3 Ways To Confirm Support & Resistance - Footprint Chart Trading | Axia Futures

Summary

TLDRThis video delves into the concept of support and resistance in trading, explaining how these levels are not just static lines but dynamic interactions between buyers and sellers. It explores how once a support level is broken, it often turns into resistance, and emphasizes the importance of patience in waiting for retests to identify key entry points. The speaker introduces strategies like the 'quickie auction reversal' and 'elephant orders' to demonstrate how market interactions signal the right times to buy and sell. Using real market examples, the video offers practical insights into improving trade timing and risk management with tools like footprint charts.

Takeaways

- 😀 Support and resistance are not static lines but zones where market participants (buyers and sellers) interact repeatedly.

- 😀 A significant support level can turn into resistance once it is broken, forming the key pattern of 'support to resistance'.

- 😀 Patience is crucial in trading—wait for the market to retest broken support levels to confirm new resistance before acting.

- 😀 Interaction at a price point (whether aggressive buying or selling) is what creates meaningful support and resistance, not just price lines.

- 😀 The more times a price level is tested, the more significant the support or resistance becomes.

- 😀 A 'quickie auction reversal' is a key strategy for identifying when a market has confirmed a shift from support to resistance.

- 😀 Volume and delta analysis are essential tools for confirming transitions from support to resistance and identifying key price movements.

- 😀 Traders should avoid selling too aggressively right after a break; the market often revisits these broken levels before continuing.

- 😀 A proper 'auction reversal' pattern signals that sellers have gained control after a period of buying, reinforcing the validity of resistance.

- 😀 Footprint charts help identify market imbalances, indicating whether the sellers or buyers are in control at key price levels.

- 😀 Successful trading involves timing your entries correctly based on market interactions and using tools like footprint charts to minimize risk and maximize potential profit.

Q & A

What is the concept of support to resistance in trading?

-Support to resistance refers to when a market creates a significant support zone, holds above it for a period, and then breaks below it, turning that support into new resistance. This often leads to the market using that level as resistance in future movements.

How do you identify true support and resistance levels?

-True support and resistance levels are identified through repeated interactions at a specific price point. These interactions involve buyers holding the market up at support and sellers holding the market down at resistance. The more times these interactions occur, the more significant the level becomes.

Why is it important to let the market retest broken support before trading?

-It’s important to let the market retest broken support because the market often returns to test whether the sellers who broke the support are still active or whether buyers will reassert themselves. Patience at this stage increases the chances of success in trade execution.

What is a 'quickie auction reversal'?

-A 'quickie auction reversal' is a specific type of market interaction where, after a market retests a broken support level, it shows a sharp reversal, typically with strong volume and clear price movement. It’s a sign that sellers are active and the market is likely to continue downward.

What role does volume play in identifying key market reversals?

-Volume is crucial in identifying market reversals. A significant increase in volume during a retest of support or resistance signals strong market interaction. For instance, a spike in volume after breaking a support level can indicate a real shift from support to resistance.

How do footprints help in identifying the right time to trade?

-Footprint charts provide real-time insights into market dynamics, such as volume and order flow. They help traders pinpoint the optimal timing to enter or exit trades by showing where buyers and sellers are most active, and where imbalances are occurring.

What is an 'elephant' in trading and how does it impact market movement?

-An 'elephant' is a large, hidden order in the market that significantly influences price action. These orders, often referred to as iceberg orders, are typically absorbed at a key price level, signaling potential market reversals or continuation. The market reacts when it detects such large orders.

What is the importance of market psychology in support and resistance?

-Market psychology plays a key role in support and resistance. At support levels, buyers' psychology drives them to defend the price, while at resistance levels, sellers' psychology leads them to protect the price from rising. Understanding these psychological dynamics can enhance trading decisions.

How does the auction process affect market interactions?

-The auction process refers to the continuous interaction between buyers and sellers, where prices are bid up or down. In the context of support and resistance, it’s the process of buyers defending a level at support, or sellers defending a level at resistance, which creates the market's movement patterns.

What is the significance of a breakout after a support to resistance transition?

-A breakout after a support to resistance transition signals that the market has successfully broken a key level, and this often leads to continued movement in the direction of the breakout. It’s important to watch for confirmation, such as strong volume or a price surge, to validate the breakout.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Support & Resistance Trading in Stock Market | Price Action Trading

Kapan Waktu yang Tepat untuk Beli Saham? Tips Pakai Support dan Resistance | feat. Michael Yeoh

How to Indentify Liquidity Day Trading

Babypips Forex Education: Elementary Grade 1 - Forex Support and Resistance

Cara Menentukan Support Resistance Part 1 | Kelas Trading Si Koko Saham Hari Ke-8

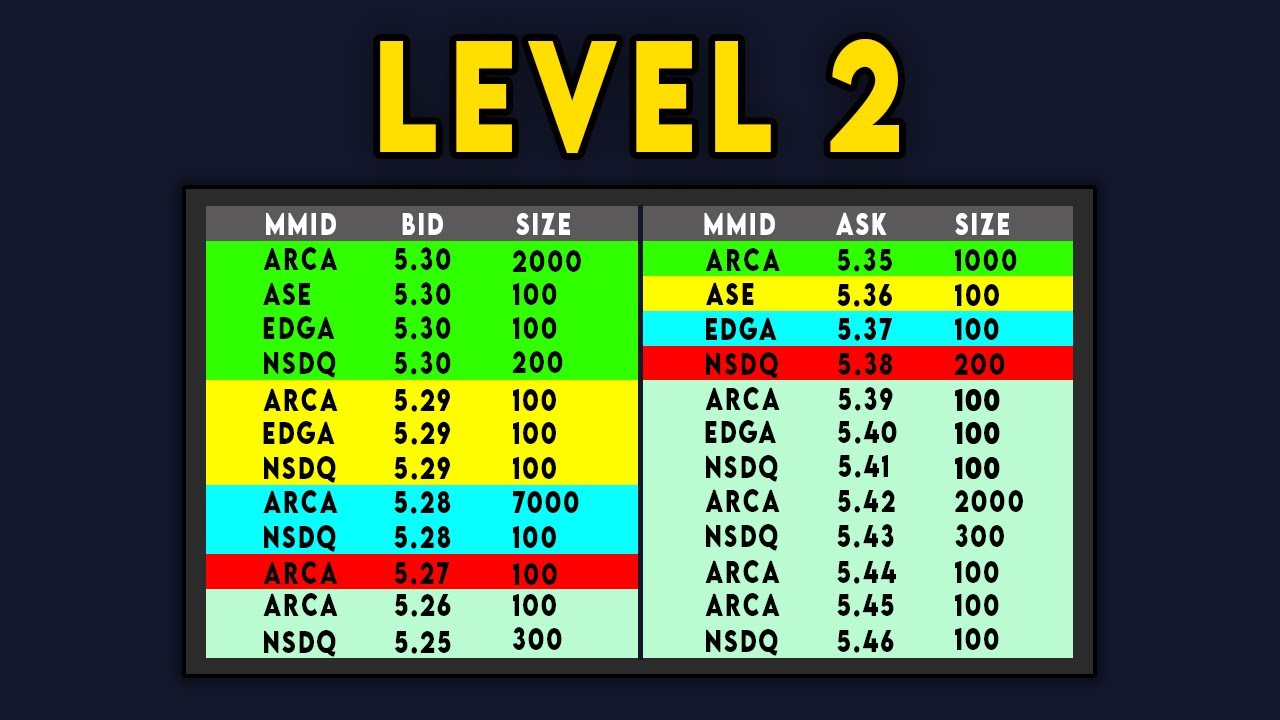

How To Read Level 2 Market Data

5.0 / 5 (0 votes)