Greatest Smart Money Concepts Indicator on TradingView (In-Depth Tutorial)

Summary

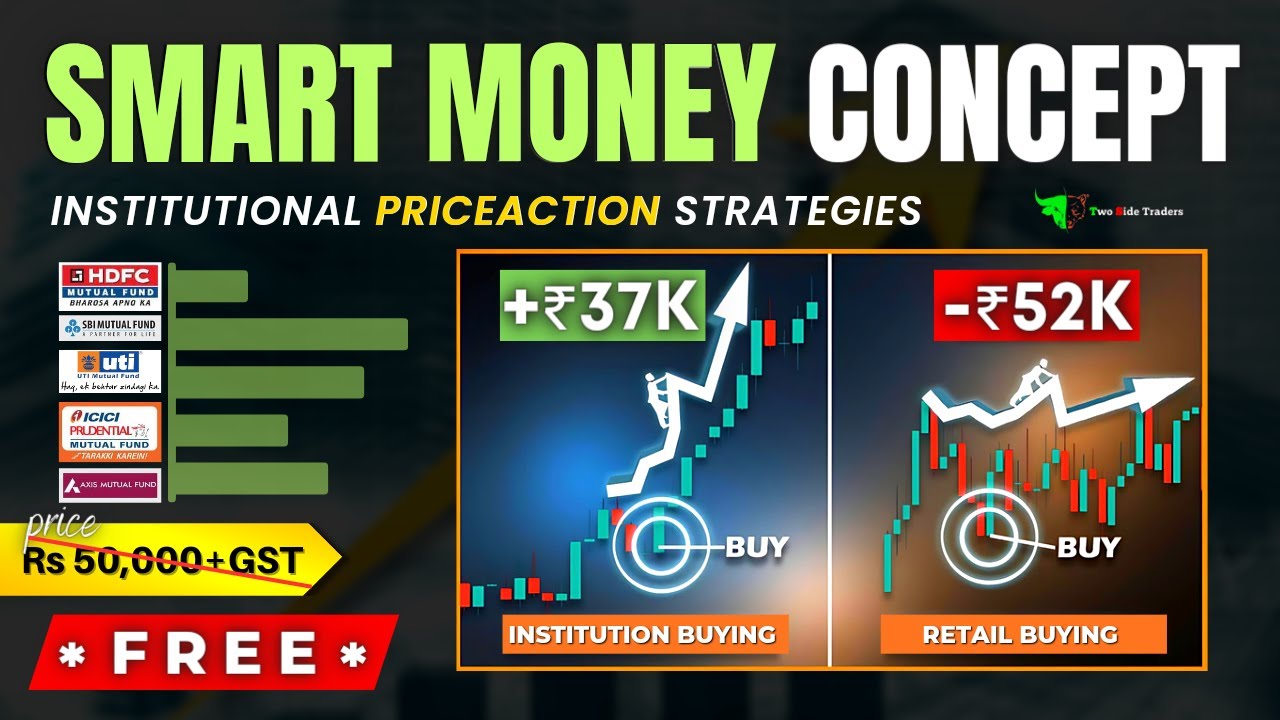

TLDRThe video introduces a top-ranking, free, open-source indicator for traders based on smart money concepts. It simplifies market structure analysis, trend detection, and order block identification. The indicator highlights key features like change of character, break of structure, and liquidity zones, enhancing trading strategies. The video also emphasizes the importance of using this tool in conjunction with other analysis for effective trading, showcasing practical trade setups and suggesting premium features for advanced insights.

Takeaways

- 🚀 The Smart Money Concepts indicator is a popular tool on TradingView, ranking in the top 10 indicators of all time.

- 📊 It simplifies market analysis by combining essential elements of smart money concepts into a single, free, and open-source indicator.

- 📈 Market structure is a key feature for detecting trend changes and validating existing trends through higher highs and lows.

- 🔍 Change of character (CH) labels in red indicate a trend reversal, while break of structure (BOS) labels in green signify a continuation of the trend.

- 🔄 Larger solid lines represent swing structures, which can help determine the significance of a directional change in the market.

- 📍 The indicator can detect equal highs and lows, and major price points to locate areas of resting liquidity.

- 📉 Order blocks highlight significant buying and selling activity, with bullish blocks in blue and bearish in red, useful for trade exits or taking profits.

- 💰 Fair value gaps represent price imbalances that the market gravitates towards, useful for finding precise entry points in a trade.

- 📊 The premium and discount feature helps in detecting regions of supply and demand, guiding traders on optimal entry points for trades.

- 📝 Traders should use the indicator in conjunction with other analysis tools and not rely solely on change of character or break of structure points for trade execution.

- 🌐 The Smart Money Concepts indicator is available for free on five different platforms and can be further enhanced with the premium version for additional features.

Q & A

What is the primary function of the Smart Money Concepts indicator?

-The Smart Money Concepts indicator is designed to help traders perform analysis on market structure, order blocks, and liquidity concepts, enabling them to detect trend changes and validate existing ones using price action.

How does the indicator represent trend changes in an uptrend?

-In an uptrend, the market typically makes higher highs and higher lows. The indicator plots a red 'CH' label for 'Change of Character' when a higher low point is broken, signaling a change in market direction.

What does the 'BOS' label signify in the indicator?

-The 'BOS' label stands for 'Break of Structure' and is plotted when the previous higher high point is broken, signifying that the market trend is continuing.

How can the indicator's internal structures be nested within larger structures?

-Internal structures can exist within larger swing structures, which are represented by solid lines. These larger structures can help determine the significance of a directional change and provide context for the internal changes.

What is the purpose of detecting equal highs and lows in the indicator?

-Equal highs and lows are used to locate areas of resting liquidity. Traders can use these levels to identify potential support or resistance zones where the price may struggle to move in a particular direction.

How does the indicator use order blocks to assist traders?

-Order blocks represent areas of significant buying and selling activity. When the price returns to these levels, there is often a strong reaction, which traders can use to take profit or exit trades.

What are fair value gaps and how do they help in trading?

-Fair value gaps are price imbalances that need to be filled; the price will gravitate towards them. They can be used to find more precise entry points within a retracement for trading.

What is the significance of the premium and discount feature in the indicator?

-The premium and discount feature helps detect regions of supply and demand in the market. It can guide traders on whether to enter a trade or wait for a pullback to the discount zone, potentially saving them from getting stopped out in a retracement.

How should traders use the Smart Money Concepts indicator in conjunction with other tools?

-Traders should use the Smart Money Concepts indicator alongside their analysis and other complementary indicators before executing any trade, rather than blindly taking trades at change of character or break of structure points.

What is the Money Flow Profile and how does it complement the Smart Money Concepts indicator?

-The Money Flow Profile is a volume analysis tool that shows where the most volume is and whether traders have more bullish or bearish sentiment within a region. It complements the Smart Money Concepts indicator by providing insights into the strength and direction of market sentiment.

How can users access the Smart Money Concepts indicator and its premium version?

-Users can access the Smart Money Concepts indicator for free within the Lux Algo Library by searching for it. The premium version, which includes additional features and improvements, can be tried for 30 days at Lux Algo's website.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

How To Trade Smart Money Concepts | LuxAlgo

The ONLY Market Structure Trading Video You’ll Ever Need

✨Smart Money Setup 01 Indicator - Proof of Two Order Blocks for TradingView-TFLab

The Seven FREE Wonders that make the Modern Smart Home

Smart Money Concepts Indicator (Best in the Game?)

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

5.0 / 5 (0 votes)