How To Pay Low / No Tax in South Africa (Not a meme)

Summary

TLDRThis video educates viewers on minimizing tax liabilities for small businesses through strategic structuring. It highlights three main structures: Turnover Tax for businesses under 1 million Rand annually, with rates from 0-3%; Small Business Corporation (SBC) for eligible businesses with turnover below 20 million Rand, featuring rates of 0-27%; and the standard PTY with a fixed 27% tax rate. The presenter emphasizes the benefits of SBC for new businesses and the tax efficiency of PTYs, while cautioning against the higher individual tax rates of 18-45%. The video encourages viewers to consult with accountants about these options.

Takeaways

- 🏦 Structure Matters: The way you structure your business significantly impacts how it will be taxed.

- 🚫 Avoid Trusts: The speaker does not recommend using trusts due to high tax rates of 45% on profits.

- 📉 Turnover Tax: For businesses with less than 1 million Rand turnover per year, a 0 to 3% tax rate applies, with the first 350,000 Rand being tax-free.

- 💼 Small Business Corporation (SBC): Offers tax rates between 0 to 27% and is suitable for businesses with certain limitations, such as individual shareholding and below 20 million Rand turnover.

- 🚫 Professional Services Limitation: Both Turnover Tax and SBC have restrictions on professional services.

- 🔒 PTY Benefits: PTY companies have a fixed tax rate of 27% and can claim assessed losses to offset against future profits.

- 📉 Lower Audit Risk: PTY and SBC structures generally have a lower risk of audits compared to individuals.

- 👤 Individual Tax Rates: Individuals face higher tax rates ranging from 18 to 45% and have limited ability to claim losses or expenses.

- 🚫 High-Risk for Individuals: Operating as an individual is riskier from a tax compliance perspective and can be less tax-efficient.

- ❓ Consult an Accountant: It's important to consult with an accountant to understand and utilize tax-efficient structures like Turnover Tax or SBC.

Q & A

What is the main focus of the video?

-The video focuses on explaining how to pay low to no tax in a small business by choosing the right business structure.

Why is business structure important in determining tax obligations?

-Business structure is crucial because it determines how a company or business will be taxed, affecting the overall tax rate and potential deductions.

What is turnover tax and how does it work?

-Turnover tax is a tax structure for businesses or individuals with annual turnovers of less than 1 million Rand. It has tax rates ranging from 0 to 3% based on different turnover brackets, with the first 350,000 Rand being tax-free.

What are the tax rates for turnover tax and how are they applied?

-Turnover tax rates are between 0 and 3%, applied as follows: 0% for the first 350,000 Rand, 1% for the next 150,000 Rand (350,001 to 500,000), 2% for the next 250,000 Rand (500,001 to 750,000), and 3% for anything above 750,000 Rand up to 1 million Rand.

What is a Small Business Corporation (SBC) and its tax rate range?

-A Small Business Corporation (SBC) is a tax structure for certain businesses with turnovers below 20 million Rand and individual shareholding. The tax rate for an SBC ranges from 0 to 27%.

What are the eligibility criteria for registering a business as an SBC?

-To register as an SBC, a business must have a turnover below 20 million Rand, individual shareholding, and cannot have shareholding with other companies. Additionally, professional services may apply.

Why might an SBC be a better choice than a PTY for some businesses?

-An SBC might be a better choice due to its lower tax rate range of 0 to 27%, as opposed to a PTY's fixed tax rate of 27%. It's also more tax-efficient, especially in the early years of a company.

What is a PTY and what are its tax implications?

-A PTY, or Private Company, is a business structure registered with CIPC. It has a fixed tax rate of 27% on its profits, regardless of the amount, and can claim assessed losses.

What are the benefits of a PTY in terms of audit risk?

-A PTY has less audit risk because financial statements are typically prepared in a way that doesn't raise alarm bells with tax authorities like SARS.

What are the tax rates for an individual trading under their own name?

-For individuals trading under their own name, tax rates range between 18 and 45%, which can be significantly higher than the rates for turnover tax or an SBC.

What are the risks and limitations of an individual structure compared to other business structures?

-An individual structure is riskier from a legal perspective, does not allow for claiming losses, and has a higher tax rate. It also makes it more difficult to justify business expenses, leading to potentially higher tax liabilities.

What advice does the video give regarding consulting with an accountant?

-The video advises viewers to consult with their accountant about the possibility of registering for turnover tax or SBC to potentially pay low to no tax.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

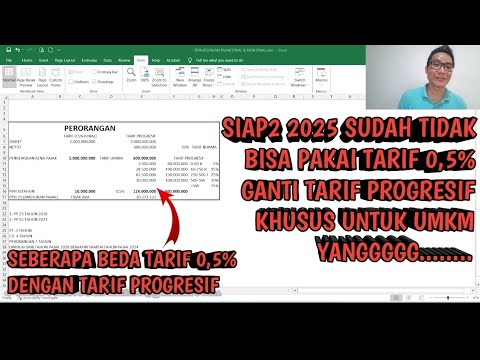

PPH FINAL UMKM 0 5% BERAKHIR 2024? BEGINI TAX PLANNING DI 2025

Save Thousands & Protect Everything: Real Wealth Matrix

Tax Saving Tricks used by Employees of Big MNCs in India | CA Sahil Jain

Taxes, Companies & Legalities for eCommerce, POD or drop shipping businesses in India(in Hindi)

Strategi Perencanaan Pajak (Tax Planning) PPN

Tarif UMKM 0,5% berakhir di 2024, 2025 Pakai Pajak Progresif lagi !! || Solusi,Bayar Pajak Kecil

5.0 / 5 (0 votes)