Market Structure Masterclass (SMC Full Strategy)

Summary

TLDRIn this video, the speaker walks through key market structure concepts, explaining how to identify breaks of structure, liquidity sweeps, and internal vs. external market shifts. They emphasize the importance of understanding fractal patterns in the market and using higher timeframes for more accurate analysis. The speaker also introduces the three-drive pattern and how to capitalize on retracements, offering practical tips for traders to align their strategies with broader market trends. The video provides a comprehensive guide to applying market structure in real trading scenarios.

Takeaways

- 😀 Price structure is crucial in understanding market trends and making informed trading decisions.

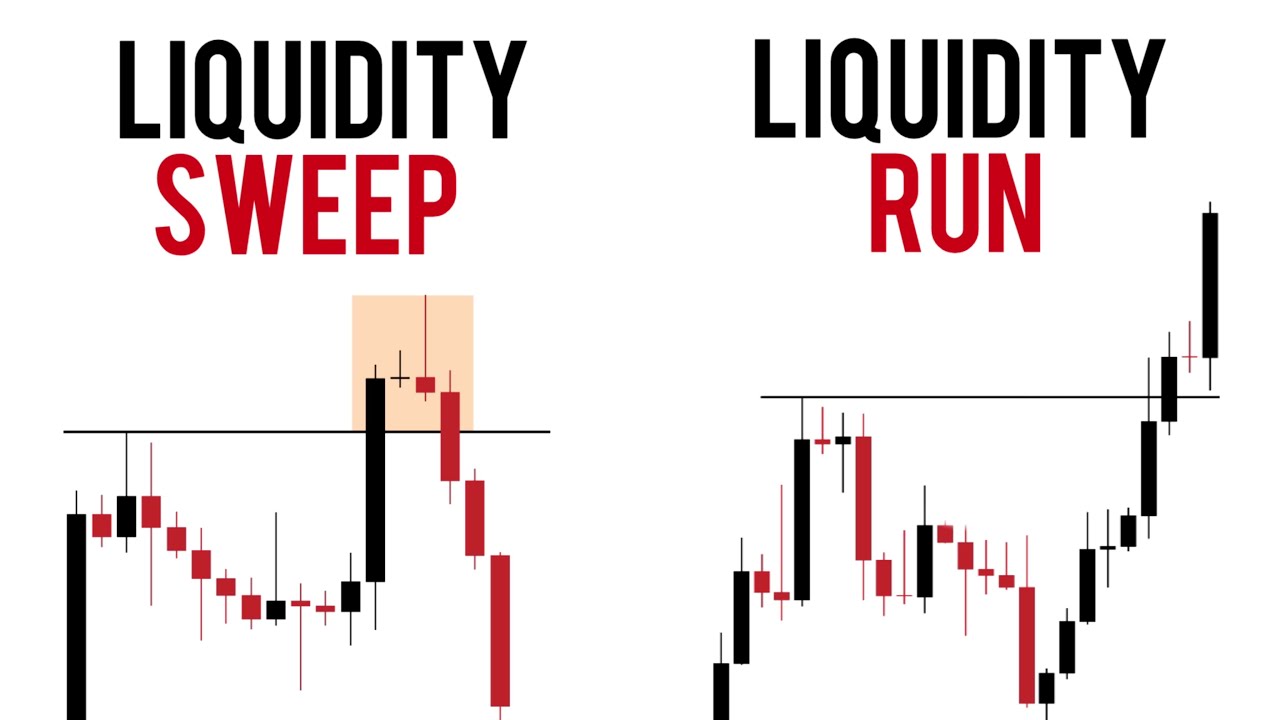

- 📉 A 'sweep' occurs when price tests a low multiple times before moving in the opposite direction, indicating potential trend shifts.

- 🚀 The 'three-drive pattern' is when price returns to a fair value gap three times before breaking structure and moving up.

- 🔑 Breaking structure is considered a strong shift in market direction, particularly when price fails to retrace after a sweep.

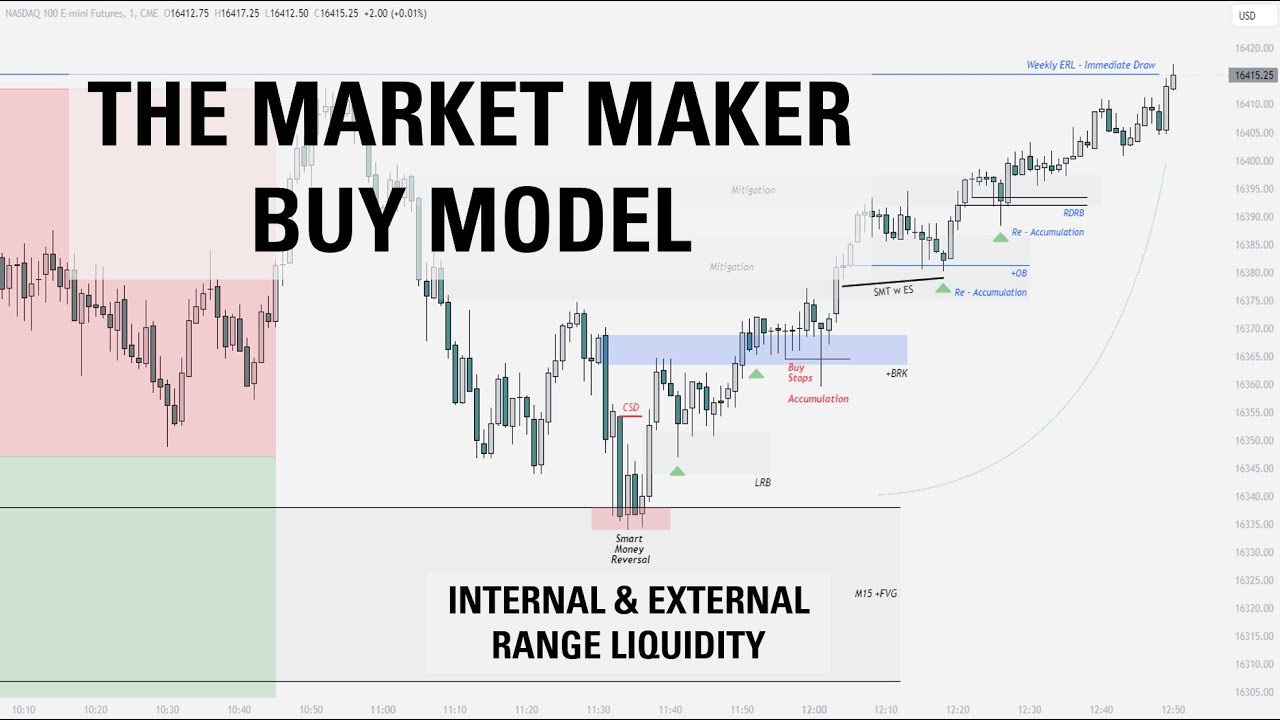

- 📊 Identifying the difference between internal and major market ranges is essential for understanding the broader market context.

- ⏳ A shift from a large to a small range may not necessarily indicate a strong trend unless the price shows significant movement in the new range.

- 📈 Market structure analysis works on any timeframe, but higher timeframes provide clearer and more accurate insights.

- 🔄 The market is fractal, meaning that smaller structures exist within larger ones, and it's important to recognize both.

- 💡 Always align your market structure analysis with liquidity levels and the flow of price between external and internal market moves.

- 🧠 Focus on one timeframe for trading decisions, but incorporate analysis from higher timeframes for better perspective and accuracy.

- 📆 Applying market structure effectively requires understanding the balance between short-term fluctuations and long-term market shifts.

Q & A

What is the main focus of the video transcript?

-The video primarily focuses on explaining market structure in trading, with an emphasis on identifying key price patterns, understanding breaks in structure, and applying the concept of ranges and liquidity sweeps in trading strategies.

What does the term 'sweep of a low' mean in the context of the video?

-'Sweep of a low' refers to a price movement where the market breaks through a previous low, often to gather liquidity before moving in the opposite direction, potentially leading to a structural change in the market.

How is the 'three-drive pattern' explained in the script?

-The three-drive pattern is described as a situation where price touches a fair value gap three times before reversing. This pattern is significant because it indicates a potential price move, often marking the end of a retracement and the start of a new trend.

What does the speaker mean by 'breaking structure'?

-Breaking structure refers to a price movement that surpasses a previous high or low, signaling a shift in market direction. It is considered a key point of analysis when identifying trend reversals or continuations.

What is the role of internal and external market shifts in this analysis?

-Internal shifts refer to smaller, less significant moves within a range, while external shifts refer to larger moves that break key levels or structures. The video emphasizes the importance of recognizing the difference between the two, as they provide valuable insights into market direction.

What is meant by 'liquidity sweep' in the video?

-A liquidity sweep is when the market moves to collect liquidity by triggering stop-losses or taking out previous highs or lows. This often leads to a market reversal or significant movement once the liquidity has been absorbed.

How does the speaker suggest handling minor versus major market ranges?

-The speaker advises that when transitioning from a major to a minor range, traders should be cautious. If a price break occurs in a minor range, it might not signal a significant change in direction unless further confirmation from higher timeframes is observed.

Why does the speaker emphasize the fractal nature of the market?

-The fractal nature of the market means that patterns repeat on different timeframes. While a pattern may look simple on a higher timeframe, it could show more intricate movements on lower timeframes. Recognizing this helps traders adapt their strategies to the scale of the market they are analyzing.

What is the recommended approach to analyzing market structure in different timeframes?

-The speaker recommends focusing on one primary timeframe for analysis while also considering the higher timeframes to align the market structure and liquidity levels. This helps ensure a clearer understanding of the broader market context while identifying trade opportunities on a specific timeframe.

How does the speaker suggest using market structure for trade entry?

-The speaker suggests looking for discounts or retracements below 50% of a newly formed range after a break in structure, as this provides an optimal entry point for a trade. The analysis of the market structure and fair value gaps helps in identifying the best times to enter or exit trades.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)