Jenis-Jenis Instrumen Investasi yang Wajib Diketahui, Yuk Berinvestasi!

Summary

TLDRThis educational video provides an overview of various types of investment instruments, categorizing them into real assets and financial assets. It discusses tangible investments like gold and real estate, highlighting their potential for appreciation and rental income. Additionally, it covers financial investments such as deposits, foreign currency trading, bonds, stocks, and mutual funds, explaining their mechanisms and risks. The video emphasizes the importance of understanding one’s financial situation and investment goals before selecting suitable investment options, ultimately aiming to educate viewers on informed investment choices.

Takeaways

- 😀 Investment instruments are divided into real assets and financial assets.

- 🏅 Real assets like gold and property provide tangible value and tend to appreciate over time.

- 💰 Gold is a stable investment influenced by supply and demand and currency fluctuations, particularly the US Dollar.

- 🏡 Property investment can generate consistent rental income and typically appreciates in value due to inflation and demand.

- 📈 Financial assets include money market investments, foreign currencies, and securities, offering varying levels of risk and return.

- 🏦 Money market investments, such as deposits, are safer but provide lower returns compared to other investments.

- 🌍 Foreign currency investments involve trading currencies and can be volatile due to economic changes.

- 📜 Bank Indonesia Certificates help stabilize the currency and yield returns to participating banks.

- 📊 Stocks represent ownership in a company, offering potential dividends and capital gains but come with higher risks.

- 💼 Mutual funds allow individuals to invest collectively, making it easier for those without extensive investment knowledge to participate.

Q & A

What are the two main categories of investment instruments discussed in the video?

-The two main categories of investment instruments are real assets (aktiva riil) and financial assets (aktiva finansial).

What is considered a real asset and why is it a popular investment choice?

-Real assets include tangible investments like gold and real estate. They are popular because their value tends to appreciate over time and they provide a sense of security as physical assets.

How does the value of gold fluctuate according to the video?

-The value of gold is influenced by supply and demand, availability of gold mines, and fluctuations in the US dollar's value.

What factors affect property investments mentioned in the video?

-Property investments are affected by inflation, location, and market supply and demand dynamics.

What are some examples of financial assets mentioned in the video?

-Examples of financial assets include deposits, foreign exchange, Bank Indonesia certificates, and securities.

What is the purpose of deposits as a financial investment?

-Deposits serve as a safe investment option, allowing individuals to earn interest over a fixed period, similar to savings accounts.

How do foreign exchange investments work?

-Foreign exchange investments involve trading currencies between countries, with profits derived from changes in currency exchange rates.

What are bonds and why do companies issue them?

-Bonds are debt securities issued by companies to raise capital, typically offering lower interest rates compared to traditional bank loans.

What distinguishes stocks from other investment types?

-Stocks represent ownership in a company, and their value can fluctuate based on the company's performance, potentially offering higher returns than other investments.

What are mutual funds and who can invest in them?

-Mutual funds are pooled investments managed by professionals, making them accessible to the general public without requiring extensive investment knowledge or large capital.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

PLAN CONTABLE- ELEMENTO 3: Activo Inmovilizado - CUENTA 30 y 31- TEORÍA Y PRÁCTICA

21 ASSETS that make you financially free | How to get rich HINDI |30 FREE Assets | GIGL

Materi Dasar Pengelolaan Investasi Oleh BPJS Ketenagakerjaan

Alasan si Kaya semakin KAYA dan si Miskin semakin MISKIN!

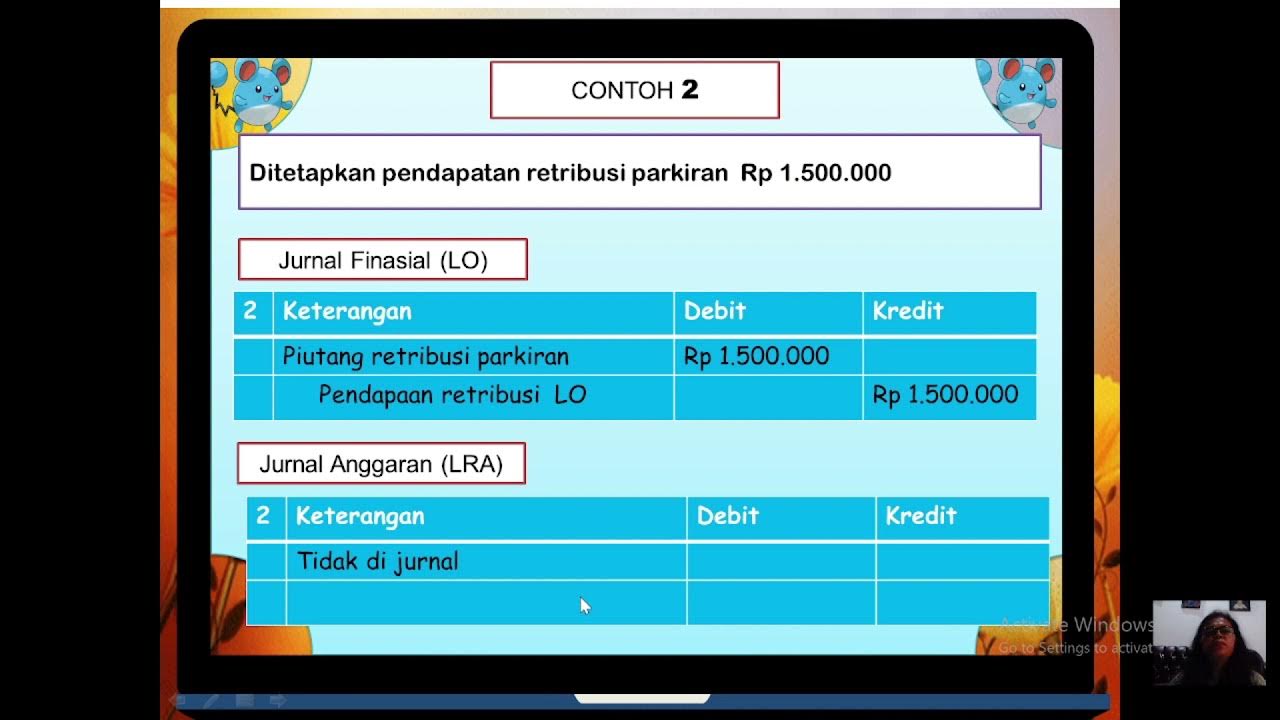

JURNAL SKPD AKUNTANSI PEMERINTAHAN

Persamaan Dasar Akuntansi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

5.0 / 5 (0 votes)