| MCA trading | made simple - Episode 3: Stop & DM Positions Interaction

Summary

TLDRThis video explains the concept of market causality in forex trading, focusing on the relationship between smart money algorithms, dumb money positions, and stop hunts. It demonstrates how smart money manipulates market movements by targeting stop-losses set by retail traders to drive prices towards predetermined targets (MTS). The video illustrates these dynamics through real-life examples and provides insights for both beginner and advanced traders on how to trade effectively by understanding stop levels, position management, and market manipulation. The overall goal is to equip traders with the knowledge to anticipate market moves and trade strategically.

Takeaways

- 😀 Understand market causality: The interaction between stops, positions, and smart money algorithms is crucial for successful trading.

- 😀 The role of smart money: Algorithms manipulate price movements to trigger stop hunts and position hunts, targeting dumb money traders.

- 😀 MTS (Medium-Term Stops) and market movements: Smart money uses these stops to clear out dumb money traders by pushing prices in the opposite direction.

- 😀 Dumb money behavior: Dumb money traders (retail traders) tend to buy or sell at inopportune times, often entering positions that smart money exploits.

- 😀 Smart money algorithms can push prices away from stop levels, clearing out dumb money traders and then moving toward the target (MTS).

- 😀 Stop hunts are key to understanding price action: Smart money pushes prices to hunt for stops before reversing to the intended target.

- 😀 Real-life example: The Euro/USD scenario demonstrates how smart money pushed the price against dumb money traders, ultimately reaching the target.

- 😀 Trading with causality: Successful traders understand the importance of where dumb money positions are and when to enter trades based on smart money actions.

- 😀 High probability setups: Advanced traders focus on high-bias setups, where the likelihood of a successful trade is higher, while avoiding low-bias setups.

- 😀 The importance of discretion: While understanding market causality is key, traders must also apply discretion and consider the size of dumb money positions and stop placements in their strategies.

Q & A

What is the main focus of this video series?

-The main focus of this video series is to simplify the understanding of market causality in Forex trading. The series aims to break down the interaction between market dynamics, stop hunts, and positions in an accessible manner for traders, especially beginners.

What are 'dumb money' and 'smart money' in the context of this video?

-'Dumb money' refers to inexperienced traders who make decisions based on emotions or poor understanding of market dynamics, while 'smart money' refers to institutional or experienced traders who understand and exploit market causality, including stop hunts and position manipulation.

How do smart money algorithms affect dumb money positions?

-Smart money algorithms manipulate the market to trigger stop hunts, pushing the price in a direction that forces dumb money traders into losses. This allows smart money to collect stop orders and move towards their profit targets.

What is a Medium-Term Stop (MTS) and how does it relate to trading strategies?

-A Medium-Term Stop (MTS) is a stop level in the market that represents a key target for smart money algorithms to hit. When dumb money traders enter positions (buying or selling), smart money will often push the market towards these MTS levels to trigger stop losses and profit from the movement.

How does the 'dumb money' buying and selling dynamic play out in the market?

-When dumb money traders go long (buy), smart money will push the price down to trigger their stop losses, making them exit their positions. Conversely, when dumb money traders go short (sell), smart money will push the price up to trigger their stops, causing them to incur losses.

What is the significance of understanding the interaction between stops and positions?

-Understanding the interaction between stops and positions is crucial for traders to recognize the market's true movements. This knowledge helps traders avoid being manipulated by stop hunts and to trade more strategically towards key price levels set by smart money.

Why is it important for traders to recognize when dumb money positions are entering the market?

-Recognizing when dumb money positions are entering the market helps traders identify potential opportunities for smart money to exploit those positions. By understanding where dumb money is likely to be trapped, traders can predict market movements and position themselves accordingly.

What is the purpose of 'post stop hunt dynamics'?

-Post stop hunt dynamics refer to the behavior of the market after a stop hunt has been conducted. This often involves the price overshooting the stop levels and then retracing, providing opportunities for traders to capitalize on the market's correction.

How do advanced traders approach trading based on market causality?

-Advanced traders use a deeper understanding of market causality to not only wait for stop hunts but also trade against them when necessary. They may trade towards the MTS after dumb money positions are cleared, and are aware of post stop hunt movements to capitalize on price retracements.

What is the difference between high bias and low bias setups in trading?

-A high bias setup occurs when there is a strong likelihood that smart money will push the market towards a key stop level, usually because many dumb money traders are positioned against it. A low bias setup has a weaker likelihood of success and involves less certainty about market movements.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

How To Identify Liquidity in Trading (SMC Trading)

How Smart Money Manipulate YOUR Trades….(leaked video)

ICT Institutional Order Flow Explained – Trade Like the Banks and Outsmart the Market

| MCA trading | made simple - Episode 9: H4 Reversals & Range Mode

ICT Mentorship Core Content - Month 03 - Institutional Market Structure

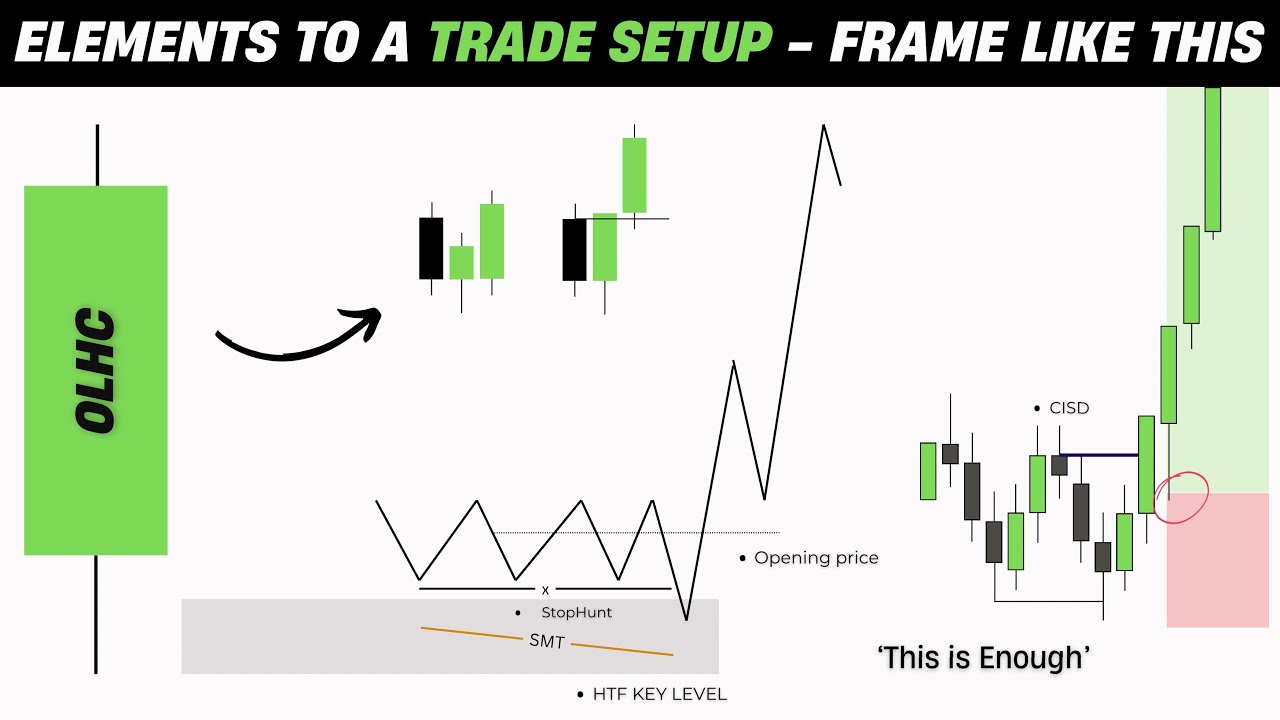

ICT Concepts - Elements To A Trade Setup

5.0 / 5 (0 votes)