How JOURNAL ENTRIES Work (in Accounting)

Summary

TLDRIn this video, James explains the concept of journal entries in accounting as an alternative to using T-accounts. He highlights the importance of bookkeeping for managing finances, cash flow, and taxes, and demonstrates how to create a journal entry. The example of a $20 laundry expense for cleaning equipment shows the process of recording debits and credits. James also distinguishes between automatic and manual journal entries, and discusses how accounting software simplifies the process. The video provides practical insights for small businesses and startups on managing financial transactions.

Takeaways

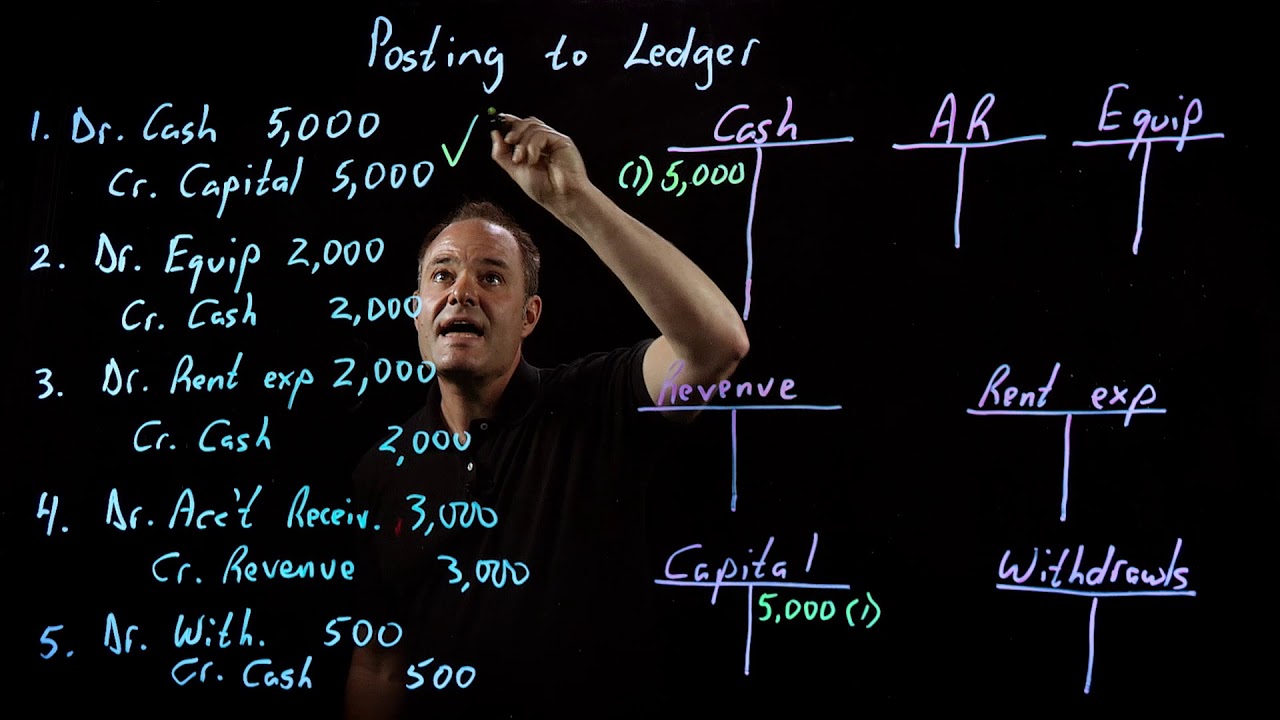

- 😀 T-accounts are not practical for everyday use due to their complexity and space requirements, making journal entries a better alternative.

- 😀 Bookkeeping is essential for measuring business performance, managing cash flow, staying organized, claiming tax deductions, and preparing for audits.

- 😀 A journal entry records a financial transaction and includes a journal number, transaction date, impacted accounts, debit/credit entries, and a description.

- 😀 The debit and credit totals of a journal entry must always match to maintain the accounting equation in double-entry bookkeeping.

- 😀 Automatic journals in accounting software save time by posting transactions automatically when invoices and payments are entered.

- 😀 Manual journal entries are used for unique or adjusting transactions that require manual input.

- 😀 In double-entry bookkeeping, every journal entry affects at least two accounts: one is debited and the other is credited.

- 😀 Each journal entry should include a clear description to help recall the purpose of the transaction in the future.

- 😀 Accounting software like QuickBooks prevents posting journals with mismatched debits and credits, ensuring accurate records.

- 😀 Journal entries are a key part of bookkeeping, allowing businesses to maintain organized and accurate financial records.

- 😀 James uses a real-life example of paying for equipment cleaning to demonstrate how to create and post a journal entry.

Q & A

What is the main topic of the video?

-The main topic of the video is about journal entries and how they provide an alternative to T-accounts for recording financial transactions in accounting.

Why are T-accounts considered impractical in day-to-day accounting?

-T-accounts are considered impractical because they take up too much space and can lead to missing one side of a transaction. Journal entries offer a more efficient and organized method of recording transactions.

What are the key benefits of recording financial transactions?

-Recording financial transactions helps in measuring business performance, managing cash flow, staying organized, preparing for tax time, and being ready for audits.

What is bookkeeping and why is it important?

-Bookkeeping is the process of recording all financial transactions in a business. It's crucial because it helps with financial analysis, cash flow management, organization, tax preparation, and audit readiness.

What are journal entries in accounting?

-Journal entries (JEs) are records of financial transactions, consisting of a journal number, entry date, affected account names, debit and credit amounts, and a description explaining the transaction.

Why is it important to have the debit and credit columns match in a journal entry?

-It is important because of the accounting equation, which ensures that debits always equal credits. This maintains the balance in the financial records and is a key control in accounting systems.

What are the differences between automatic and manual journal entries?

-Automatic journal entries are generated by accounting software when transactions like invoices and payments are recorded, saving time. Manual journal entries are used for adjusting entries or unique transactions, requiring manual input of data.

In the example provided, how was the journal entry for laundry costs created?

-The journal entry for laundry costs was created by assigning a unique journal number, using the entry date of September 21st, and recording the affected accounts (laundry costs and cash) with appropriate debit and credit amounts. The description 'laundry costs, week one' was also added.

What is the role of accounting software in journal entries?

-Accounting software, like QuickBooks, helps by automatically posting journal entries behind the scenes, ensuring that debits and credits match, which reduces the chances of errors and saves time.

What are the key elements that make up a journal entry?

-The key elements of a journal entry are the journal number, date of the entry, affected accounts, debit and credit amounts, and a description of the transaction.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)