3 High Probability Scalping Strategies Using Smart Money Concepts

Summary

TLDRThis video dives into Smart Money Concepts, focusing on how professional traders use market structure, liquidity, and imbalances for high-quality scalping. It covers key topics such as market direction, liquidity grabs, and entry confirmation across different time frames. Viewers will learn to spot liquidity zones, analyze price action, and apply advanced strategies through real chart examples. With insights into risk management and trading psychology, the video offers valuable tools for traders aiming for discipline and consistency in their strategy. Subscribe for more in-depth content and exclusive access to advanced trading techniques.

Takeaways

- 😀 Smart Money Concepts (SMC) help professional traders execute high-quality scalping trades using market structure and liquidity.

- 😀 Liquidity levels, including equal highs, equal lows, and reversal points, act as critical zones where price is drawn to for execution.

- 😀 A key strategy is to use two time frames: one higher time frame to define liquidity and one lower time frame for execution of the trade.

- 😀 Identifying liquidity grabs, whether bullish or bearish, provides entry signals based on price action behavior.

- 😀 Bullish liquidity grab: Price trades below a low and quickly returns, signaling potential upside momentum.

- 😀 Bearish liquidity grab: Price trades above a high and returns, signaling a potential downtrend.

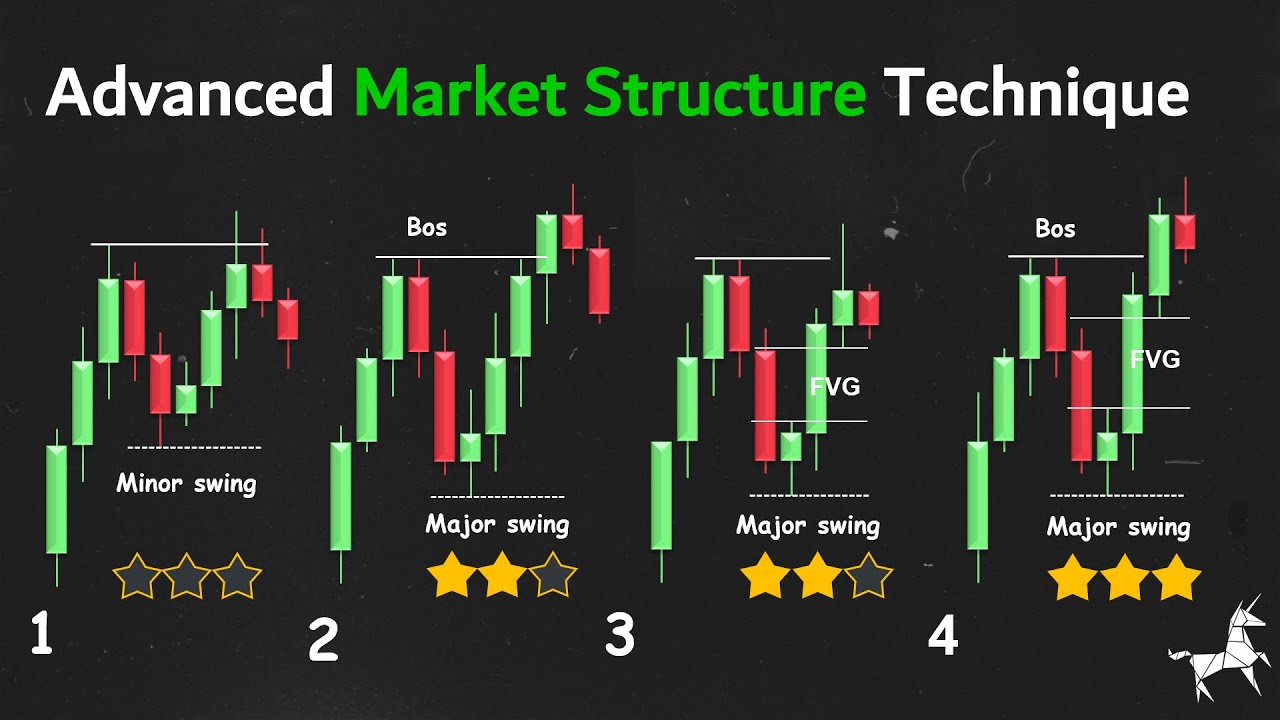

- 😀 Fair value gaps, or price imbalances, are used as optimal trading zones for price to revisit and form potential entry points.

- 😀 Always place stop losses with enough room to account for price fluctuations, and define clear targets based on liquidity levels.

- 😀 The use of multiple time frames (e.g., 1-hour for trend direction and 5-minute for entries) helps refine trade setups and enhance precision.

- 😀 Successful scalping involves understanding liquidity sweeps where smart money drives price to trigger stop losses before reversing direction.

- 😀 Patience is key in trading. It's important to wait for high-probability setups and avoid chasing low-quality opportunities for better risk management.

Q & A

What is the primary focus of Smart Money Concepts in scalping?

-Smart Money Concepts focus on using market structure and liquidity to execute high-quality scalping trades. Traders identify key liquidity levels and imbalances to make informed entry decisions.

How does the two-time frame strategy work for scalping?

-The two-time frame strategy involves using a higher time frame to identify key liquidity levels and a lower time frame to spot a liquidity grab that aligns with the overall market direction, which confirms the trade entry.

What is a 'draw on liquidity' in trading?

-A 'draw on liquidity' refers to the market's tendency to move toward areas with high liquidity, such as equal highs, equal lows, or strong reversal points. These areas often contain stop losses and pending orders, which smart money can target.

How should liquidity levels be identified in the chart?

-Liquidity levels should be manually marked on the chart by identifying key price zones, such as equal highs or lows, and areas where stop losses are likely concentrated. This helps in understanding where liquidity is forming.

What is the role of liquidity grabs in trading strategies?

-Liquidity grabs occur when price temporarily breaches a key high or low before returning inside the range. A bullish liquidity grab suggests a reversal to the upside, while a bearish liquidity grab signals a potential downward move. These patterns are used for entry confirmation.

What is the importance of fair value gaps in scalping?

-Fair value gaps represent areas where the market moved too quickly, leaving price imbalances. These zones are treated as optimal trading areas, and when price revisits them, it often leads to market reactions. Traders use these gaps for setting entries in alignment with the market direction.

How do higher time frames and lower time frames complement each other in trading?

-Higher time frames are used to determine the overall market trend and identify key liquidity levels, while lower time frames are used for precise entry points. This combination helps traders execute trades with greater confidence and accuracy.

What is the significance of a 'change of character' in price action?

-A 'change of character' refers to a shift in market behavior, such as a break in structure or a reversal after a liquidity grab. This change acts as an additional confirmation for a trade setup, signaling that the market is likely to continue in the new direction.

What is the role of risk management in executing these strategies?

-Risk management is crucial to protect capital and avoid emotional trading. Traders are advised to limit risk to 2-3% of their account per trade and follow a structured trading plan. This helps maintain discipline and avoid significant losses.

What are liquidity sweeps, and how do they affect the market?

-A liquidity sweep occurs when price briefly breaks through a key support or resistance level to trigger stop orders and collect liquidity before reversing. These sweeps are often followed by market moves in the opposite direction, offering potential entry points for traders.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

How To Trade Like Smart Money With These Easy Steps!

I Discovered Best Market Structure Analysis (Premium Video)

My List of Top ICT Concepts for Successful Trading

How To Identify Liquidity in Trading (SMC Trading)

ICT SMT Divergence - Everything to Know About (Secrets)

Identifying Key Structures & Liquidity Zones

5.0 / 5 (0 votes)