Profit Maximisation in Perfect Competition

Summary

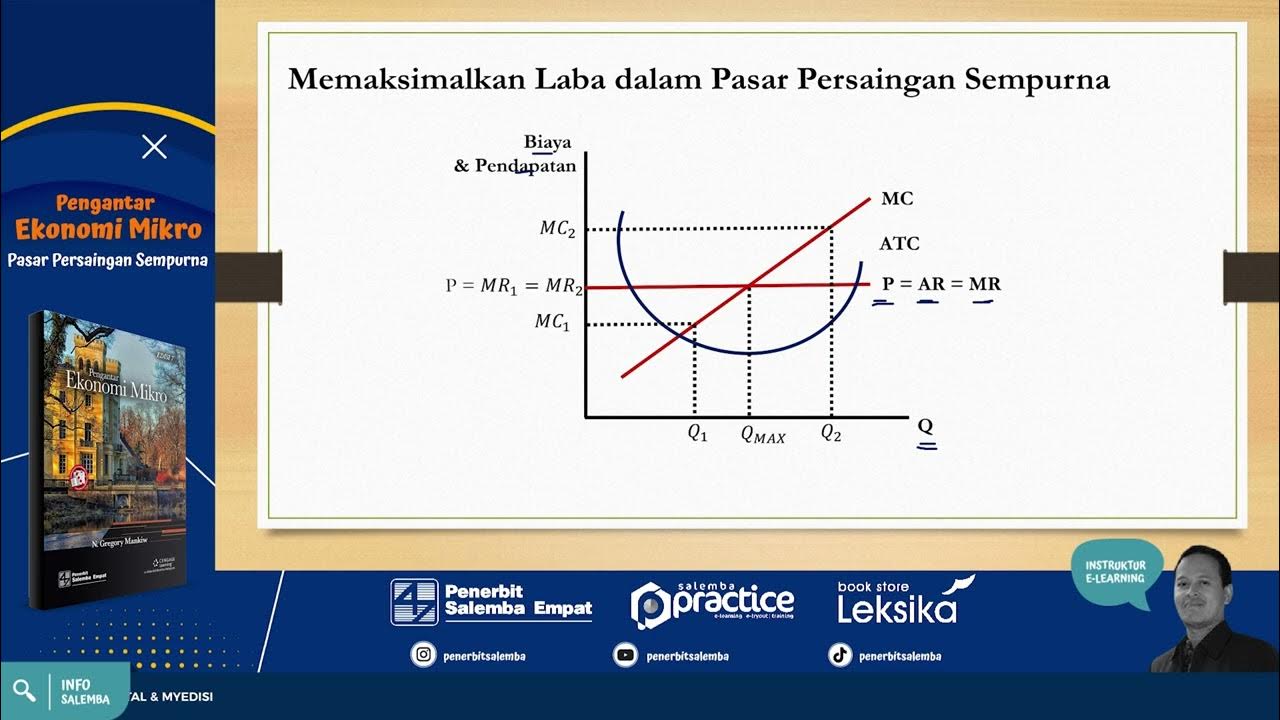

TLDRThis video explains profit maximization in perfect competition, highlighting that firms aim to maximize profit by setting marginal revenue equal to marginal cost. In perfect competition, the price equals marginal revenue, leading to the crucial condition of price equaling marginal cost for optimal production. The speaker uses diagrams to illustrate market dynamics and discusses the implications of producing below or above the profit-maximizing quantity. Additionally, two key caveats are presented: firms must cover average variable costs in the short run and average total costs in the long run to remain viable. Further resources are suggested for deeper exploration.

Takeaways

- 😀 Profit (π) is defined as Total Revenue (TR) minus Total Cost (TC).

- 😀 To maximize profit, firms must take the derivative of their profit function with respect to quantity (q) and set it to zero.

- 😀 The profit maximization condition for firms in perfect competition is where Marginal Revenue (MR) equals Marginal Cost (MC).

- 😀 In perfect competition, MR is equal to the market price (P) because firms are price takers.

- 😀 The optimal production level (q*) is reached when price (P) equals marginal cost (MC).

- 😀 Producing below q* results in lost potential profits because MR exceeds MC.

- 😀 Producing above q* results in losses since MC exceeds MR.

- 😀 In the short run, firms must ensure that price is greater than or equal to Average Variable Cost (AVC) to avoid shutting down.

- 😀 In the long run, firms must ensure that price is greater than or equal to Average Total Cost (ATC) to remain in the industry.

- 😀 The analysis of profit maximization in perfect competition highlights that the price consumers pay equals the cost of production.

Q & A

What is the formula for profit maximization in perfect competition?

-Profit (Pi) is calculated as total revenue (TR) minus total cost (TC). To maximize profit, firms set the derivative of the profit function with respect to quantity (q) equal to zero.

What does the condition 'marginal revenue equals marginal cost' signify?

-This condition indicates that a firm maximizes its profit when the additional revenue from selling one more unit (marginal revenue) is equal to the additional cost of producing that unit (marginal cost).

Why does marginal revenue equal price in perfect competition?

-In perfect competition, firms are price takers; they accept the market price as given. Therefore, the marginal revenue from selling an additional unit is equal to the market price.

How is the profit-maximizing quantity represented in a diagram?

-In the diagram, the profit-maximizing quantity (q*) occurs where the marginal cost curve intersects the price line, which represents both the price and marginal revenue.

What happens if a firm produces less than the profit-maximizing quantity?

-If a firm produces less than q*, marginal revenue will exceed marginal cost, indicating that the firm could increase profits by producing more units.

What are the consequences of producing more than the profit-maximizing quantity?

-Producing more than q* results in marginal cost exceeding marginal revenue, which means the firm would incur losses on those additional units and should reduce production.

What are the short-run conditions for a firm to continue operating?

-In the short run, the price must be greater than or equal to average variable costs (AVC). If the price falls below AVC, the firm will shut down.

What must hold true in the long run for a firm to remain in the market?

-In the long run, the price must be greater than or equal to average total cost (ATC). If the price is below ATC, the firm will exit the industry.

What additional resources does the speaker mention for further understanding?

-The speaker references another video explaining the caveats related to profit maximization and mentions an associated practice problem for additional practice.

What is the significance of the relationship between price and marginal cost in perfect competition?

-The relationship illustrates that in perfect competition, the price consumers pay is equal to the cost of production, highlighting the efficiency and lack of markup characteristic of this market structure.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Pasar Persaingan Sempurna -Pengantar Ekonomi Mikro- #soaldanpembahasan #elearningplatform

Teoria da Firma / Parte 02

Microeconomics Unit 3 COMPLETE Summary - Production & Perfect Competition

Perfect Competition Short Run (1 of 2)- Old Version

Y2 7) Revenue - MR, AR & TR

Chapter 1: 3 The concept of Profit

5.0 / 5 (0 votes)