Financial Statement Based on PAS #1

Summary

TLDRIn this lecture on Philippine Accounting Standards, the speaker explains the key components of financial statements, including the balance sheet, income statement, statement of comprehensive income, statement of changes in equity, and statement of cash flows. The discussion highlights the relationships between these components and their significance in assessing a company's financial health. The speaker emphasizes the differences in financial statement preparation for various business types, such as trading, service, and professional firms, concluding with insights into the importance of accurate financial reporting for effective business management.

Takeaways

- 📊 Financial statements are crucial for presenting a business's financial position and performance under Philippine Accounting Standards (PAS) No. 1.

- 📋 The main components of financial statements include the Balance Sheet, Income Statement, Statement of Comprehensive Income, Statement of Changes in Equity, Statement of Cash Flows, and Notes to Financial Statements.

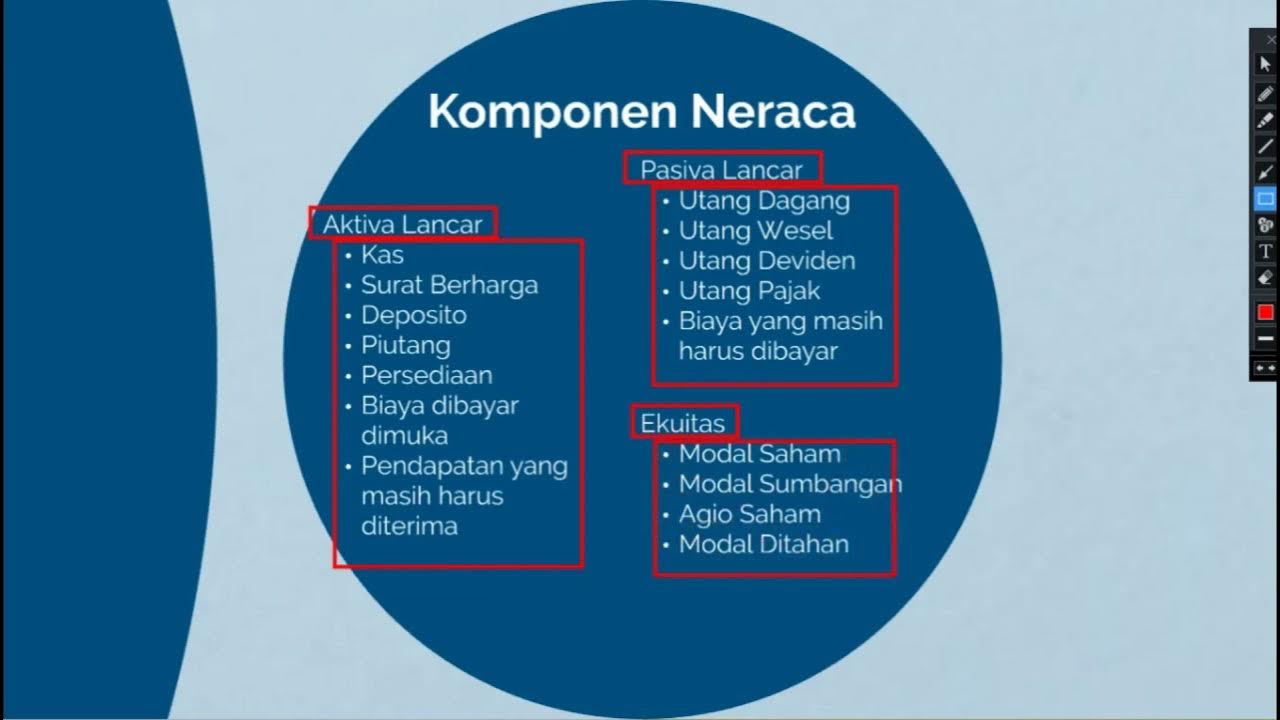

- 💰 The Balance Sheet provides a snapshot of assets, liabilities, and equity at a specific time, which helps assess a company's liquidity and solvency.

- 📈 The Income Statement outlines the company's operational performance over a period, detailing revenues and expenses to calculate net income.

- 📑 The Statement of Comprehensive Income includes gains and losses that are not reflected in the Income Statement, contributing to a broader view of financial performance.

- 🔄 The Statement of Changes in Equity reconciles the opening and closing balances of equity, considering profits and dividends paid out to shareholders.

- 💵 The Statement of Cash Flows summarizes cash inflows and outflows from operating, investing, and financing activities, linking net income to cash balances.

- 📝 The preparation of financial statements requires careful organization of components to ensure total assets equal total liabilities and equity.

- 🏢 Different industries have varying requirements for financial statements; for example, trading and merchandising businesses need only basic components, while corporations must prepare comprehensive statements with detailed notes.

- 🤔 Understanding these financial statements enables stakeholders to make informed decisions based on a company's financial health and performance.

Q & A

What are the main components of financial statements according to Philippine Accounting Standards Number One?

-The main components include the balance sheet (statement of financial position), income statement (statement of operation), statement of comprehensive income, statement of changes in equity, statement of cash flows, and notes to the financial statement.

How does the balance sheet represent a company's financial position?

-The balance sheet presents the company's financial position at a specific point in time, showing its assets, liabilities, and equity, which helps assess liquidity and solvency.

What is the difference between nominal accounts and real accounts in financial statements?

-Nominal accounts, found in the income statement, include revenues and expenses, while real accounts, found in the balance sheet, consist of assets, liabilities, and equity.

What approaches can be used to present the income statement?

-The income statement can be presented using either the functional approach or the natural approach, depending on the nature of the business.

What does the statement of comprehensive income include that the income statement does not?

-The statement of comprehensive income includes gains and losses that are not captured in the income statement but are reflected in the equity section.

How is the statement of changes in equity structured?

-The statement of changes in equity starts with the beginning capital balance, adds net income, deducts dividends paid, and reflects any additional investments to determine the ending capital balance.

What is the purpose of the statement of cash flows?

-The statement of cash flows summarizes a company's cash inflows and outflows from operating, investing, and financing activities, reconciling the beginning and ending cash balances.

What types of businesses might only need to prepare basic financial statements?

-Small businesses, particularly sole proprietorships and micro-enterprises in trading and merchandising, typically only need to prepare the statement of financial position, statement of operation, and statement of cash flows.

How do professional service businesses, like clinics or law firms, handle their income statements?

-Professional service businesses may prepare income statements using simplified methods, sometimes applying a fixed percentage tax based on their earnings rather than itemizing expenses.

Why is it important for corporations to prepare all components of financial statements?

-Corporations must prepare all components of financial statements, including notes, to ensure compliance with regulations and provide a comprehensive view of their financial performance and position.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Financial Statements - Interconnectivity

mgt201 short lectures || vu mgt201 short lectures || Mgt201 vu guess paper || vu mgt201 mcqs

Video Pembelajaran Jenis Laporan keuangan

Basic Financial Statements

KD 3 10 MENGANALISIS LAPORAN KEUANGAN SEDERHANA || PRODUK KREATIF DAN KEWIRAUSAHAAN

The Financial Statements & their Relationship / Connection | Explained with Examples

5.0 / 5 (0 votes)