Alex Hormozi Explains How to Find The Best Business Opportunities

Summary

TLDRThe video script discusses key principles of investing in businesses with strong cash flow, emphasizing the importance of low capital expenses, particularly during inflationary periods. It highlights businesses with high gross margins, such as service-based and digital industries, as ideal investments. The speaker compares businesses like insurance and pharmaceuticals, which have historically endured economic challenges, to demonstrate the value of low-cost, high-return models. The script also stresses the role of technology and efficiency in reducing costs and boosting profitability, with an emphasis on niching down and maximizing margins in service-based industries.

Takeaways

- 😀 Low capital expense businesses are preferred, especially in inflationary periods, as they provide higher cash flow and better pricing power.

- 😀 Businesses with low capital expenses include service-based businesses, digital companies, and some types of software companies.

- 😀 High capital expense businesses, like those with large inventories or heavy manufacturing needs, should generally be avoided due to their constant need for reinvestment.

- 😀 The best businesses for wealth creation are those with **high gross margins**, meaning the cost of producing additional units is minimal.

- 😀 Insurance companies, such as Geico, are examples of businesses with no capital expenses but high profitability, as they are based on assessing risk and calculating math.

- 😀 The longevity of businesses like insurance and banks (some over 100 years old) indicates they are profitable and have endured economic hardships like wars and depressions.

- 😀 Gross margin is a key metric to assess business profitability—high margins (e.g., a pill costing a penny to make but selling for $10) result in higher profits.

- 😀 Starting a business with gross margins over 80% is ideal, which means selling services for at least five times the cost of delivery.

- 😀 Technology reduces the cost of delivering services, allowing more people to access previously high-end products or services, thereby increasing the market reach.

- 😀 Specializing in a niche customer base allows for higher margins, as it enables businesses to become more efficient and scale faster with less customization required.

Q & A

What is the main focus when acquiring or investing in a business?

-The main focus is identifying businesses that have strong cash flow and low capital expenses, especially in an inflationary period, as these businesses are more likely to be resilient and profitable.

Why are low capital expense businesses preferred over high capital expense ones?

-Low capital expense businesses, like service-based or digital businesses, are preferred because they allow for greater scalability without the need for constant reinvestment in physical assets, reducing financial risk and increasing profitability.

What is an example of a high capital expense business?

-An example of a high capital expense business would be one that requires significant inventory, manufacturing, or heavy equipment investments, like retail or industrial manufacturing, which continually need reinvestment to grow capacity.

Can you explain the concept of gross margins and why they matter?

-Gross margin refers to the difference between the cost of producing a product and its selling price. It matters because higher gross margins allow businesses to keep more profit per sale, making it easier to cover other expenses and become profitable.

How does technology impact business costs and efficiency?

-Technology reduces the cost of delivering valuable products and services. Over time, technology can make what was once expensive and exclusive to the wealthy accessible to a wider audience by decreasing the cost basis of production or delivery.

What role does leverage play in business success?

-Leverage allows businesses to maximize returns with fewer resources. Wealthy individuals typically invest in businesses with high leverage potential, such as insurance companies, which can generate significant returns without requiring heavy capital expenditures.

Why do many successful businesses, like insurance companies, last for so long?

-Successful businesses like insurance companies have been around for so long because their business models are highly resilient and profitable. They rely on risk assessment and mathematical modeling, which can withstand economic downturns, wars, and other crises.

How can small business owners improve their profitability?

-Small business owners can improve profitability by focusing on high gross margins, efficiently scaling operations, and narrowing their target market to specialize in specific customer needs. This allows them to charge premium prices while keeping costs low.

What is the advantage of niching down in business?

-Niching down allows businesses to specialize in a particular market, making them more efficient and better able to meet specific customer needs. This leads to higher margins, easier scaling, and more targeted marketing.

How does the concept of productization help a business scale?

-Productization turns custom services into standardized offerings, making it easier to scale because the business can deliver the same solution repeatedly, improving efficiency and reducing costs while maintaining high profit margins.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Causes of Cash Flow Problems | A-Level, IB & BTEC Business

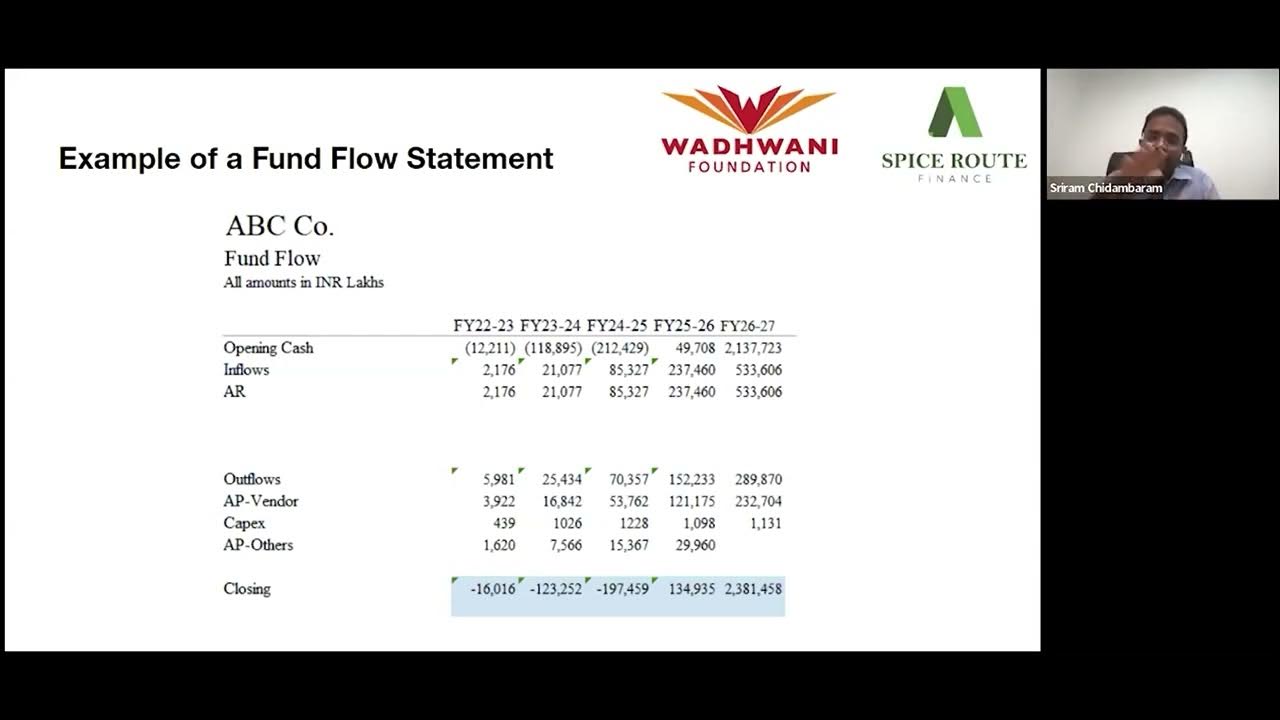

Week 9 Masterclass Sriram Chidambaram Crucial Financial Insights for Startups Success

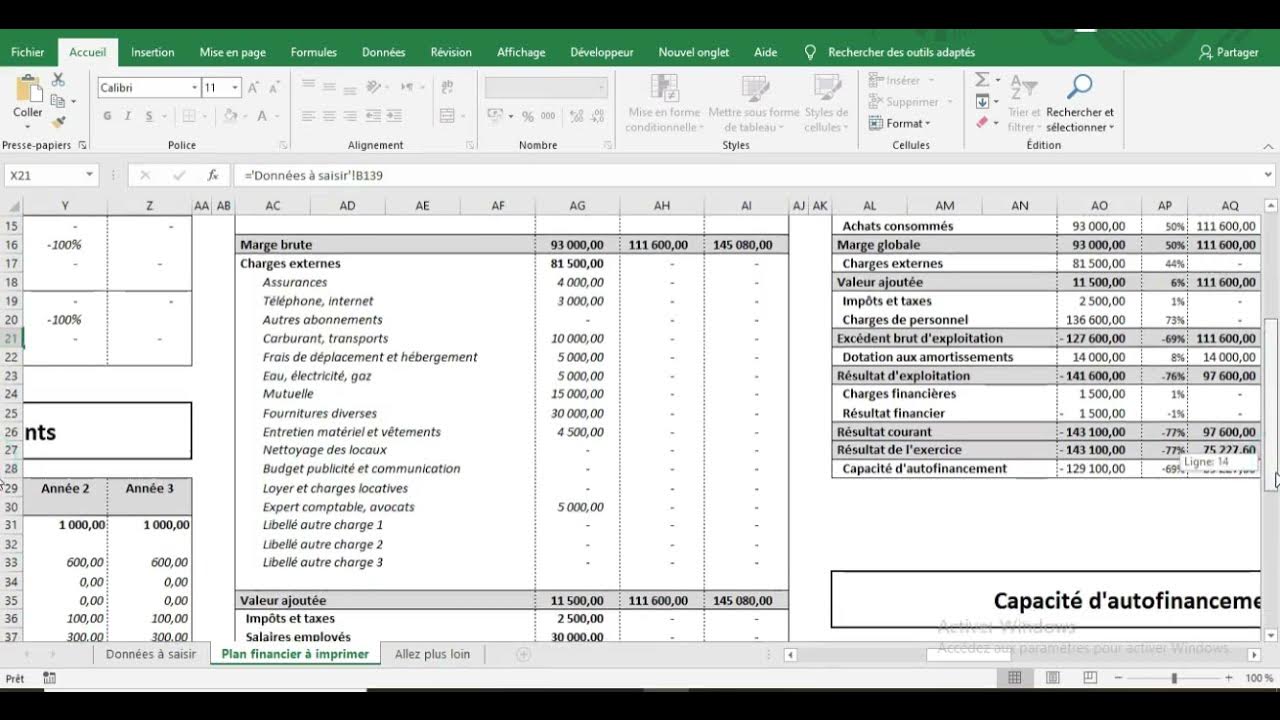

Business Plan : Plan Financier Prévisionnel sur 3 ans دراسة مالية لمشروع شرح مبسط جداا

Ray Dalio: Having Idle Money in 2026 Will Ruin You — Do This Now

Working capital explained

The Real Estate Cash Flow Formula (Everyone Gets This Wrong)

5.0 / 5 (0 votes)