What are financial instruments? | History of History of Financial Markets

Summary

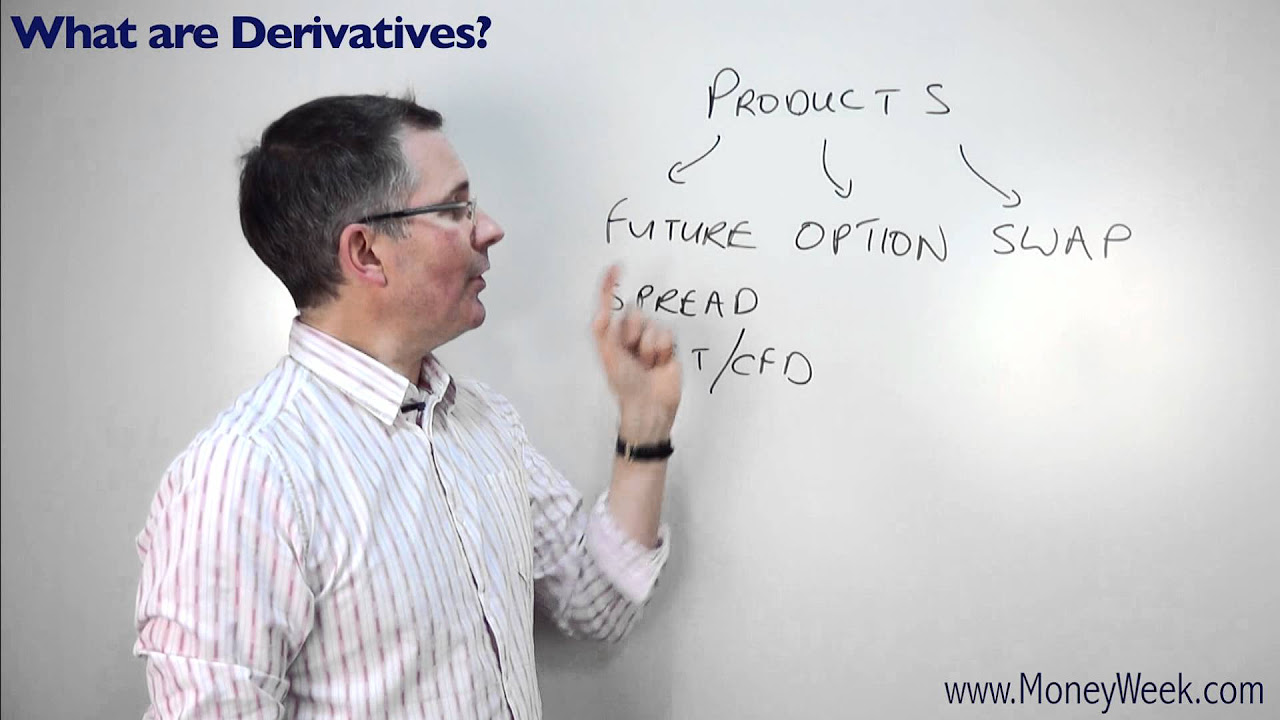

TLDRThis video introduces financial instruments, focusing on derivatives like forward and futures contracts. It explains how these instruments originated to help sellers and buyers hedge against the uncertainty of future prices. The video uses historical examples, such as ancient merchants and farmers, to illustrate the need for such agreements. It highlights how forward contracts allow sellers to guarantee prices for goods that aren't yet produced, offering security for both parties. The video also sets the stage to explore the origins of forward contracts and their evolution into more formal futures contracts.

Takeaways

- 😀 Financial instruments are documents that can be converted into money when sold.

- 😀 Examples of financial instruments include stocks, bonds, and futures.

- 😀 A subset of financial instruments, known as derivatives, involve obligations like buying, selling, or delivering.

- 😀 Derivatives include forward contracts, futures contracts, options, and many others.

- 😀 Forward and futures contracts are key examples of derivatives.

- 😀 These financial instruments were created to address the fear of price changes in important commodities.

- 😀 Farmers, merchants, and business owners throughout history have used derivatives to hedge against price fluctuations.

- 😀 Sellers worry about prices dropping below their costs, while buyers fear prices increasing.

- 😀 In a forward contract, the seller agrees to sell a product at a set price and date in the future.

- 😀 A forward contract provides security for both buyers and sellers, helping them mitigate the risks of price changes.

- 😀 The first forward contracts appeared long ago and were crucial in the development of risk management in trade.

Q & A

What are financial instruments?

-Financial instruments are documents that can be sold and converted into money. Examples include stocks, bonds, and futures.

What is a derivative?

-A derivative is a financial instrument that involves an obligation, such as buying, selling, or delivering an asset. Examples include forward contracts, futures contracts, and options.

What are the key types of derivatives mentioned in the script?

-The key types of derivatives mentioned are forward contracts and futures contracts.

What are the common concerns of buyers and sellers in markets?

-Sellers are concerned that the price of a commodity may drop, causing them to not recover their costs. Buyers worry that the price may increase, leading them to pay more than expected.

How do forward contracts address the concerns of buyers and sellers?

-Forward contracts allow sellers to lock in a selling price for a product at a future date, ensuring they cover their costs and profit. Buyers lock in a price that protects them from potential price increases.

What is the main difference between a forward contract and a futures contract?

-A forward contract is a private agreement between two parties and is not traded on an exchange. A futures contract, on the other hand, is standardized and traded on exchanges.

How do forward contracts help in risk management?

-Forward contracts help manage risks by locking in prices for future transactions, which eliminates the uncertainty of price fluctuations in commodities.

Why did people in ancient times use derivatives like forward contracts?

-People in ancient times, such as merchants and farmers, used derivatives to protect themselves from the risks of fluctuating commodity prices, ensuring stable costs and profits.

What kind of products were forward contracts used for in ancient times?

-Forward contracts were used for products like dates, wheat, olive oil, and other agricultural commodities.

What is the historical context of forward contracts mentioned in the script?

-The script refers to ancient merchants, such as those in the time of King Hammurabi, and farmers in the 19th-century United States using forward contracts to mitigate risks related to commodity price changes.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

1. Options, Futures and Other Derivatives Ch1: Introduction Part 1

Derivatives Trading Explained

CFA Level I Derivatives - Forward Contracts vs Futures Contracts

History of Derivatives Trading

Futures and Options Halal or Haram? Derivatives Halal or Haram?

What are derivatives? - MoneyWeek Investment Tutorials

5.0 / 5 (0 votes)