Session 2: The Objective in Corporate Finance

Summary

TLDRThis script delves into the core objective of corporate finance: maximizing business value, often translated into maximizing stock prices. It critiques the utopian assumptions behind this approach and explores the potential misalignments between managerial and shareholder interests. The lecture highlights issues like greenmail, golden parachutes, poison pills, and shark repellents, which can undermine true value creation. It also emphasizes the importance of understanding power dynamics within a company, as these can significantly influence corporate decisions and governance.

Takeaways

- 🎯 The primary objective in corporate finance is to maximize the value of the business, focusing on both assets in place and growth assets.

- 📉 In practice, corporate finance often narrows its focus to maximizing stock prices, which can be a pragmatic approach due to the influence of stockholders.

- 🌐 Achieving the utopian condition where maximizing stock prices is the sole objective requires unrealistic assumptions, such as complete power of stockholders over managers, honest and timely information disclosure, and no social costs.

- 🤝 The effectiveness of the linkage between managers and stockholders is questionable, with mechanisms like annual meetings and Boards of Directors often failing to keep managers accountable.

- 💼 Managers may prioritize their interests over those of stockholders, leading to actions like greenmail, golden parachutes, and poison pills that protect their positions but not necessarily shareholder wealth.

- 🏦 The assumption that lenders will not get exploited if they lend money without protection is flawed, as seen in cases like RJR Nabisco's leveraged buyout.

- 📊 The assumption of timely and honest information disclosure by companies to financial markets is often violated, leading to market inefficiencies and misinformed trading.

- 🌐 The belief in the absence of social costs created by companies is unrealistic, as all businesses inherently create social costs that impact society.

- 🔍 Analyzing the power structure within a company is crucial for understanding where decisions are made and whose interests are being served, which can vary from managers to large shareholders or even governments.

- 🛑 The presence of activist shareholders or influential individuals, like Steve Jobs in Disney, can act as a catalyst for change and better represent the interests of smaller shareholders.

Q & A

What is the primary objective of corporate finance?

-The primary objective of corporate finance is to maximize the value of the business, which includes both assets in place and growth assets.

Why does the focus on maximizing stock prices become a narrower objective in practice?

-In practice, the focus narrows to maximizing stock prices because managers of publicly traded companies are often evaluated and compensated based on shareholder wealth, which is commonly measured by stock price performance.

What are the utopian conditions assumed for maximizing stock prices to be the only corporate objective?

-The utopian conditions include total power of stockholders over managers, lenders not getting ripped off even without protection, companies revealing news honestly and on time, rational and cool financial markets, and no social costs created by firms.

How do the mechanisms of annual meetings and Boards of Directors affect shareholder power over managers?

-Annual meetings and Boards of Directors are supposed to give shareholders power over managers, but in reality, they are often ineffective. Most shareholders don't attend annual meetings, and many proxies are not returned, leading to managers having significant control over votes. Additionally, Board members are often chosen by the CEO or are connected to management, which can lead to a lack of independent oversight.

What is the issue with the Disney Board of Directors in 1997 according to the script?

-The Disney Board of Directors in 1997 was considered problematic due to its large size of 17 members, the presence of eight insiders, the chairman also being the CEO, and the majority of outside members having personal connections to the CEO, leading to a lack of independent oversight.

What are some examples of managerial interests overshadowing shareholder interests?

-Examples include greenmail, golden parachutes, poison pills, shark repellents, and managerial ego driving acquisitions that don't make sense from a shareholder perspective.

How can the assumption of companies revealing information honestly and on time go wrong?

-Companies may delay bad news, commit errors of omission, or even engage in outright fraud, which means information does not reach financial markets freely and on time.

What is the significance of the shift in Disney's top shareholders from 2003 to 2009?

-The shift signifies a change in the power dynamics within the company. In 2009, Steve Jobs, who was known for pushing companies to change, became the largest shareholder, which could potentially lead to more proactive management and better alignment with shareholder interests.

Why is the structure of shareholding in companies like Tata Motors and Baidu significant from a corporate finance perspective?

-The structure of shareholding in companies like Tata Motors and Baidu indicates that decisions may be made in the best interest of the group or controlling entities rather than individual shareholders, which can affect shareholder value and influence the company's strategic direction.

What is the implication of the discussion on corporate finance objectives and the distribution of power within a company?

-The discussion implies that while the objective of corporate finance is to maximize stock prices, the distribution of power within a company can significantly influence whether this objective aligns with the interests of all shareholders, and it's crucial for investors to understand where the power lies and how it might affect their investments.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Session 3: The Objective in Corporate Finance - Reality

Session 1: Corporate Finance: What is it?

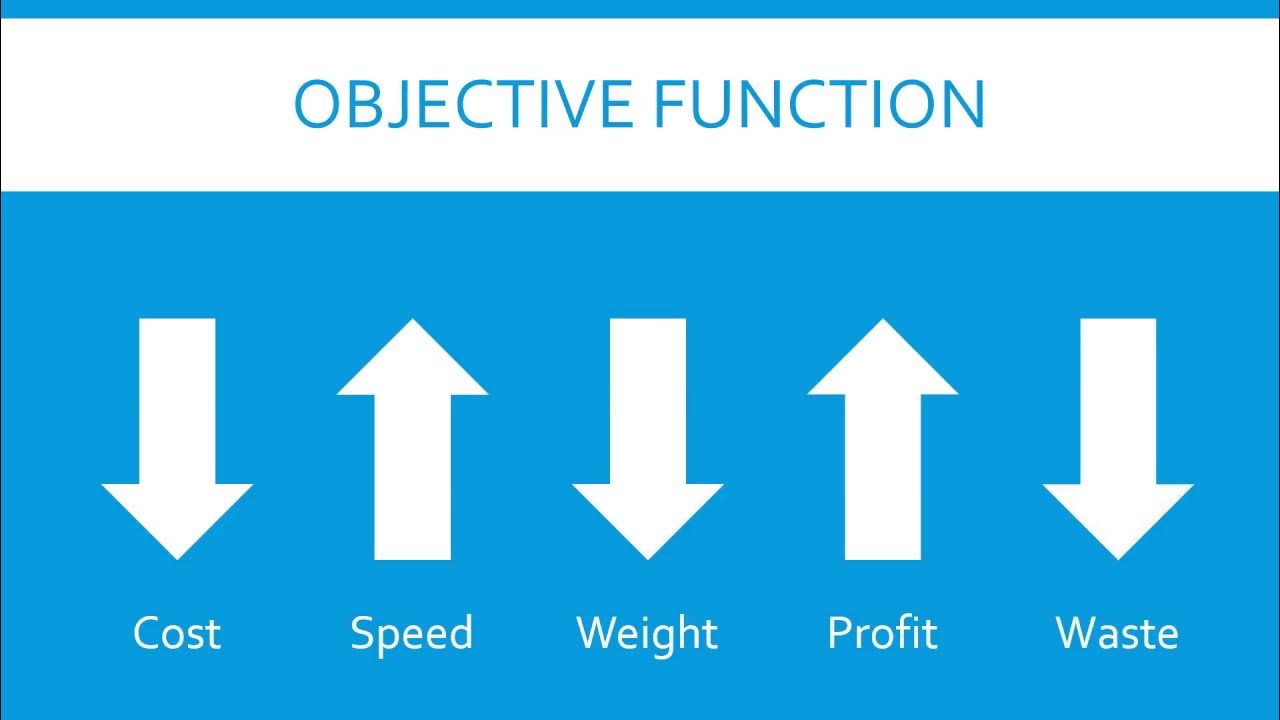

Introduction To Optimization: Objective Functions and Decision Variables

What is Operations Management and the Transformation Model

CH 11 Basics of Capital Budgeitng

Corporate Actions -- Examples & Impacts- Video 12

5.0 / 5 (0 votes)