How to Trade Profitably like a Professional - EURUSD Trade Breakdown 3/3/25 - ICT Concepts

Summary

TLDRIn this detailed breakdown, the trader walks through a trade signal shared in a group, explaining the key factors behind it. Starting with a high-timeframe analysis on the EUR/USD (EU), the trader discusses the major market structure, SMT divergence with GBP/USD (GU), and the identification of critical support and resistance levels. The trader moves down to lower timeframes, illustrating how specific setups aligned with the overall market context, including key order blocks and liquidity targets. The thought process behind each decision is clearly explained, emphasizing market manipulation, timing, and trade entry techniques.

Takeaways

- 😀 The trade analysis is based on a setup shared within a group on Monday, explaining the reasoning behind the trade signal.

- 😀 The main focus of the analysis is on the weekly time frame, where a significant price move occurred in the discount region, combined with an SMT divergence between EUR/USD (EU) and GBP/USD (GU).

- 😀 The SMT divergence revealed a discrepancy in price behavior between EU and GU, signaling potential market maker involvement and the possibility of either an expansion or reversal in price.

- 😀 A bullish directional bias was maintained due to price being in the discount region and testing key levels, with an expectation for price to rise and take out swing highs.

- 😀 The minimum price target was set at a premium key level, specifically a weekly swing high, and the price was expected to continue higher.

- 😀 A retracement occurred, but it formed equal highs above previous swing highs, generating more liquidity and making these levels an easy target for price expansion.

- 😀 A detailed analysis on the daily time frame reinforced the bullish bias, with key elements such as SMT divergence and structure formation supporting an upward move.

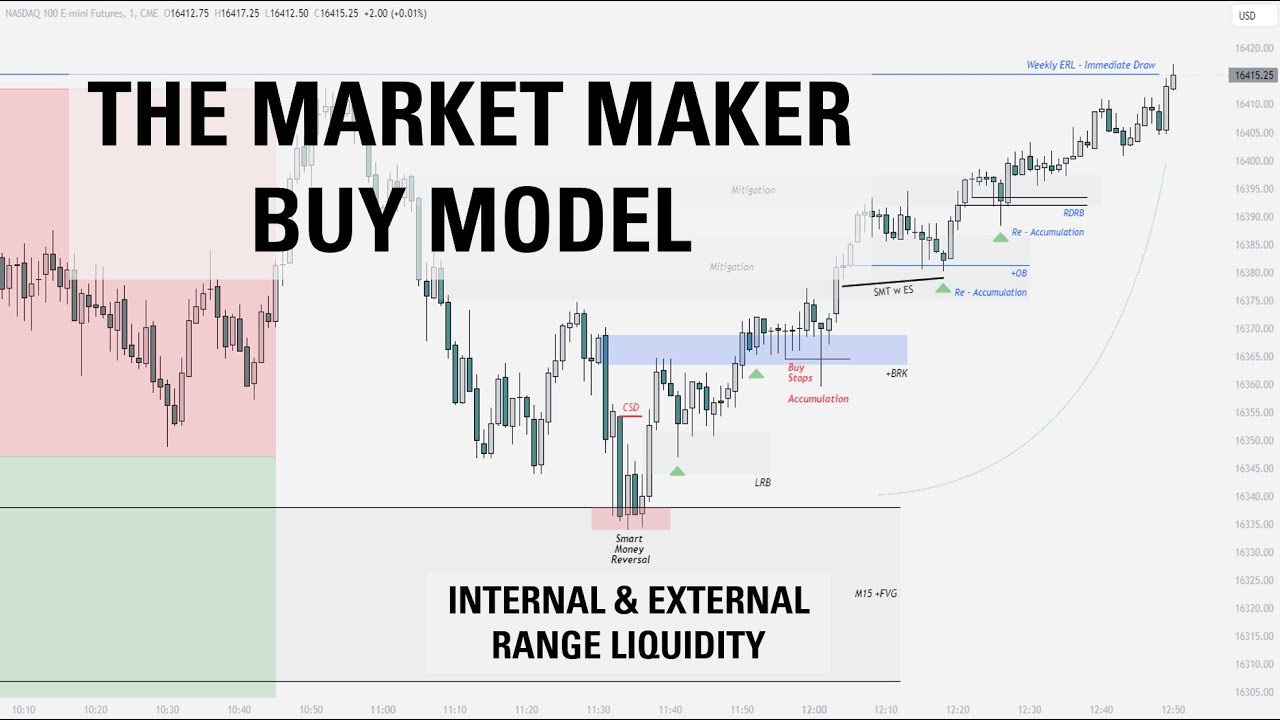

- 😀 On the 4-hour time frame, the order block and range low formed a market context for further expansion higher after a minor retracement.

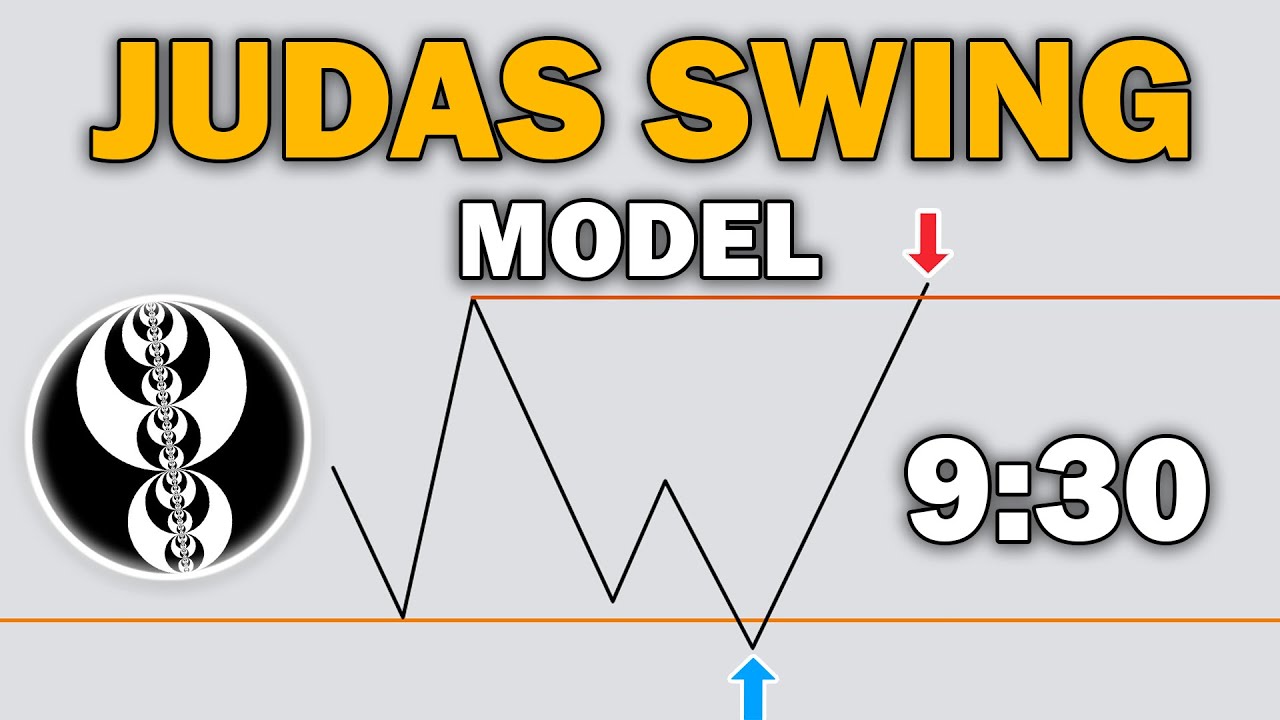

- 😀 The analysis included a focus on the 15-minute chart, where an Asian session range formed, followed by a manipulation profile during the London open, suggesting price would test key levels and expand quickly.

- 😀 A key entry point was identified during a manipulation at 3:00 a.m., a time known for price purging, followed by rapid price expansion based on aligned factors.

- 😀 Throughout the breakdown, trade signals were provided based on candle patterns, order blocks, and liquidity levels, confirming the trade idea at various points throughout the week.

Q & A

What is the primary focus of the trade breakdown in the video?

-The primary focus is to break down a trade signal given earlier in the week, outlining the trader's thought process, market context, and reasoning behind the directional bias, entry, and exit strategy.

What is the significance of the SMT divergence mentioned in the analysis?

-The SMT (Smart Money Tool) divergence between EU and GU is crucial because it indicates non-symmetry between the two correlated assets. EU formed a lower low, while GU did not, suggesting active participation by market makers and a potential market reversal.

How does the trader use the weekly time frame in their analysis?

-The trader begins by analyzing the weekly time frame to identify key market levels such as a **mitigation block** and a **refined fair value gap**. These are used to gauge the price's position within the larger market structure and to set a directional bias.

Why does the trader expect a reversal in the market?

-The trader expects a reversal because price is in the **discount region** of the trading range and has tested a **key level** (the mitigation block). The combination of this with the **SMT divergence** suggests that a market reversal is likely.

What role do liquidity zones play in the trader's strategy?

-Liquidity zones are critical because they represent areas where price is likely to reach in order to trigger stops or execute large orders. The trader identifies **liquidity above swing highs** as key levels to target after a potential reversal or expansion.

How does the trader refine their entry using the 4-hour time frame?

-On the 4-hour time frame, the trader identifies an **order block** formed by a specific candle range low, which they expect to be tested before price expands higher. This order block serves as the key level for a more refined entry.

What is the significance of the **3:00 a.m. macro time** mentioned in the video?

-The **3:00 a.m. macro time** is highlighted as a key time window where manipulations in the market are more likely to occur, such as testing or purging candle range lows. The trader uses this time to expect rapid price movement and increase their conviction in the trade.

How does the trader manage their expectations for the trade after the entry point is identified?

-Once the entry point is identified, the trader expects **price to expand immediately** with speed, particularly when multiple key factors align at the same time. This leads to higher confidence in the trade, and the trader watches for the price to move towards drawn liquidity targets.

What is an **order block**, and how is it used in the trader’s strategy?

-An **order block** is a group of consecutive candles or a single candle that either purges a swing low or swing high or tests a key level. In this case, the trader identifies candles that take out a swing low or test important levels, and these become key points for entry or validation of the trade idea.

What additional offer does the trader mention at the end of the video?

-The trader promotes **Bitefi**, a platform that offers sign-up bonuses, copy trading, and a 20% cash back on trades. They also mention that no KYC (Know Your Customer) is required for regional users, and users can receive a 10% deposit bonus, totaling a 30% bonus on their trading budget.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Smart Money NY Session Trade | ICT Concepts + FVG + Order Block Precision | BREAKDOWN

The Market Maker Buy Model | Full Trade Breakdown $NQ

ICT 9:30am Judas Swing Model - Explained In-depth

How to identify a CHoCH easily + Secret Strategy to trade a CHoCH!

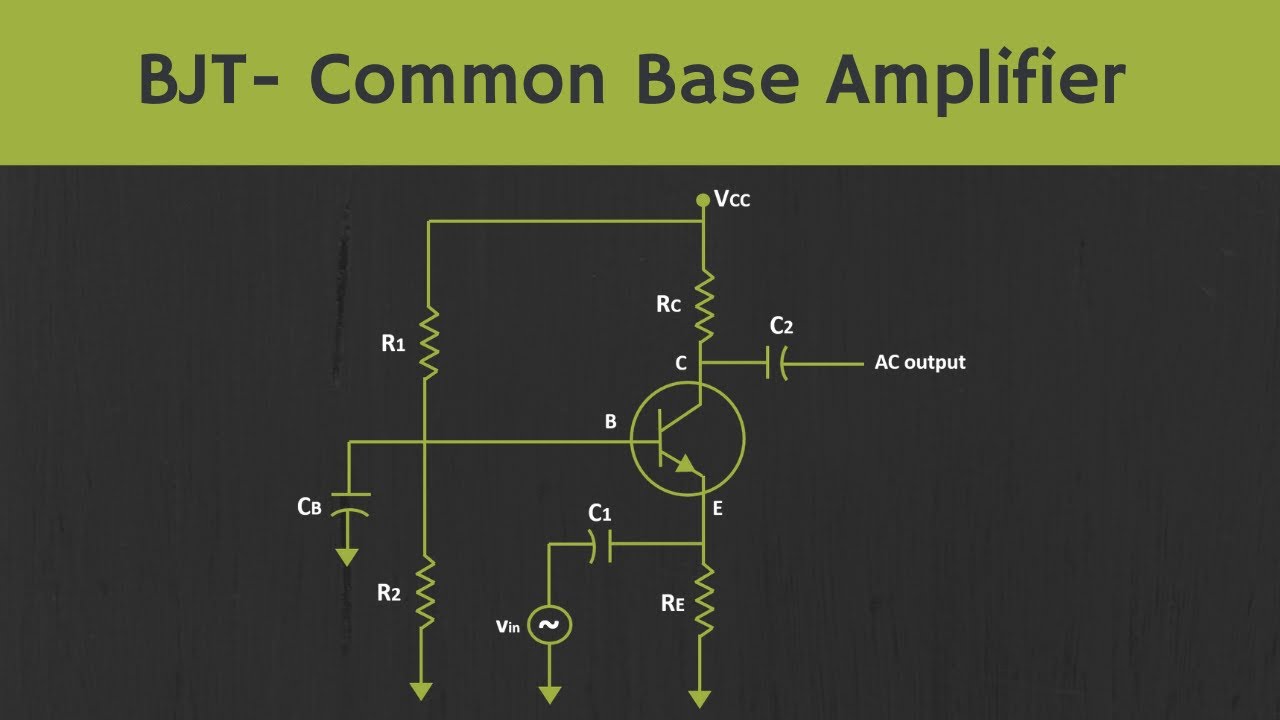

BJT- Common Base Amplifier Explained

PULSO e FREQUÊNCIA CARDÍACA | Sinais Vitais Ep.01

5.0 / 5 (0 votes)