FVGs Can Tell You Everything (Secrets)

Summary

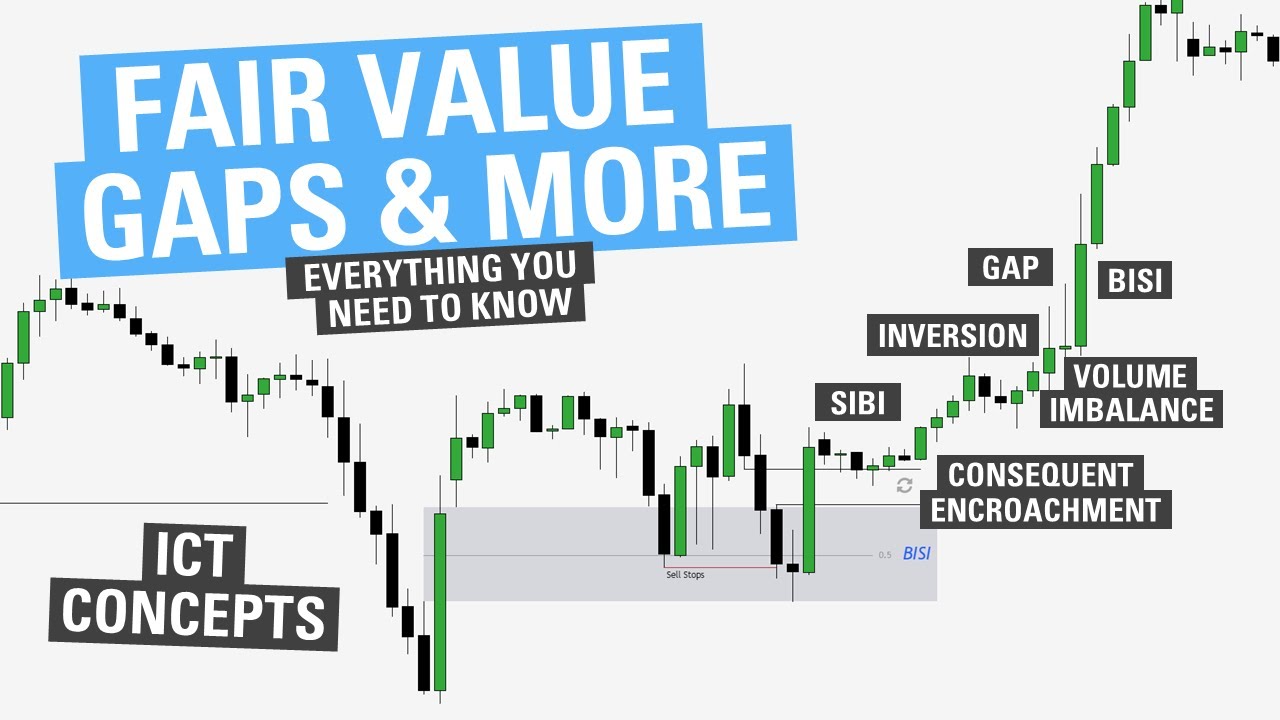

TLDRThis video explains the concept of Fair Value Gaps (FVGs) in trading, focusing on the importance of the third candle in the FVG pattern. It highlights how the third candle can provide critical information about whether a gap will be filled or not, and how it can predict market direction. The video discusses different scenarios of FVGs, such as rejections and momentum shifts, and how these factors impact the likelihood of the gap being filled. Additionally, the video provides tips on recognizing patterns, understanding probability, and timing for effective trading strategies.

Takeaways

- 😀 Fair Value Gaps (FVG) are not all the same, and each one tells a different story about price action.

- 😀 The third candle of a Fair Value Gap is crucial in determining how the market will react and whether the gap will be filled.

- 😀 A rejection in the third candle often indicates that the Fair Value Gap will not be filled, especially if there is strong bullish momentum.

- 😀 When a Fair Value Gap is not filled immediately, it may indicate a lower probability of the gap being filled in the future.

- 😀 A small third candle with a small wick often increases the likelihood that the Fair Value Gap will be filled quickly.

- 😀 A large wick on the third candle or a significant rejection suggests a lower probability of the gap being filled, often indicating a delay or no fill at all.

- 😀 If the third candle shows a strong momentum in the opposite direction of the gap, the Fair Value Gap is less likely to hold.

- 😀 When price retraces slowly to a Fair Value Gap over several candles, the likelihood of filling the gap is higher compared to a fast retracement.

- 😀 Lower time frames often provide more clarity on Fair Value Gaps, showing whether a lower time frame gap has already been filled before the higher time frame gap.

- 😀 Understanding the behavior of the third candle can help predict whether the market will respect or fill a Fair Value Gap, improving trading strategies.

Q & A

What is a Fair Value Gap (FVG) in trading?

-A Fair Value Gap is a price inefficiency formed when there is a gap between the wicks of three candles. This gap often indicates that price may eventually retrace to fill the inefficiency, providing trading opportunities.

Why is the third candle in a Fair Value Gap significant?

-The third candle in a Fair Value Gap is crucial because it can reveal whether the gap will be filled or not. If the third candle shows a strong rejection or momentum in one direction, it reduces the likelihood of the gap being filled.

How can the size of the third candle affect the probability of filling a Fair Value Gap?

-The smaller the third candle and its wick, the higher the probability that the gap will be filled quickly. A larger third candle with strong rejection or momentum signals that the gap is less likely to be filled immediately.

What does a large wick in the third candle indicate about the Fair Value Gap?

-A large wick in the third candle typically indicates a rejection, suggesting that price is less likely to retrace to fill the gap. This implies that there has already been a strong momentum in the market.

What is the significance of a Fair Value Gap formed after a liquidity sweep?

-A Fair Value Gap formed after a liquidity sweep may indicate a more immediate price reaction, as price often retraces quickly to fill the gap, especially if the third candle has a small wick or body.

What is the difference between a quick and slow fill of a Fair Value Gap?

-A Fair Value Gap that fills quickly often has a small third candle with little rejection. In contrast, a slow fill typically involves a larger third candle with strong rejection or momentum, indicating that the market is not in a hurry to fill the gap.

How does the momentum of the third candle influence the gap's behavior?

-The momentum of the third candle helps determine whether price will continue moving in the direction of the gap or retrace. A strong bullish or bearish momentum suggests that the gap may not be filled immediately, whereas a weaker momentum increases the chance of filling the gap.

What is the role of lower time frames in analyzing Fair Value Gaps?

-Lower time frames can provide a clearer picture of price action within the Fair Value Gap, revealing whether liquidity has been swept or if the gap is likely to be filled soon, helping traders make more informed decisions.

When can a trader expect a Fair Value Gap to be respected and not filled?

-A Fair Value Gap may not be filled if the third candle shows significant rejection with strong momentum, indicating that the market is already moving in the opposite direction and there may be no need to retrace to fill the gap.

What does it mean when a Fair Value Gap is respected immediately after formation?

-When a Fair Value Gap is respected immediately, it usually means the third candle had a small wick and showed weak momentum. This suggests that the price is likely to retrace to fill the gap quickly and reach its liquidity target.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)