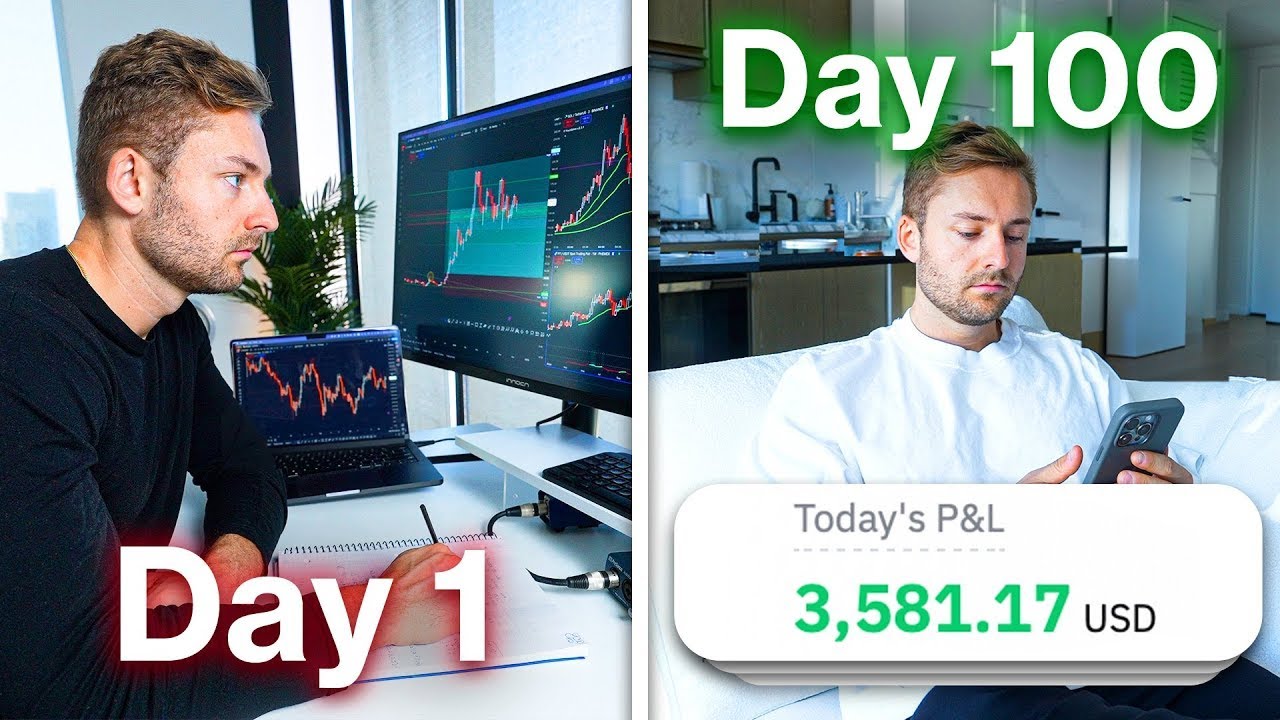

How To Trade With Discipline & Without Emotion

Summary

TLDRThis video delves into the psychology of trading, emphasizing the importance of treating trading as a business and developing emotional discipline. It highlights key principles such as accepting losses, managing risks, and building a trading strategy rooted in probability. The gambler's fallacy and biases are explored, demonstrating how they can undermine disciplined trading. By focusing on the process rather than short-term rewards, traders can navigate market unpredictability and achieve long-term success. Ultimately, the video encourages traders to embrace uncertainty, rely on statistical analysis, and stay committed to a well-defined strategy for sustainable profitability.

Takeaways

- 😀 The market is the best teacher of trading psychology and discipline, with past market behavior setting expectations for future outcomes.

- 😀 Traders must treat trading as a business, creating a solid business plan and accepting responsibility for both wins and losses.

- 😀 Emotional control is a key differentiator between successful and unsuccessful traders. Managing emotions leads to a more disciplined approach.

- 😀 The market is always right, and it is the trader’s perception and psychology that create challenges, not the market itself.

- 😀 Understanding that losses are inevitable is crucial. Effective risk management ensures that losses don’t grow uncontrollable and ruin the strategy.

- 😀 A trader’s focus should be on the process, not immediate returns. Success in trading is a byproduct of a well-structured strategy and consistent execution.

- 😀 Following rules based on past performance and analysis is vital. Blindly following rules without solid backing could lead to financial failure.

- 😀 Traders must recognize and accept their psychological biases, such as the gambler’s fallacy, which can affect decision-making and perception of randomness.

- 😀 The law of large numbers and a long-term perspective are necessary to see the true potential of a strategy. Small sample sizes can be misleading.

- 😀 Losses are an integral part of every trading strategy. The key to success is managing them effectively, keeping them small, and remaining calm.

- 😀 Trading is a probability game. By understanding and embracing this concept, traders can remove the emotional weight of individual wins or losses.

Q & A

What is the main theme of the video script?

-The main theme of the video revolves around the importance of discipline, emotional control, and treating trading as a business. It emphasizes the need for a well-structured trading process, accepting losses, and focusing on long-term performance rather than short-term results.

Why is it crucial to treat trading as a business?

-Treating trading as a business is essential because it helps build a structured approach, ensuring that decisions are based on a sound plan rather than emotional impulses. By adopting this mindset, traders can more effectively manage risk, accept losses, and stay focused on the process instead of the immediate financial outcome.

What does 'emotional control' mean in the context of trading?

-Emotional control refers to the ability to prevent emotions from influencing trading decisions. Successful traders understand that the market is irrational and that their own emotions can cloud judgment. Managing emotions helps traders stick to their trading rules and avoid making impulsive decisions based on fear, greed, or frustration.

How does the concept of the 'gamblers fallacy' apply to trading?

-The gambler's fallacy in trading refers to the mistaken belief that after a series of losses, a win is 'due'. In reality, each trade is independent and the market has no memory, meaning that past results do not influence future outcomes. This fallacy can lead traders to make irrational decisions based on random events.

What role do 'rules' play in maintaining discipline in trading?

-Rules are essential because they remove emotional bias and provide a framework for consistent decision-making. By creating specific rules for identifying opportunities, executing trades, and managing risk, traders can avoid impulsive actions and stay aligned with their trading strategy.

Why is it important to accept losses as part of the trading process?

-Accepting losses is vital because they are an inevitable part of trading. Understanding that losses occur due to randomness or market conditions helps traders manage risk effectively. By accepting losses as part of the process, traders can focus on maintaining discipline and following their trading plan, rather than getting discouraged or deviating from the strategy.

What does Mark Douglas mean by 'trading is simply a probability game'?

-Mark Douglas suggests that trading is about probabilities, not certainties. Traders should understand that each trade is a random event with its own unique outcome. Rather than focusing on being 'right' with every trade, successful traders base their strategies on statistical probabilities, accepting that some trades will win and others will lose.

How can traders use the bell curve to understand their trading results?

-The bell curve helps traders visualize their trading results in terms of probability. It shows the distribution of outcomes, with most trades falling within an average range and a small percentage yielding extreme results (both wins and losses). Understanding the bell curve helps traders recognize that short-term losses are normal and that, over time, a strategy with a positive expectancy should produce favorable results.

What is meant by 'managing risk' and how does it help a trader maintain discipline?

-Managing risk means controlling the amount of capital exposed to each trade and ensuring that losses are kept small. By sizing positions appropriately and using stop-losses or other risk management tools, traders can avoid large losses that could wipe out profits from winning trades. This discipline helps traders stay within their strategy even during periods of drawdown.

How does Mark Minervini incorporate the concept of 'failure' into his trading system?

-Mark Minervini builds failure into his system by expecting a 50% win rate for his trades. He understands that half of his trades will likely be losses, but his winning trades are designed to be larger than the losses. This acceptance of failure helps him stay focused on the bigger picture and avoid emotional reactions to losses, ultimately leading to more consistent long-term performance.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)