The BCG model explained

Summary

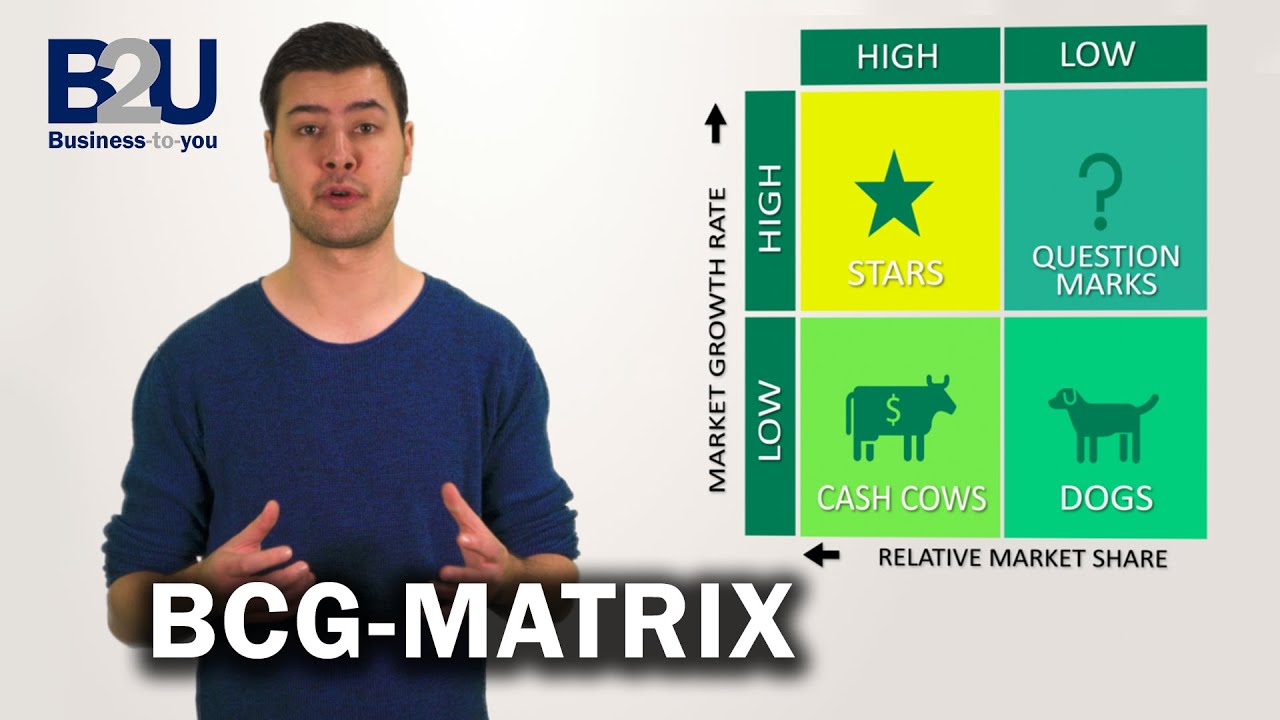

TLDRIn this webinar, the speaker provides a detailed analysis of the BCG Matrix, a strategic tool for portfolio management that categorizes business units into four quadrants: Dogs, Question Marks, Stars, and Cash Cows. The model helps businesses decide where to allocate resources based on market growth and relative market share. While the BCG Matrix offers a straightforward approach, the speaker critiques its oversimplifications, lack of competitive context, and outdated assumptions. An updated version of the matrix is introduced, highlighting the need for a more nuanced analysis in today’s fast-evolving business landscape.

Takeaways

- 😀 The BCG Matrix is a strategic tool that helps businesses analyze and prioritize their product or business unit portfolio based on market growth and relative market share.

- 😀 The matrix consists of four categories: Stars, Cash Cows, Question Marks (Wildcats), and Dogs, each representing different combinations of market growth and relative market share.

- 😀 Stars require heavy investment to maintain their position in a high-growth market but are expected to generate high returns in the future.

- 😀 Cash Cows generate steady revenue with minimal investment but are typically in a low-growth market, serving as the financial backbone of a company.

- 😀 Question Marks (Wildcats) are products in high-growth markets with low market share, requiring significant investment to potentially turn them into Stars.

- 😀 Dogs are low in both market growth and relative market share, and are often candidates for divestment or repositioning in niche markets.

- 😀 The BCG Matrix simplifies complex business decisions by categorizing products into a two-dimensional grid, aiding resource allocation.

- 😀 The model is limited by its simplicity, as it only uses two dimensions and doesn't account for other critical factors such as competitive dynamics or product lifecycle.

- 😀 One major critique of the BCG Matrix is that it neglects the impact of small, fast-growing competitors (startups) which can disrupt markets despite having low market share.

- 😀 The BCG Matrix can lead to poor profit outcomes if relied upon solely, as studies have shown that its use may not always align with maximizing long-term profitability.

- 😀 The Boston Consulting Group has acknowledged the limitations of the original BCG Matrix and has developed a more advanced version that incorporates additional factors to provide a more precise analysis.

Q & A

What is the BCG Matrix, and who developed it?

-The BCG Matrix is a portfolio analysis tool used to evaluate business units or product-market combinations based on market growth and relative market share. It was developed in 1968 by Bruce Henderson of the Boston Consulting Group (BCG).

What are the key components of the BCG Matrix?

-The BCG Matrix consists of two main axes: the y-axis represents market growth (high to low), and the x-axis represents relative market share (high to low). The matrix categorizes business units into four quadrants: Stars, Cash Cows, Question Marks (Wildcats), and Dogs.

What does the 'relative market share' mean in the BCG Matrix?

-Relative market share refers to the ratio of a company's market share to that of its largest competitor, not the actual percentage of market share. This measure helps determine whether a business unit is a leader or laggard in its market.

What is the role of market growth in the BCG Matrix?

-Market growth is a critical factor in determining the potential of a business unit. High market growth indicates a dynamic, expanding market that may offer greater opportunities, while low market growth suggests a more stagnant or declining market.

How should investments be managed according to the BCG Matrix?

-Investments should be prioritized based on the BCG Matrix. Cash Cows generate profits with minimal investment, while Stars need reinvestment to maintain market leadership. Question Marks require substantial investment to increase market share, and Dogs may need divestment or repositioning.

What is the significance of 'Cash Cows' in the BCG Matrix?

-'Cash Cows' are business units with high relative market share in low-growth markets. They generate stable cash flow with minimal investment, making them crucial for funding other business units like Question Marks and Stars.

Why should businesses be cautious about dismissing 'Dogs' in the BCG Matrix?

-'Dogs' are business units with low market share in low-growth markets. While they are not immediately profitable, they can still provide revenues and might be linked to other successful units. It's important to assess their strategic value before deciding to divest.

What challenges might arise when calculating market share and market growth in the BCG Matrix?

-Challenges include defining the market accurately, obtaining reliable data on market share and growth, and dealing with fluctuating market conditions. The BCG model assumes consistent growth, which may not reflect the dynamic nature of some markets.

What are some limitations of the BCG Matrix, according to the transcript?

-The BCG Matrix neglects factors such as market synergies, competition from small startups, and the changing dynamics of fast-growing markets. It also oversimplifies decision-making by using only two dimensions (market share and market growth), which may not fully capture a business unit's potential.

How has the BCG Matrix evolved over time?

-While the original BCG Matrix has been widely used, the Boston Consulting Group acknowledged its limitations and has since updated the model to account for the changing business landscape. The new version includes additional dimensions to make the analysis more comprehensive.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)