Departmentalization (Basic Concepts)

Summary

TLDRThis video script provides an in-depth discussion on cost accounting practices within a production environment. It covers departmental segmentation to manage costs efficiently, including cost allocation to various departments like production, service, and maintenance. The script highlights the importance of tracking physical costs and regular reporting for accurate financial management. Key challenges such as inter-departmental coordination and cost distribution are addressed, alongside practical examples. The focus is on optimizing cost allocation strategies to enhance efficiency and profitability across departments.

Takeaways

- 😀 Cost accounting is essential for dividing factory or plant operations into departments for better management and cost tracking.

- 😀 Each department in a production setup is allocated its own set of costs, often categorized by type of work or function.

- 😀 Different departments might have unique responsibilities, such as maintenance, production, or service provision.

- 😀 Direct and indirect costs are assigned to departments, with a focus on tracking and distributing expenses accurately across different sectors.

- 😀 The importance of keeping track of departmental expenses and updating reports on a regular basis is emphasized to maintain accurate financial records.

- 😀 Inter-departmental cost distribution is crucial, especially when one department provides services to another, such as in shared resources like machinery or labor.

- 😀 The script mentions the dynamic nature of departmental functions, where changes in operations or costs may require adjustments to department classifications and cost allocations.

- 😀 Special attention is given to cost allocation for specific functions such as repair, maintenance, or specialized production activities.

- 😀 There are references to systems where departments interact with each other, with an emphasis on how costs are transferred between them in cases like shared services or inter-departmental projects.

- 😀 The overall goal is to achieve transparency in cost allocation, allowing departments to effectively manage resources and optimize operations within the organization.

Q & A

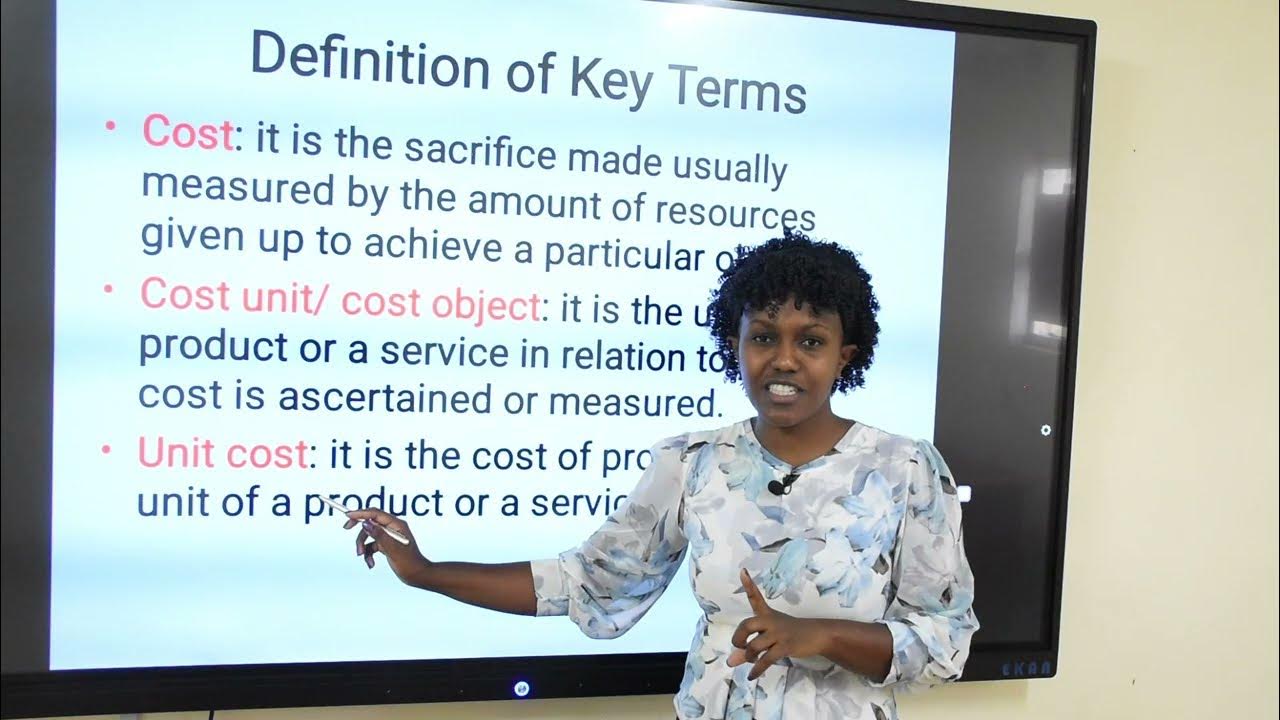

What is departmental cost accounting, and why is it important?

-Departmental cost accounting is a method of tracking and allocating costs to specific departments within an organization. It is important because it helps businesses manage their expenses more efficiently, ensuring that each department’s financial activities are tracked, which leads to better budgeting, cost control, and decision-making.

How does the segmentation of departments help in cost allocation?

-Segmentation of departments helps in identifying and separating the costs associated with different functions within a business. This allows for a more accurate allocation of expenses, ensuring that each department is only charged for the costs directly related to its operations, such as production, maintenance, or service.

What types of costs are typically tracked in departmental cost accounting?

-Typical costs tracked in departmental cost accounting include direct costs such as raw materials, labor, and production expenses, as well as indirect costs like overhead, maintenance, and service-related expenses. Each department’s share of these costs is calculated and assigned accordingly.

Why is it important to track both production and service costs separately?

-Tracking production and service costs separately is crucial because each has distinct cost drivers. Production costs are typically associated with manufacturing goods, while service costs involve supporting or enhancing customer experiences. Separating these costs ensures that businesses can better understand and manage their financial performance in each area.

What role do departments like 'production' and 'maintenance' play in cost accounting?

-Departments like 'production' and 'maintenance' are critical in cost accounting because they are directly involved in generating goods and services. Production departments incur costs for materials, labor, and machinery usage, while maintenance departments manage repair costs and upkeep, which also need to be allocated accurately.

How can inter-departmental cost distribution affect a company's overall financial health?

-Inter-departmental cost distribution can significantly impact a company’s financial health by ensuring that costs are fairly allocated across departments. If costs are not properly distributed, some departments may be overburdened, leading to inefficiencies and inaccurate financial reporting. Proper distribution ensures a balanced cost structure and supports effective financial decision-making.

What are some common examples of costs associated with service departments?

-Common costs associated with service departments include customer support, IT services, administrative overhead, and facilities maintenance. These departments often provide services that support production or enhance customer experience, and their costs must be properly allocated to ensure accurate financial reporting.

What is the significance of tracking 'repair and maintenance' costs in a plant or factory?

-Tracking 'repair and maintenance' costs is significant because they are recurring expenses that ensure the smooth operation of equipment and machinery. By accurately allocating these costs, businesses can better predict future maintenance needs, reduce downtime, and optimize their operations for long-term cost savings.

What does 'direct recharging' mean in the context of departmental cost accounting?

-In departmental cost accounting, 'direct recharging' refers to the process of assigning costs directly to the department or function that incurred them. For example, if a specific department incurs a cost, that cost is charged directly to their budget, rather than being distributed across multiple departments.

How does the concept of 'costing' apply to different departments within a business?

-The concept of 'costing' applies to different departments by assigning all incurred costs—both direct and indirect—to the relevant department. Each department is responsible for its own costs, which allows the business to track performance, allocate resources more effectively, and make informed financial decisions.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Introduction to Cost and Management Accounting

AKUNTANSI AKUISISI 1 - Harga beli sama dengan Nilai Buku, Kepemilikan 100%

CBSE/NCERT Class 11 Accounts Chapter - 1, Accounting as a Source of Information, Lecture - 3

Cost Accounting Vs Financial Accounting | Meaning and Comparison

METODE HARGA POKOK PESANAN 2 : JURNAL DAN KARTU PESANAN

Akuntansi biaya tenaga kerja

5.0 / 5 (0 votes)