TPAI Materi Pembelajaran 3: Konsep Return dan Risiko Investasi

Summary

TLDRThis video provides an in-depth exploration of investment theory, focusing on key concepts such as return types and risk analysis. It explains the differences between historical, expected, and required returns, illustrating these with examples of investments in savings accounts, stocks, and bonds. The video also covers risk measurement, emphasizing the use of standard deviation to assess uncertainty. Viewers learn about the relationship between risk and return, including risk premiums and how to estimate future returns and risks. It concludes with an explanation of relative risk and the application of statistical formulas for investment analysis.

Takeaways

- 😀 Understanding returns: The script introduces three types of returns in investing: historical return (Edward or Real Madrid), expected return, and required return (the minimum return expected by investors).

- 😀 Historical return: An example is provided of depositing money in the bank, which generates a return, showing how past returns (historical return) are calculated.

- 😀 Expected return: This is based on past experiences or projected performance, like expecting a 20% return based on a stock's past performance over ten years.

- 😀 Required return: Investors demand a specific return based on the risk of the investment. Higher risks require higher returns.

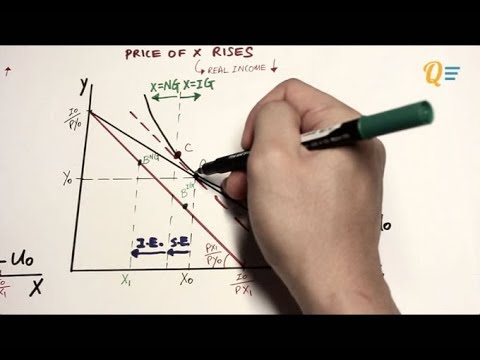

- 😀 Risk and uncertainty: Investment returns are uncertain, and risks are quantified by how much actual returns deviate from expected returns, often measured using standard deviation.

- 😀 Higher returns = higher risks: Investments with higher returns generally carry higher risks. For example, stocks offer higher returns but come with greater volatility compared to bonds.

- 😀 Risk premium: A risk premium exists between different investment options, like comparing returns from stocks versus bonds, where the stock market offers a higher return for a higher risk.

- 😀 Calculating risk: Risk can be calculated using statistical methods like standard deviation, which helps assess the likelihood of deviation from expected returns.

- 😀 Estimating returns and risk: Investors use historical data and probability-based models to estimate returns and risks for different investment options, including stocks, bonds, and market portfolios.

- 😀 Coefficient of variation: A metric used to evaluate relative risk of an investment. A lower coefficient of variation suggests that the investment is relatively less risky compared to others.

- 😀 Investment decisions: Investors need to balance between expected returns and the associated risks. No investment guarantees a higher return than the market, making diversification important.

Q & A

What are the three types of returns mentioned in the video?

-The three types of returns discussed in the video are: 1) Historical Return (also known as realized return), 2) Expected Return, and 3) Required Return.

How is historical return calculated?

-Historical return is calculated by looking at the actual return that has already occurred. For example, if an investment of 100,000,000 yields 110,000,000 after a year, the historical return would be 10%, calculated as the profit divided by the initial investment.

What is expected return?

-Expected return is the return an investor anticipates from an investment based on historical data or market trends. It is an estimate of future performance, such as an expected annual return of 20% based on past performance.

What is the meaning of required return?

-Required return refers to the return that an investor demands or expects from an investment to compensate for its level of risk. The higher the perceived risk, the higher the required return.

How is return calculated in dollar value?

-To calculate return in dollar value, subtract the initial investment from the final value of the investment. For example, if you invest 1,000 dollars and the investment grows to 1,100 dollars, the return is 100 dollars.

What does 'risk' mean in the context of investment?

-In investment, risk refers to the uncertainty regarding the return of an investment. It is the possibility that the actual return will deviate from the expected return, and it is quantified using statistical measures such as standard deviation.

How is investment risk measured?

-Investment risk is typically measured using standard deviation, which quantifies the degree of variation or volatility in the returns of an investment over time.

What is risk premium?

-Risk premium is the additional return an investor demands for taking on a higher level of risk. For example, if the return on stocks is 8.7% and the return on bonds is 2.1%, the risk premium for investing in stocks is the difference between these returns, which is 6.6%.

How does the video explain the trade-off between risk and return?

-The video explains that higher returns generally come with higher risks. This trade-off is demonstrated through historical data showing that while stocks offer higher returns, they also come with higher volatility and potential for losses.

What is the role of portfolio theory in investment decisions?

-Portfolio theory helps investors manage the trade-off between risk and return by diversifying their investments across various assets. It aims to optimize the expected return for a given level of risk.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

PERTEMUAN 3 RETURN DAN RISIKO y

Markowitz Model and Modern Portfolio Theory - Explained

How to analyze the risk using Scenario Analysis Techniques

EC1002 Chapter 2 Lesson 3 - Normal, Inferior, Giffen Goods; Complements & Substitutes [Full]

Ukuran Penyebaran Data : Kuartil, Desil dan Persentil + Contoh Soal

RPL-4 Perencanaan Perangkat Lunak

5.0 / 5 (0 votes)