s What I’m Doing NOW

Summary

TLDRIn this video, the speaker discusses their strategy for managing cash holdings as interest rates are expected to decrease. With Federal Reserve Chair Jerome Powell signaling rate cuts, the speaker plans to increase holdings in Singapore Savings Bonds (SSB), allocate funds for emergency savings, short-term goals like property purchases, and invest more for medium to long-term goals. They highlight the importance of adapting to changing financial landscapes and staying informed through their Telegram channel for the latest updates and deals.

Takeaways

- 📉 The speaker anticipates a decrease in interest rates, with Jerome Powell hinting at cuts and current rates already falling.

- 💼 The speaker plans to adjust their cash management strategy in response to the changing interest rate environment.

- 🏦 They will increase their holdings in Singapore Savings Bonds (SSB), considering the rates have become more attractive compared to other options.

- 💹 The speaker suggests that SSBs are a good fit for emergency funds due to their long-term returns and liquidity.

- 🏡 There's a plan to allocate funds for a new property purchase, which includes setting aside money for down payment and related costs.

- 💡 The speaker advises keeping some liquidity in cash for emergencies, as SSBs only allow monthly withdrawals.

- 💰 They will allocate a portion of their funds to short-term savings promos, taking advantage of current market promotions.

- 🌐 The speaker encourages joining their Telegram channel for updates on financial products and strategies.

- 🏦 For medium to long-term funds, the speaker intends to shift more towards investments as cash yields decrease.

- 🔄 The speaker reflects on being too cash-heavy in the past and sees the falling interest rates as a motivation to invest more.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the management of cash holdings in response to the anticipated decrease in interest rates, as indicated by the Federal Reserve Chairman Jerome Powell.

What does the speaker anticipate regarding interest rates in the near future?

-The speaker anticipates that interest rates will be coming down, with traders expecting at least a 0.25% point reduction in September, based on information from CNBC.

How does the speaker plan to allocate their money across different categories?

-The speaker plans to allocate their money into three categories: emergency funds, short-term funds, and medium-term to long-term funds.

Why is the speaker considering increasing their holdings in Singapore Savings Bonds (SSB)?

-The speaker is considering increasing their holdings in SSB because the gap between the rates offered by SSB and other financial instruments has narrowed, making SSB a more attractive option.

What is the current interest rate for SSB mentioned in the script?

-The current interest rate for SSB mentioned in the script is 3.06% per annum.

How much of their funds does the speaker plan to allocate to emergency savings in SSB?

-The speaker plans to allocate roughly 9 to 10 months' worth of expenses to emergency savings in SSB.

What is the speaker's strategy for short-term goals like upcoming vacation plans?

-The speaker's strategy for short-term goals is to keep the outlay minimal and cover it from active income, as they have not yet started serious property hunting.

What is the speaker's current apartment refinancing rate, and why did it deter them from buying a new apartment earlier?

-The speaker's current apartment refinancing rate is around 1.45%, which was a deterrent to buying a new apartment due to the higher mortgage rates available in the market at that time.

How does the speaker plan to manage their short-term funds for buying a new apartment?

-The speaker plans to set aside funds for the down payment, stamp duty, legal costs, and potential renovation costs for their next property, which they estimate to be between $328,000 to $473,000.

What is the speaker's approach to medium to long-term funds that they do not need to touch for at least 5 years?

-The speaker plans to allocate more of their medium to long-term funds towards investments, as they believe the high interest rates of the past couple of years were not sufficient to combat inflation and they want to invest more for their long-term goals.

How does the speaker intend to stay updated on the best savings deals and earning opportunities?

-The speaker encourages joining their Telegram channel to stay informed about important updates, the best savings deals, and ways to earn more from credit cards and savings accounts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Where to Park Cash in Today's Market

Buy Low - Sell High - Semiconductor Stocks Are On Sale

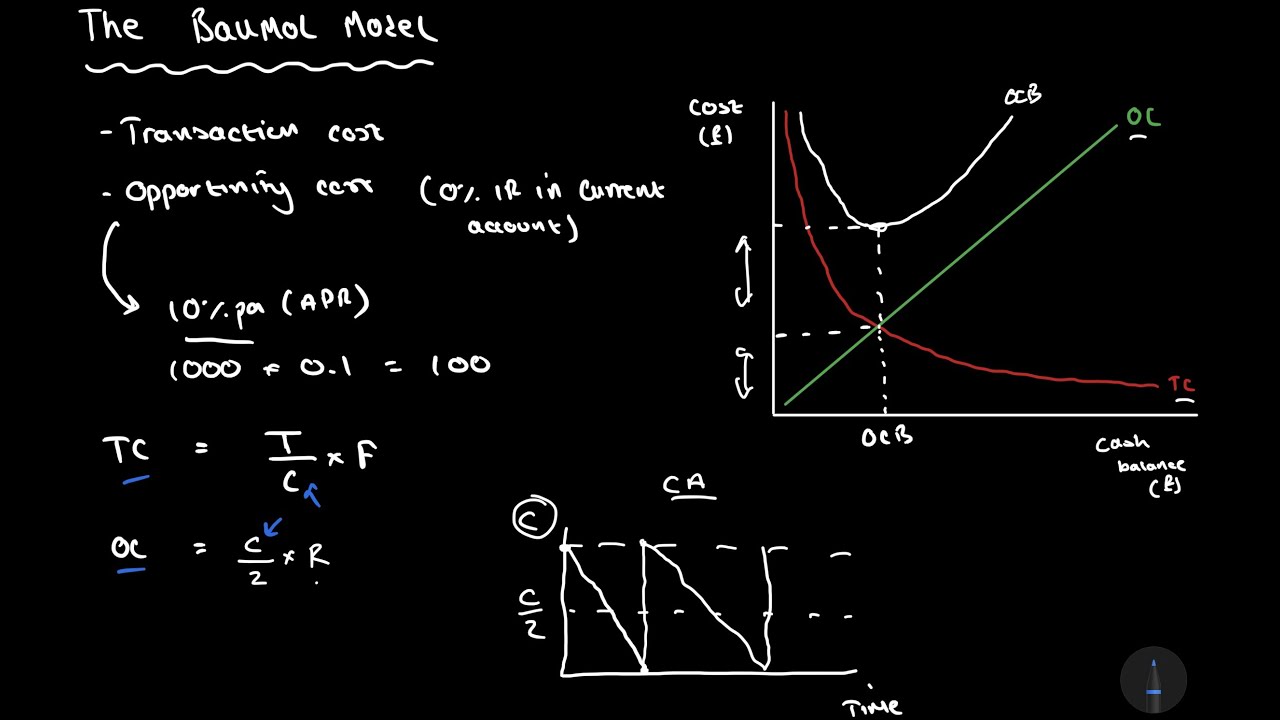

Deriving The Baumol Model of Cash Management | Corporate Finance

Rekonsiliasi Bank | Adhelia Desi Prawestri, S.Pd., M.Akun.

Warren Buffett Preparing For A Crash Like 2007

Should We Ditch our Dividend Stocks for 5.2% on Cash?

5.0 / 5 (0 votes)