Issue a credit note | Odoo Accounting

Summary

TLDRThis video tutorial explains the concept of credit notes, their importance in business transactions, and how to handle them in OpenERP (ODU). It demonstrates creating a credit note for a returned or damaged product, guiding through the process of issuing a credit note directly from an existing invoice. The video covers the steps from accessing the accounting app, configuring the sales journal, creating and editing the credit note, to reconciling it with the original invoice. It emphasizes the ease of managing customer satisfaction and transparency in financial dealings.

Takeaways

- 📝 A credit note is a document used to inform customers that they have been credited for a reason, such as a product return or receiving a damaged product.

- 🔄 The journal entry for a credit note is the reverse of an invoice, with debits to income accounts and credits to accounts receivable.

- 💼 In Bloom's accounting system, credit notes can be configured to have a dedicated sequence separate from invoices, denoted by an 'R' prefix.

- 📊 The sales journal configuration in the accounting app allows for the setup of credit note sequences and other related settings.

- 📑 Credit notes can be created through the credit notes menu or directly from an invoice in the system.

- 🛒 If a product is returned or damaged, a credit note can be issued by selecting the credit note option on the invoice and entering the appropriate details.

- 📅 The reversal date on a credit note can be set to the current date or another specified date, depending on the situation.

- ➡️ There's an option to either reverse the transaction or reverse and create a new invoice, which affects how the credit is processed.

- 📝 After selecting to reverse, the credit note is created in draft status, where specific items can be adjusted before confirmation.

- 💸 If the customer hasn't paid, the credit note is automatically marked as paid by reconciling it with the original invoice, streamlining the process.

- 🔗 The system maintains transparency by linking the credit note to the original invoice and updating the customer portal accordingly.

Q & A

What is a credit note and why is it used?

-A credit note is a document used to notify customers that they have been credited for some reason, such as returning a product or receiving a damaged product. It decreases the amount a customer owes.

How is the journal entry for a credit note different from an invoice?

-The journal entry for a credit note is essentially the opposite of that of an invoice, with a debit to the income account and a credit to the account receivable.

Can you create a dedicated sequence for credit notes in the accounting app?

-Yes, in the accounting app's configuration, you can create a dedicated credit note sequence that separates the sequences of invoices and credit notes, adding an 'R' to the beginning of the short code for credit notes.

How does the process of creating a credit note from an invoice differ from creating one directly from the credit notes menu?

-Creating a credit note from an invoice automatically populates the same sales journal as the invoice, making the process more streamlined and ensuring consistency.

What is the purpose of the 'reverse' option when creating a credit note from an invoice?

-The 'reverse' option allows you to create a partial credit note for the returned or damaged goods, without fully reversing the original invoice or creating a new one.

What does the 'reverse and create invoice' option do in the credit note creation process?

-The 'reverse and create invoice' option fully reverses the original invoice and then creates a new invoice that can be adjusted to include only the undamaged goods.

How does the system handle a credit note when the customer hasn't made a payment yet?

-If the customer hasn't paid, the credit note is automatically marked as paid by reconciling the amount directly with the original invoice, avoiding the need for a refund payment.

How can customers view their credit notes and invoices?

-Customers can view their credit notes and invoices in the customer portal, where both documents are available for easy access and transparency.

What is the significance of marking the credit note as paid in the original invoice?

-Marking the credit note as paid in the original invoice ensures transparency and helps in understanding that the amount for the returned or damaged goods has been accounted for, even if no actual money has been paid.

How does the system ensure that the customer is aware of the credit note issued to them?

-The system includes a note in the 'chatter' section linking back to the credit note, ensuring that the customer is informed and can easily access the document.

What is the ultimate goal of handling credit notes efficiently as described in the script?

-The ultimate goal is to keep customers satisfied by efficiently handling credit notes, ensuring they have a positive experience and are likely to return for more business.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Types of Source Documents

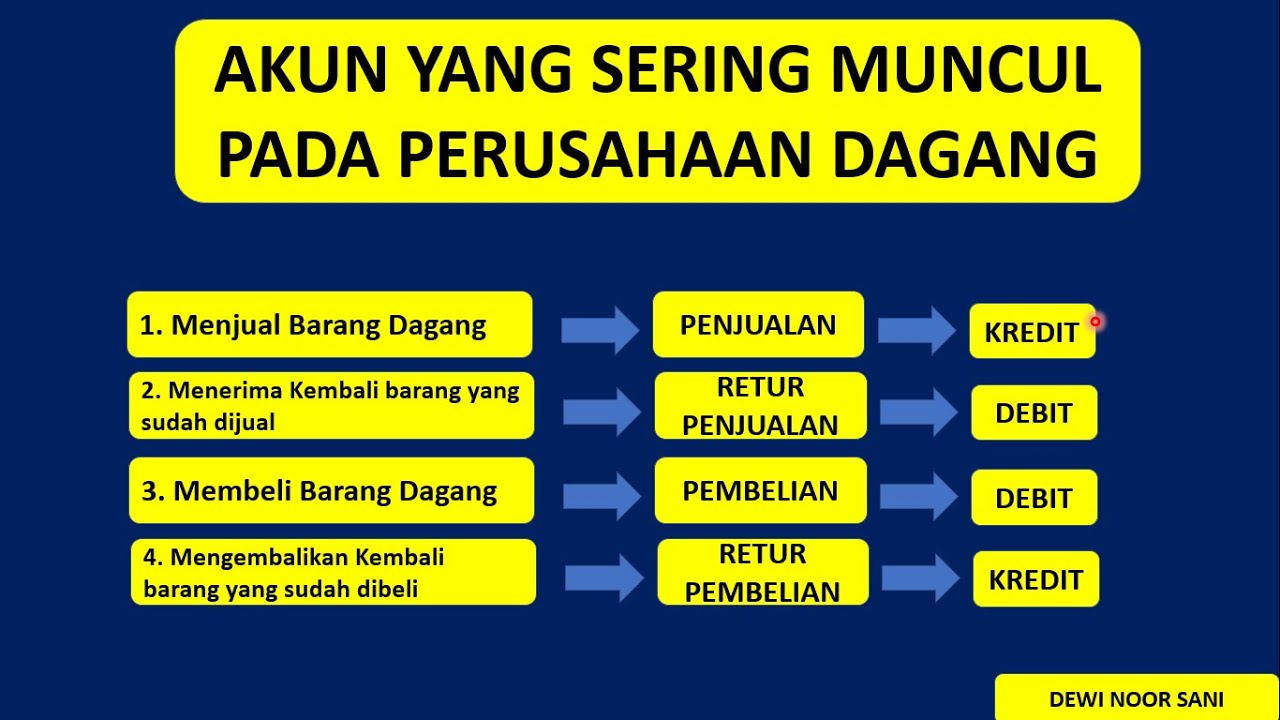

JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

CARA INPUT TRANSAKSI PENJUALAN KREDIT, PENJUALAN TUNAI DAN RETURN PENJUALAN DI MYOB ACCOUNTING

Akuntansi Keuangan - Kelas XI - Kartu Utang

Perbankan Dasar Kelas X SMK | Kredit Perbankan 1

What is a Credit Note?

5.0 / 5 (0 votes)