비트코인 '1위' 투자자가 밝히는 2025년 하반기 대폭등 시점!ㅣ라울 팔 NEW 인터뷰

Summary

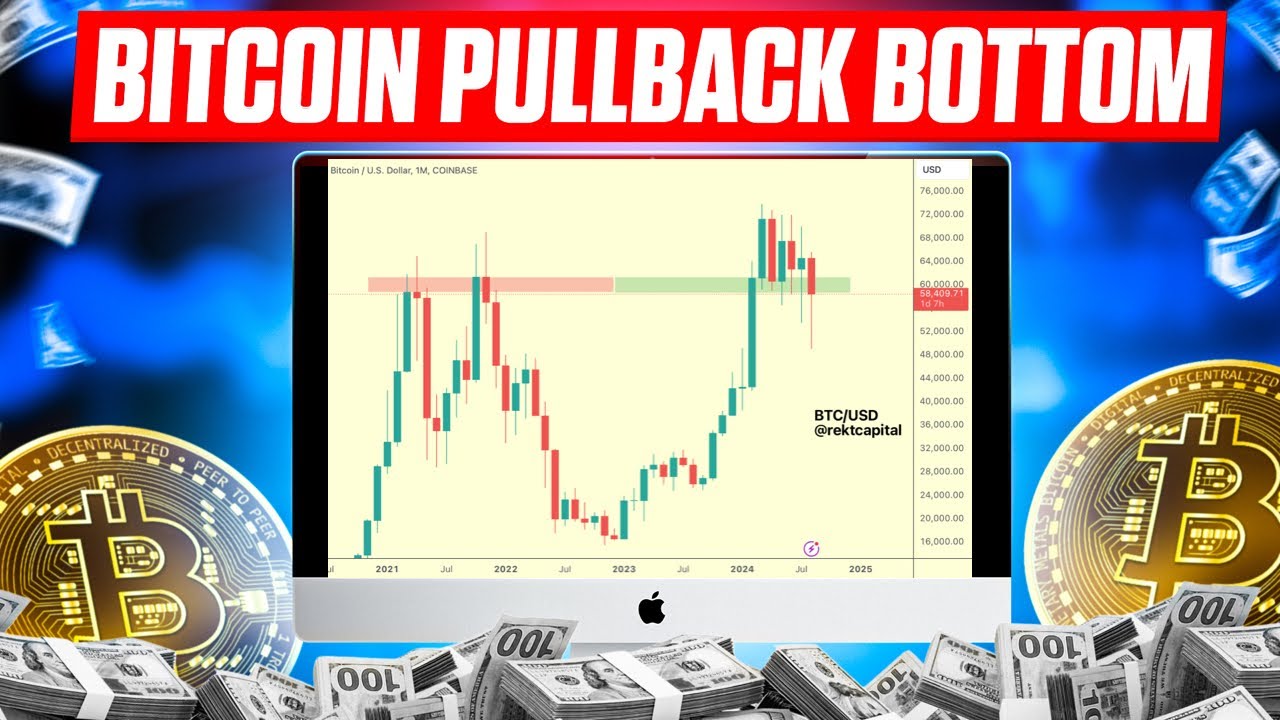

TLDRIn this insightful analysis, the speaker discusses the ongoing evolution of the financial markets, focusing on Bitcoin's rise to all-time highs and the 'banana zone' phase. The narrative links Bitcoin's success to liquidity, global monetary policies, and the weakening dollar, predicting a continuation of this trend with altcoins soon following suit. The speaker contrasts market reactions to past economic cycles, highlighting the correlation between liquidity and asset performance. The message is clear: with the right conditions, risk assets, especially Bitcoin, will thrive, as the dollar weakens and economic recovery boosts demand for such assets.

Takeaways

- 😀 Bitcoin has reached an all-time high, confirming the 'banana zone' theory and setting the stage for further growth.

- 😀 The correction phase, which happened after Bitcoin's first major rise, has concluded, and the market is entering a new bullish phase.

- 😀 Liquidity, not inflation or tariffs, is the primary driver of asset price movements, with scarce assets like Bitcoin, stocks, and gold benefiting the most.

- 😀 The market will likely see a dramatic shift once tariffs are agreed upon and fears subside, enabling a more favorable environment for altcoins.

- 😀 Total global liquidity has been responsible for 90% of Bitcoin's price movements since 2013, emphasizing its dominant role in price growth.

- 😀 The correlation between Bitcoin and global M2 (money supply) has been remarkably strong, with Bitcoin outperforming global liquidity during bullish phases.

- 😀 Bitcoin's rise is driven by network adoption, with cryptocurrency adoption rates significantly outpacing traditional equity markets, especially the NASDAQ.

- 😀 The potential for altcoins to perform well is linked to improving financial conditions and an eventual recovery in the global economy.

- 😀 A weaker dollar, which is a key macroeconomic driver, will lead to increased asset prices, including Bitcoin, as it strengthens global liquidity.

- 😀 Past market cycles, such as the one in 2017, show that a weakening dollar typically leads to massive returns for Bitcoin, with some historical gains surpassing 500%.

Q & A

What is the 'banana zone' mentioned in the script?

-The 'banana zone' refers to a phase in the market cycle where Bitcoin and other cryptocurrencies experience significant price increases. The speaker suggests that Bitcoin's price is currently in this zone, hitting all-time highs and showing strong growth, with expectations for further gains, especially for altcoins.

What is the relationship between Bitcoin's price and global liquidity according to the speaker?

-The speaker emphasizes that global liquidity plays a major role in driving Bitcoin's price movements. Bitcoin's price has been highly correlated with changes in global liquidity, which is influenced by factors like bond market conditions and central bank actions. Liquidity increases the demand for scarce assets like Bitcoin.

How does the speaker view the role of inflation and tariffs in Bitcoin's price movements?

-The speaker argues that inflation and tariffs are not the main factors driving Bitcoin's price. Instead, they claim that liquidity—driven by central bank policies and global monetary expansion—is the primary factor affecting Bitcoin's price. Tariffs and inflation are distractions from this larger liquidity-driven trend.

What is the significance of the term 'correction phase' in the market cycle described?

-The 'correction phase' refers to a period after a strong upward movement in Bitcoin's price when the market experiences a pullback or downward adjustment. The speaker notes that after the first move in the last quarter of 2024, Bitcoin went through a correction phase before entering the 'banana zone,' where prices are expected to rise again.

What does the speaker mean by 'network adoption' and its role in Bitcoin's performance?

-Network adoption refers to the increasing number of people and entities adopting and using Bitcoin, which in turn drives its value. The speaker highlights that the adoption of Bitcoin as a technology leads to excess returns, contributing to its performance, especially as the crowd becomes more invested in Bitcoin during bullish market phases.

How does the speaker compare Bitcoin's performance to traditional assets like stocks or the NASDAQ?

-The speaker compares Bitcoin's performance to traditional assets like stocks and the NASDAQ, noting that Bitcoin has outperformed these assets by a significant margin. The speaker points out that Bitcoin's returns have been substantially higher than those of NASDAQ and traditional equities, particularly over the past several years.

Why does the speaker believe the dollar is a key macroeconomic factor in determining Bitcoin's price?

-The speaker argues that the value of the US dollar is a critical macroeconomic variable influencing Bitcoin's price. A weaker dollar, in particular, drives up the demand for alternative assets like Bitcoin. The speaker points out that when the dollar falls, it creates liquidity conditions favorable for Bitcoin and other risk assets.

What are the predicted effects of a weakening dollar on Bitcoin and the global economy?

-A weakening dollar is expected to lead to higher liquidity in the global economy, which would benefit assets like Bitcoin. As foreign nations and corporations can more easily roll over their debts in a weaker dollar environment, there will be more excess spending and higher demand for risk assets, pushing up prices, including for Bitcoin.

What is the significance of the correlation between Bitcoin and the M2 money supply?

-The correlation between Bitcoin and the M2 money supply highlights how Bitcoin's price has been influenced by changes in global liquidity. As the M2 money supply increases, it creates more liquidity in the financial system, which the speaker suggests is a major driver of Bitcoin's price movements.

What role do financial conditions and the Fed play in the speaker's thesis on Bitcoin?

-The speaker argues that financial conditions, including interest rates and liquidity measures controlled by the Fed, are integral to understanding Bitcoin's price movements. The Fed's policies, especially in terms of rolling debt and managing interest rates, impact liquidity and thus Bitcoin's performance. The speaker believes that favorable financial conditions will drive further growth in Bitcoin's price.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)