#62 Secure Inter Branch Payment Transaction (SET Protocol )|CNS|

Summary

TLDRIn this video, the concept of Secure Inter Branch Payment Transactions (SET Protocol) is explained in simple terms. SET ensures the security and integrity of electronic transactions, such as credit card payments, UPI transfers, and online banking. It prevents the exposure of sensitive information like credit card details to merchants by using digital certificates, keys, and signatures. The process involves multiple entities—customer, merchant, customer bank, and merchant bank—each verifying the authenticity of the transaction through secure channels. The video breaks down how these elements work together to ensure safe and successful online payments.

Takeaways

- 😀 Secure Inter Branch Payment Transactions (SET Protocol) refers to the protection of electronic transactions like credit card, debit card, UPI, and net banking.

- 😀 SET Protocol ensures the security and integrity of electronic transactions, preventing hackers from accessing sensitive data.

- 😀 The protocol protects credit card details by preventing merchants from seeing the full account number during transactions.

- 😀 Digital certificates are used to verify the identity of all parties involved in a transaction: customer, merchant, customer bank, and merchant bank.

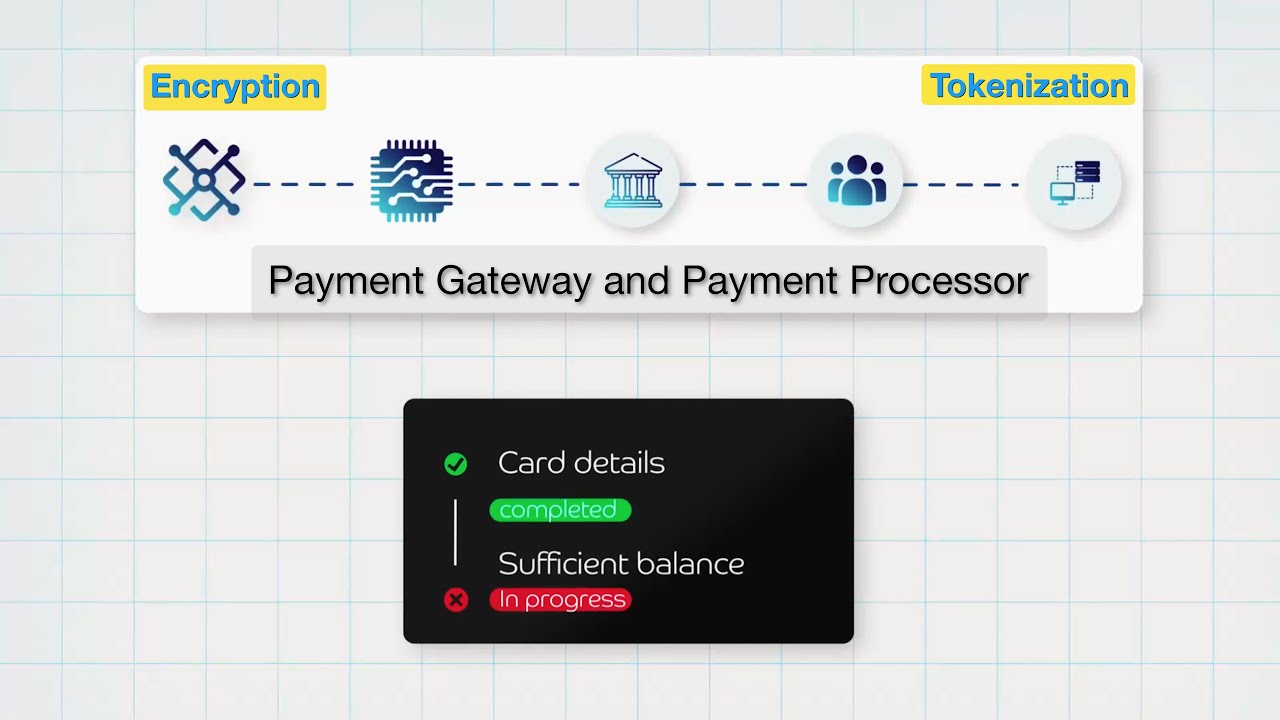

- 😀 Payment gateways act as intermediaries, communicating with both the customer’s bank and the merchant’s bank to ensure successful transactions.

- 😀 Only the last few digits of the customer's account number are revealed to the merchant, ensuring privacy.

- 😀 Customer and merchant banks do not interact directly with each other; instead, they go through the payment gateway for transaction processing.

- 😀 Digital keys are also used in the SET protocol to verify and confirm the authenticity of digital certificates between customer and merchant banks.

- 😀 Every time an electronic purchase is made, a digital certificate is generated for the customer, merchant, and both banks involved in the transaction.

- 😀 SET Protocol helps prevent online fraud by verifying the legitimacy of each participant (customer, merchant, and banks) through digital certificates and keys.

- 😀 The customer and merchant banks verify each other's digital certificates to ensure secure and legitimate transactions, protecting both parties.

Q & A

What is Secure Inter-Branch Payment Transaction?

-Secure Inter-Branch Payment Transaction refers to electronic transactions like credit card payments, debit card transactions, UPI transfers, net banking, or mobile banking, which are made securely between different branches of a bank or between different banks.

What is the SET protocol?

-The SET protocol (Secure Electronic Transaction protocol) ensures the security and integrity of electronic transactions. It protects sensitive information, such as credit card details, by restricting access to the merchants, thus preventing hacking and fraud.

How does SET protocol protect customer data?

-The SET protocol ensures customer data is kept secure by masking sensitive details, such as the account number. For example, only the last four digits of an account number may be shown, while the rest is replaced with asterisks or 'X'.

Who are the participants involved in a Secure Inter-Branch Payment Transaction?

-The main participants in a Secure Inter-Branch Payment Transaction are the customer, the merchant, the customer's bank, and the merchant's bank.

What role does the Payment Gateway play in the SET protocol?

-The Payment Gateway acts as an intermediary between the customer and the merchant, as well as between the banks. It verifies whether the transaction is successful and communicates the status to both the customer and merchant banks.

What happens if a transaction is unsuccessful in the SET system?

-If a transaction is unsuccessful, the Payment Gateway will notify both the customer and the merchant with an error message, indicating that the transaction could not be completed.

What additional security measures are implemented in the SET protocol?

-Along with digital certificates and digital signatures, SET also generates digital keys for the customer's and merchant's banks. These digital keys verify the authenticity of the certificates and ensure the legitimacy of the transaction.

How does the SET protocol prevent fraud in online transactions?

-The SET protocol prevents fraud by ensuring that sensitive information, such as credit card details, is not shared with the merchant. It also uses digital certificates to authenticate the identities of the customer, merchant, and banks involved, ensuring that each party is legitimate.

How does the SET protocol use digital certificates?

-Each participant in the transaction, including the customer, merchant, and both banks, is issued a digital certificate. These certificates authenticate their identity and ensure that the transaction is secure and legitimate.

Are digital keys used by both the customer and merchant banks?

-Yes, digital keys are used by both the customer's bank and the merchant's bank. These keys help confirm the authenticity of each other's certificates, ensuring secure communication and transaction processing.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)