Until You Overcome This, Trading Will Always Feel Hard

Summary

TLDRThis video addresses the common struggles traders face, emphasizing the importance of detachment from trades and outcomes. The speaker shares their personal journey of trying numerous strategies without success, only to realize the key to success is letting go of attachment to results. They stress that trading is not about chasing the perfect strategy, but about trusting the process, managing emotions, and developing internal confidence. By detaching from outcomes and focusing on executing trades with discipline, traders can achieve success and experience the freedom they desire.

Takeaways

- 😀 Trading is challenging when you are emotionally attached to the outcome. The key to overcoming this is learning detachment.

- 😀 You might spend years searching for the perfect strategy, but the real barrier is emotional attachment to trades, not the strategy itself.

- 😀 The obsession with finding a magical strategy or the next course can hold you back from success in trading.

- 😀 Trading success is not about a specific strategy but about how you manage your emotions and detach from the results.

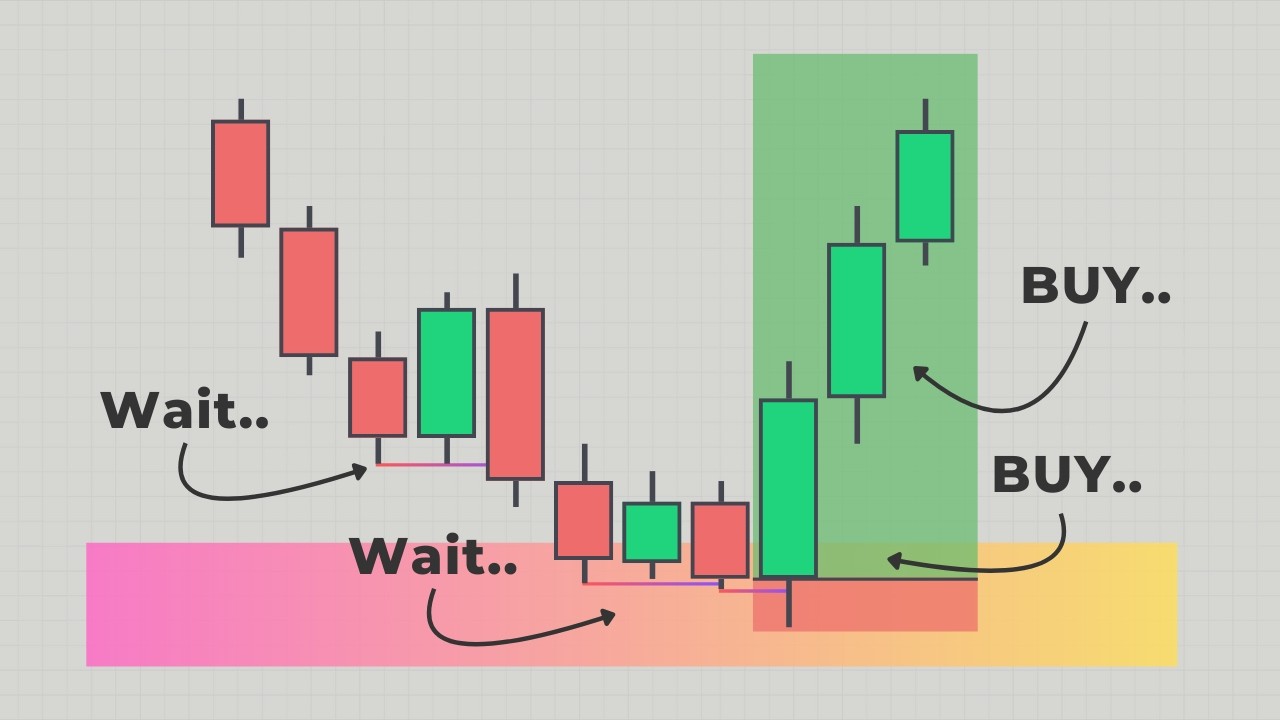

- 😀 Detachment means not obsessing over your trades or constantly checking your charts—trust your system and process.

- 😀 It's crucial to put in the necessary chart time (about 10,000 hours) but without being emotionally invested in every trade you make.

- 😀 A loss in trading should not destroy your mental state. Instead, follow your system and focus on long-term success.

- 😀 Becoming a professional trader involves shifting from being an amateur who reacts to trades to someone who is confident and detached.

- 😀 The journey to mastery in trading requires dedication, but it’s also about learning to let go of your emotional attachment to money and outcomes.

- 😀 Trading is about executing your plan without hesitation, even when you're not emotionally invested in the result.

- 😀 Trust your process, let go of the need for constant validation, and focus on mastering the mental game of trading rather than the strategy itself.

Q & A

What is the main message the speaker is trying to convey in the script?

-The main message is that traders often struggle because they are too attached to the outcome of their trades. By detaching from the outcome and focusing on executing a well-defined strategy, traders can reduce emotional interference and become more successful.

Why does the speaker mention spending years trying different strategies?

-The speaker mentions this to emphasize that many traders waste time searching for the perfect strategy, believing that a special, magic strategy will solve all their problems. The speaker wants to highlight that the solution is simpler than most traders realize.

How does attachment to the outcome affect trading?

-Attachment to the outcome makes traders emotionally invested in each trade. This leads to behaviors like revenge trading, moving stop-losses, or not letting profits run, which can disrupt the trading process and make it more difficult to succeed.

What is the concept of 'detachment' in trading, according to the speaker?

-Detachment in trading refers to letting go of emotional attachment to individual trades and the outcomes they produce. This means not obsessing over the charts, not emotionally reacting to losses or wins, and trusting in your trading process and edge.

Why is chart time important for beginner traders?

-Chart time is important because it helps traders develop familiarity and comfort with market structures, patterns, and timeframes. This experience is essential for understanding the nuances of the market and making informed decisions.

What does the speaker mean by 'less is more' in trading?

-The speaker advocates for spending less time obsessing over trades and charts. Instead of constantly monitoring the market, traders should focus on executing their strategy when the right conditions are met and avoid being emotionally attached to the outcome.

How does the speaker suggest traders should handle losses?

-The speaker advises traders to have a system in place for managing losses emotionally. Losses should not derail a trader's confidence or decision-making process. A clear framework helps traders handle losses without letting them affect their future trades.

What role does the ego play in trading, according to the script?

-The ego can interfere with trading because it causes traders to become overly attached to their identity and outcomes. The speaker emphasizes the need to kill the ego to avoid being emotionally affected by wins or losses, leading to more consistent and calm decision-making.

What does the speaker mean by 'the separation from the amateur and professional trader'?

-The separation refers to the realization that professional traders detach emotionally from their trades, while amateurs often struggle because they are too focused on the outcome. This shift in mindset is what separates those who succeed from those who don't.

What is the importance of the 'process' in trading, according to the speaker?

-The process is crucial because it provides traders with a clear, repeatable framework to follow. By focusing on the process rather than the outcome, traders can reduce emotional interference and improve consistency in executing their trades.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Does more trade = more income? Realistic expectations. becoming a risk manager

How I Stopped Losing Trades to Fake ICT Market Structure Shifts

Mark Douglas Trading Psychology 4/7 Probabilities

1 Trading Mistake That Keeps You Unprofitable (Here’s the Fix)

Which Order Block Should You Use?! (Supply & Demand Tips)

How to Conquer Overtrading | Trading Psychology | FundingYourTrades.Com

5.0 / 5 (0 votes)