How To Invest With A High Income (Real Estate, ETFs, Personal Development)

Summary

TLDRIn this video, Ravi shares essential strategies for high-income earners and business owners looking to invest in real estate and personal development. He emphasizes avoiding lifestyle creep by allocating a significant portion of income increases to investments, the importance of manifesting one's dream life through visualization, and the necessity of outsourcing tasks to free up time. Ravi also advises focusing on capital growth in property investment and protecting one's energy by surrounding oneself with positive influences. By following these principles, viewers can enhance their wealth-building journey and achieve financial freedom.

Takeaways

- 😀 Avoid lifestyle creep by allocating 80% of any income increase towards your investment portfolio.

- 💡 Manifest your dream life through visualization; create a detailed picture of your ideal daily routine and goals.

- 🏆 Aim for ambitious goals by thinking like the 1%; set 'ridiculous' targets to exceed your initial expectations.

- 🧹 Outsource tasks that consume your time; investing in services like cleaning can free up valuable hours for more productive activities.

- 💰 Focus on investing rather than just saving; once you have an emergency fund, use your money to maximize returns through investments.

- 📈 Seek properties with strong capital growth potential instead of just high rental yields to build a successful real estate portfolio.

- 🌟 Surround yourself with positive, energizing people to maintain motivation and focus as you pursue your goals.

- 🧠 Don’t hesitate to seek professional advice for mental health; consider therapy to support your personal and professional growth.

- 🏡 Invest in real estate strategically; aim for a mix of properties that can grow in value while providing decent returns.

- 📊 Continuously educate yourself on financial principles and strategies to stay ahead in your wealth-building journey.

Q & A

What is lifestyle creep, and why is it important to avoid it?

-Lifestyle creep refers to the tendency to increase spending as income rises. It's important to avoid it because it can hinder wealth growth. Instead, it's recommended to allocate a significant portion (like 80%) of any income increase towards savings and investments.

How should high-income earners approach goal setting?

-High-income earners should aim to set ambitious, even 'ridiculous' goals. This approach pushes them to achieve more than if they set lower, more attainable targets. For example, if the goal is to save $150,000, even reaching $110,000 is better than a modest target of $80,000.

What is the significance of manifestation in achieving financial goals?

-Manifestation involves visualizing and defining what your ideal life looks like. By doing this, individuals can create a clear roadmap to their goals, enhancing motivation and focus on what they truly want to achieve financially.

Why is it beneficial to outsource tasks in personal and professional life?

-Outsourcing tasks allows individuals to exchange money for time, which is finite. This approach frees up time for more valuable activities, increasing productivity and allowing focus on high-priority goals, ultimately leading to greater success.

How should investors balance capital growth and cash flow when buying property?

-Investors should look for properties that offer a mix of both capital growth and cash flow. Instead of focusing on extremes—like low-cost cash-flow properties or high-cost blue-chip areas—aim for properties that provide stable long-term growth potential.

What role does social environment play in wealth building?

-The social environment significantly impacts success and happiness. Surrounding oneself with uplifting and energizing individuals can provide motivation and support, while toxic relationships can drain energy and hinder progress.

What mindset shift is needed regarding saving versus investing?

-Once an emergency fund is established, the focus should shift from saving to investing. Investing money in assets that grow over time is more effective for building wealth compared to merely saving it in a bank account.

What are some practical steps to start avoiding lifestyle creep?

-Practical steps include budgeting wisely, committing to saving a large percentage of income increases, and consciously limiting unnecessary spending on luxury items or experiences that don't contribute to long-term goals.

What is the recommended allocation for budgeting when increasing income?

-The recommended budgeting strategy suggests that 50% of income should go to needs, 30% to wants, and 20% to savings or investments. However, it is advised to adjust these figures and allocate 80% of any income increase to investments.

Why is it important to protect your energy when pursuing wealth?

-Protecting your energy is crucial because it ensures that you focus your time and effort on activities and relationships that provide a positive return on investment, leading to greater overall happiness and productivity in your wealth-building journey.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Making Your First Hire as an Realtor | Ep. 349 - Massive Agent Podcast

15 Jobs Up to $150K Annually plus FREE HOUSE

What To Focus On To Make $1 Million Dollars in 90 days | Grant Cardone

The Best Niche To Get Listings & Buyers From In 2024 with New NAR Changes for Real Estate Agents

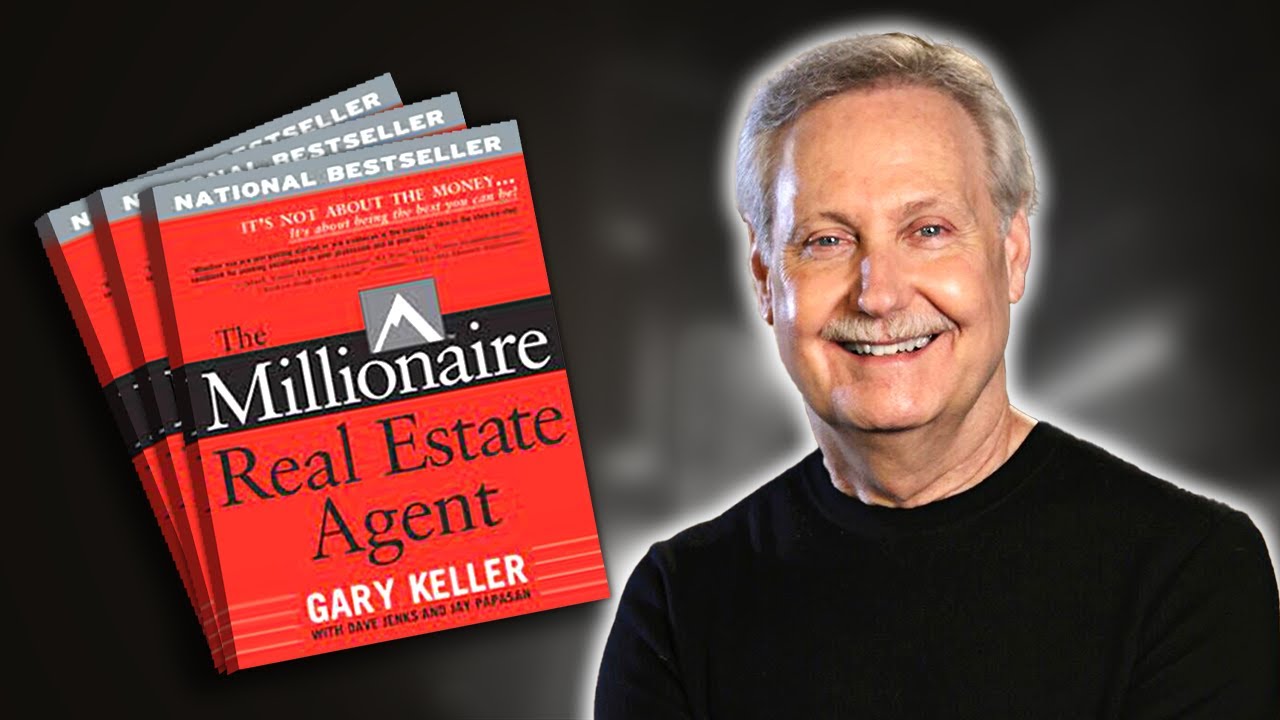

Key Strategies from "The Millionaire Real Estate Agent" by Gary Keller (Animated Book Summary)

9 Income Streams You Can Build While STILL an Employee

5.0 / 5 (0 votes)