SBL in Real Life : BCG Matrix at Unilever

Summary

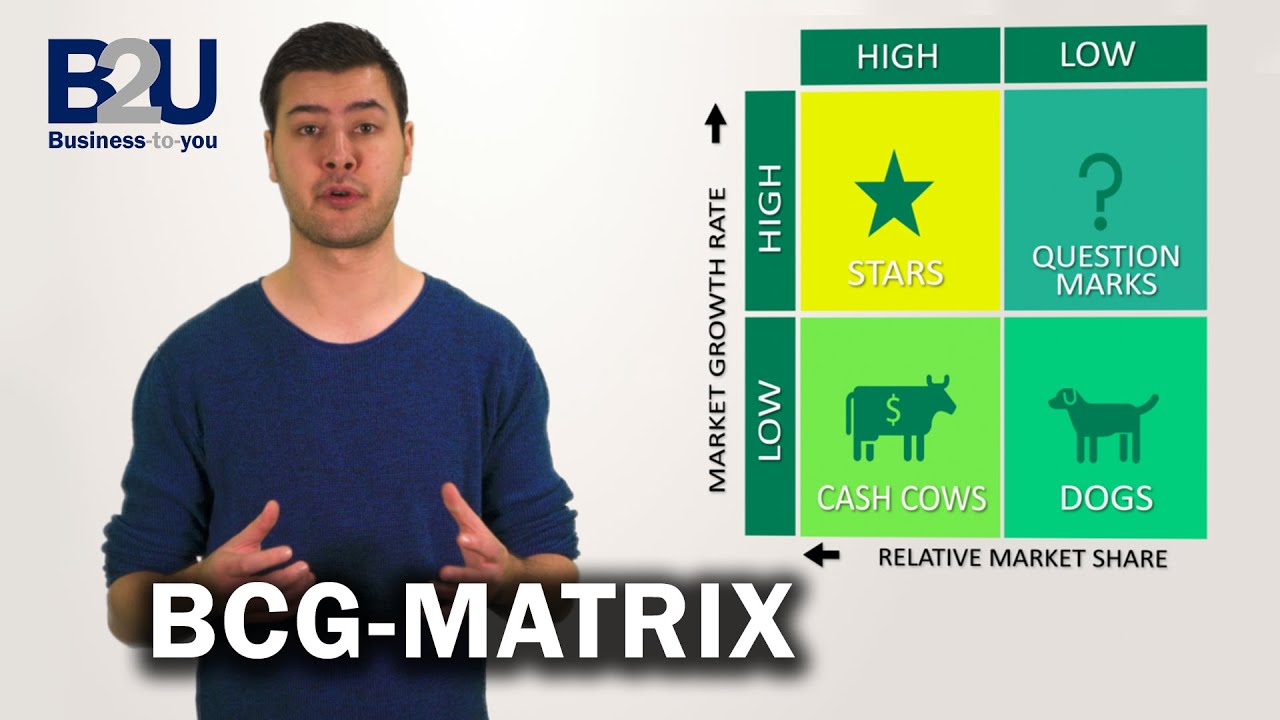

TLDRIn this SPL Guru podcast episode, Marty Wendle explains the BCG Matrix, a strategic tool for assessing a company's portfolio. He illustrates how Unilever applies the matrix, categorizing products into four quadrants: Stars (high growth, high market share), Cash Cows (low growth, high market share), Question Marks (high growth, low market share), and Dogs (low growth, low market share). Wendle emphasizes the importance of investment, divestment, and balanced portfolio management to maximize growth. The podcast provides valuable insights for SPL exam preparation, offering a clear guide on applying the BCG Matrix in real-life business scenarios.

Takeaways

- 😀 The BCG matrix is a tool used to assess a company's portfolio by categorizing products based on market growth and relative market share.

- 😀 The matrix has four categories: Stars, Cash Cows, Question Marks, and Dogs, each representing different market conditions and strategies.

- 😀 Stars are products with a high market share in high-growth markets, requiring heavy investment to maintain market leader positions.

- 😀 Cash Cows are products with a high market share in low-growth markets, generating steady cash flow to fund other areas of the portfolio.

- 😀 Question Marks are products with low market share in high-growth markets, requiring investment to increase market share or may be divested if unsuccessful.

- 😀 Dogs are products with low market share in low-growth markets, typically requiring divestment unless they offer synergies with other portfolio products.

- 😀 Unilever's Dove brand is an example of a Star, with strong market position in the growing personal care and beauty market, continuously innovating and investing in sustainability.

- 😀 Hellmann's mayonnaise is an example of a Cash Cow for Unilever, providing stable revenue in a mature market, with cost-saving initiatives in the supply chain.

- 😀 The Vegetarian Butcher, Unilever's plant-based food brand, represents a Question Mark, operating in a growing market but still building market share.

- 😀 Unilever divested its tea business (Lipton and PG Tips) in 2021, a Dog in a low-growth market, to focus on higher-growth sectors like personal care and plant-based foods.

- 😀 In the SPL exam, students are asked to categorize products using the BCG matrix and determine appropriate strategies like investment, divestment, or repositioning.

Q & A

What is the primary purpose of the BCG Matrix?

-The primary purpose of the BCG Matrix is to assess the portfolio of a company by categorizing its products or strategic business units (SBUs) based on their market growth and relative market share.

How does the BCG Matrix categorize products?

-The BCG Matrix categorizes products into four groups: Stars, Cash Cows, Question Marks, and Dogs, based on two dimensions: market growth and relative market share.

What is the key difference between market share and relative market share?

-Market share refers to a product's share of the total market, while relative market share compares a product's market share to that of the market leader.

What is a 'Star' in the BCG Matrix, and how should it be managed?

-A 'Star' is a product with high market share in a high-growth market. It should be heavily invested in to maintain its position as a market leader, focusing on research and development (R&D), innovation, and marketing.

What is the strategy for managing a 'Cash Cow' in the BCG Matrix?

-A 'Cash Cow' is a product with high market share in a low-growth market. The strategy for managing it is to harvest, which means minimizing investment while maximizing cash flow to fund other products in the portfolio.

How does Unilever manage its 'Helman's Mayonnaise' product according to the BCG Matrix?

-Unilever treats 'Helman's Mayonnaise' as a 'Cash Cow,' focusing on cost-saving initiatives and maintaining strong distribution networks and brand loyalty without heavy investment in innovation or advertising.

What is a 'Question Mark' in the BCG Matrix, and what is the goal for such products?

-A 'Question Mark' is a product in a high-growth market but with a low market share. The goal is to build market share by investing in product development, marketing, and strategic partnerships.

Can all 'Question Marks' be turned into 'Stars'?

-No, not all 'Question Marks' will successfully become 'Stars.' Some may fail to gain market share, and in such cases, they may be divested.

What is a 'Dog' in the BCG Matrix, and what is the typical strategy for such products?

-A 'Dog' is a product with low market share and low market growth. The typical strategy is to divest, meaning to sell or exit the market, although sometimes repositioning or leveraging synergy with other products can be considered.

What did Unilever do with its tea business, and why?

-Unilever divested its tea business, including brands like Lipton and PG Tips, to a private equity firm for 4.5 billion euros in 2021. This was done because the tea market was stagnating, and Unilever wanted to focus on higher-growth areas like plant-based foods and personal care.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)