Boot Camp Day 22: Order Blocks pt.2

Summary

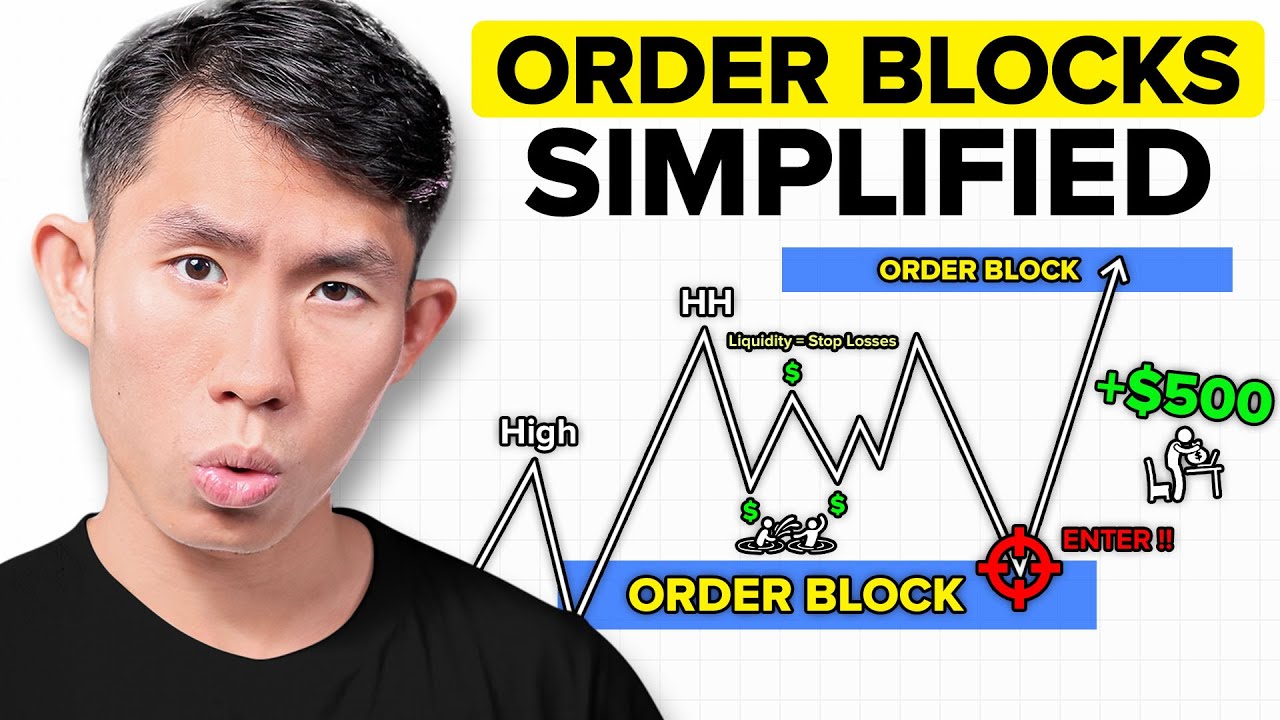

TLDRIn this video, the presenter dives into the concept of order blocks in trading, explaining how to identify them and their role in price action. Order blocks are defined as the price move prior to a liquidity sweep or market structure break, where orders are filled. The presenter provides a detailed walkthrough, using examples from different timeframes to demonstrate how to spot order blocks and how they influence price movement. Patience and understanding of timeframes are emphasized, as is the importance of identifying key price areas for entries and exits. The session aims to enhance trading intuition and technical analysis skills for participants.

Takeaways

- 😀 Order blocks are the price ranges where orders are filled before a liquidity sweep or structure break.

- 😀 The first day of the course focuses on understanding the concept of order blocks without trying to visualize them on charts.

- 😀 Order blocks are created when the market moves to fill liquidity, which allows price to break structure and change direction.

- 😀 The order block in an uptrend is the move that happened before the liquidity sweep to the upside, which sets up a potential price reversal.

- 😀 In a downtrend, the order block is the move before the liquidity sweep to the downside, setting up a retracement to fill orders.

- 😀 When identifying an order block, focus on the price action before the break of structure, not the immediate price movement after the break.

- 😀 Using multiple timeframes is key to pinpointing order blocks accurately, such as scaling down from the daily to the 15-minute chart.

- 😀 Understanding the time frame you're working on is essential, as tighter stop losses on lower time frames can result in being stopped out prematurely.

- 😀 Traders should focus on recognizing liquidity sweeps and structure breaks to identify potential order blocks and price reversals.

- 😀 Practice patience when waiting for an order block to form, as it takes time for price to retrace to these key levels, offering better risk-reward opportunities.

Q & A

What is an order block in trading?

-An order block is the price range where orders are filled before a market structure shift, such as a liquidity sweep or break of structure. It represents a move that causes or precedes a change in price direction.

How do you identify an order block on a chart?

-An order block is identified by observing the price move just before a market structure change. Look for a significant price move that causes a liquidity sweep or a shift in market direction, followed by a retracement to that same price range.

What does a liquidity sweep signify in market analysis?

-A liquidity sweep occurs when price moves through a significant area to take out stops or orders, often triggering a market shift. It is a key event that helps define the order block where orders are filled.

What role does patience play in trading with order blocks?

-Patience is essential when trading with order blocks because you must wait for the right market conditions, such as a break of structure or retracement into the order block, before entering a trade.

Why is it important to understand the time frame you are trading on when using order blocks?

-Understanding the time frame is crucial because order blocks can span multiple time frames. The market structure shift you identify on a lower time frame may not reflect the full scope of price action that you see on higher time frames, affecting your entry and stop placement.

How do you determine where to place a stop loss when trading with order blocks?

-When trading with order blocks, stop loss placement should be based on the time frame you are trading on. For instance, if you're trading a break of structure on the 4-hour chart, your stop loss should be placed further from the entry point to account for potential retracements.

What should you look for when entering a trade after identifying an order block?

-After identifying an order block, look for a break of structure to confirm that the market is moving in the direction you anticipate. A break of structure signals that the market has shifted, and you can enter the trade with more confidence.

What are the risks of not scaling down to a lower time frame after spotting an order block?

-Not scaling down to a lower time frame could result in less precise entries and higher stop losses. A lower time frame allows you to identify more specific entry points and manage risk more effectively by reducing the distance to your stop loss.

Why is it important to wait for the market to retrace into an order block before entering a trade?

-Waiting for the market to retrace into an order block ensures that you're buying or selling at a price where previous orders were filled, increasing the likelihood of a successful trade. It also allows you to manage risk more effectively with a better risk-reward ratio.

Can you trade with order blocks on any time frame?

-Yes, order blocks can be identified and traded on any time frame. However, the higher time frames tend to provide stronger and more reliable order blocks, while lower time frames can offer more precise entries but with more noise and volatility.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

How to Identify and Trade Order Blocks

Master Order Blocks to Trade like Banks (no bs guide)

Stop Guessing ENTERIES – Order Blocks vs FVG Simplified for 2025 | PRICE ACTION

Orderblocks Simplified - ICT Concepts

Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

Order Blocks - A-Z Guide Episode 1

5.0 / 5 (0 votes)