How The Next Bull Run Is Going To Make Me Millions (Copy Me)

Summary

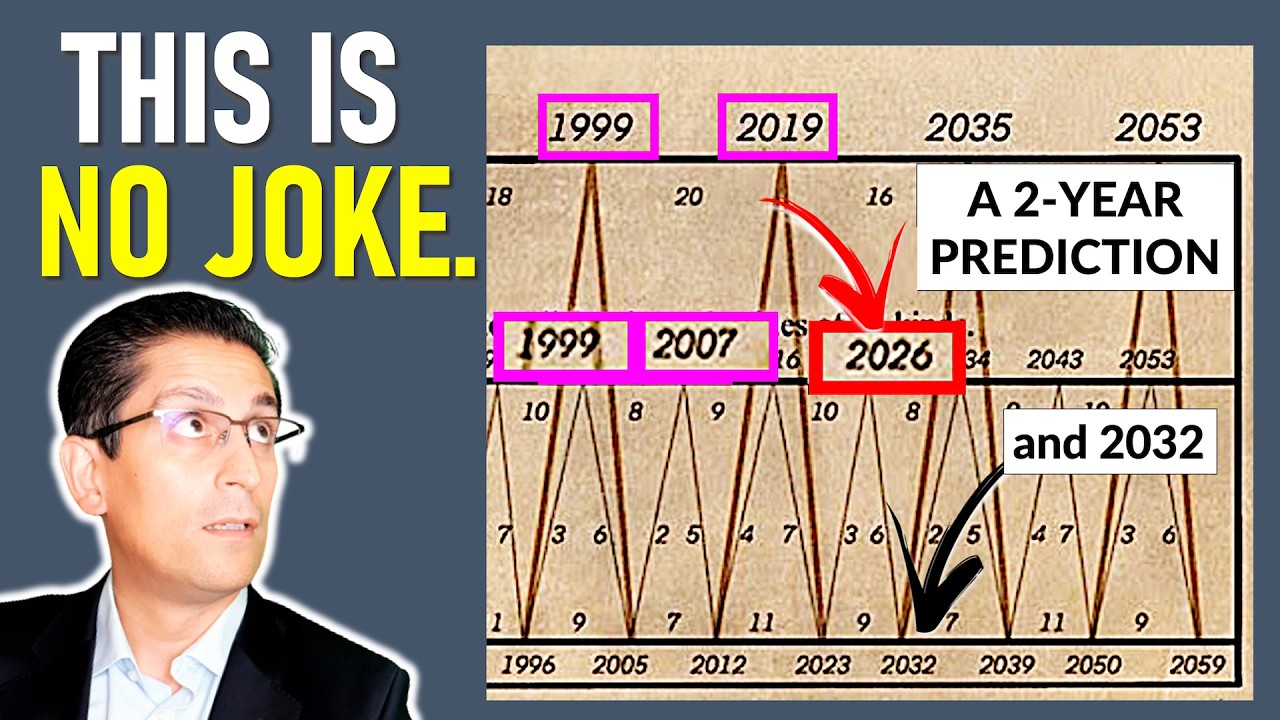

TLDRThe video emphasizes the importance of understanding cryptocurrency market cycles, highlighting that while initial periods may see rapid growth, subsequent years can be characterized by stagnation or decline. Investors are encouraged to develop a solid strategy, focusing on buying and holding quality assets rather than attempting to trade impulsively. The need for a supportive community and accountability is stressed, as well as the importance of selling to realize profits. Lastly, tax implications should be considered, but shouldn't deter investors from capitalizing on market opportunities.

Takeaways

- 😀 Long-term holding of quality assets is often more profitable than frequent trading in crypto.

- 📉 Crypto markets tend to experience cycles of euphoria followed by prolonged downturns; be prepared for both.

- ⏳ Avoid quitting your job to pursue crypto investments, as market conditions can change rapidly.

- 📊 Establish clear price targets and stick to them to prevent emotional decision-making.

- 🤝 Having an accountability group can provide valuable support and grounded advice during volatile market periods.

- ⚠️ FOMO can indicate a time to sell; if you're showing off gains, consider taking profits.

- 💰 Understand tax implications of selling, but don't let them prevent you from realizing profits.

- 📝 Create a written investment plan to guide your decisions and keep your emotions in check.

- 🤔 Consult with experienced individuals in the crypto space rather than relying solely on online influencers.

- 🚀 Taking profits during a bull market is crucial to actually realize gains and avoid losses on the way down.

Q & A

What is the primary focus of the video regarding cryptocurrency trading?

-The video emphasizes the importance of having a well-structured investment strategy and understanding market cycles in cryptocurrency trading.

Why does the speaker caution against quitting full-time jobs to trade crypto?

-The speaker warns that while the market may experience intense volatility and excitement for short periods (6 to 12 months), it often follows with prolonged downtrends or sideways movement, making it risky to rely solely on trading for income.

What does the speaker suggest as a more profitable approach than active trading?

-The speaker advocates for a buy-and-hold strategy, stating that investors will likely earn more by acquiring solid assets and holding them rather than engaging in frequent trading.

What signals does the speaker identify that suggest it's time to sell?

-The speaker indicates that if traders start to show off their profits or experience FOMO (Fear of Missing Out), it’s often a sign that they should consider selling their assets.

How does the speaker advise managing price targets during a bullish market?

-The speaker cautions against continually raising price targets as the market rises, suggesting that investors should stick to a pre-established plan to avoid getting caught up in euphoric expectations.

What role does community play in successful trading, according to the video?

-The speaker emphasizes the importance of having an accountability group or community of knowledgeable friends who can provide grounded advice and support during market fluctuations.

Why is selling highlighted as a critical action in crypto trading?

-Selling is crucial because it allows investors to realize profits. Without selling, profits remain theoretical, and investors risk losing value if the market declines.

What does the speaker suggest regarding tax implications for crypto trading?

-While the speaker acknowledges that taxes are an important consideration, they advise that the potential tax liability should not deter investors from selling, as realizing profits is the ultimate goal.

How does the speaker propose to assist those navigating the crypto market?

-The speaker offers free consultations and resources through their website to help individuals develop effective trading strategies and avoid missing out on profitable opportunities.

What is the significance of having a written plan in trading?

-A written plan helps traders stay disciplined and focused during market highs and lows, reducing emotional decision-making and increasing the likelihood of achieving their financial goals.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Raoul Pal: "This Is the ONLY Time to Start SELLING Crypto in 2025" New Bitcoin Prediction

China’s Fundamental Economic Problem

This UNBELIEVABLE Market Cycle is About to Repeat (it was predicted 150 years ago)

The real reason Argentina’s economy is such a mess

Crypto Market Cycle Theory

The business cycle | Aggregate demand and aggregate supply | Macroeconomics | Khan Academy

5.0 / 5 (0 votes)