Why The U.S. Dollar May Be In Danger

Summary

TLDRThe video script explores the ongoing debate about the future of the US dollar as the world's dominant reserve currency. Analysts discuss the potential threats to the dollar's supremacy, such as America's growing account deficit, rising inflation, and competition from alternative currencies like the euro and renminbi. While some experts warn of a possible decline, others argue that the dollar's status is secure due to its safe-haven appeal, deep financial markets, and lack of viable alternatives. The debate highlights the complexity of predicting the dollar's long-term trajectory.

Takeaways

- ⚠️ Analysts are warning about the long-term risks to the U.S. dollar's dominance, though it remains strong currently.

- 💪 The U.S. dollar is the world's most powerful currency, accepted globally and resilient through financial shocks.

- 📊 The U.S. current account deficit is a growing concern, as the U.S. continues to import more than it exports.

- 💸 The U.S. has been borrowing foreign savings due to its low national saving rate, which may pose risks in the future.

- 📉 The dollar's share in global foreign exchange reserves has been steadily declining, partly due to the rise of the euro and renminbi.

- 📈 Despite occasional declines, the dollar's status as a safe haven remains strong during global crises like the Ukraine war.

- 💡 A weaker dollar can benefit U.S. exports but risks higher inflation and reduced foreign investment if it becomes too weak.

- 🌍 A severely weakened dollar could disrupt both the U.S. economy and the global economy, especially for countries reliant on exports.

- 🛡️ The U.S. dollar's dominance is backed by strong factors like a large, liquid bond market, independent central bank, and military power.

- 🔮 While there are alternative currencies and speculation about cryptocurrencies, no realistic contender for replacing the U.S. dollar exists yet.

Q & A

What is one of the main concerns analysts have about the future of the US dollar?

-Analysts are concerned that the US dollar’s dominance may be under threat, especially due to America's growing account deficit and reliance on foreign savings to finance its economic activities.

How has the US current account deficit contributed to concerns about the dollar's future?

-The US current account deficit, which means the value of imported goods and services exceeds exports, has been growing for decades. This deficit, alongside a low national savings rate, increases America's reliance on foreign savings, which poses a long-term risk to the dollar's status.

What role does the US dollar play in the global financial system today?

-The US dollar is the world's most powerful currency and is used globally for international transactions. It has been the world's reserve currency for decades, which allows the US to borrow easily and at low interest rates.

What are some of the potential threats to the US dollar’s dominance as a global reserve currency?

-Potential threats include growing fiscal deficits, the rising prominence of alternative currencies such as the euro and renminbi, and the possibility that foreign countries might stop lending their surplus savings to the US.

How has the share of the US dollar in global foreign exchange reserves changed over time?

-The dollar's share in global foreign exchange reserves has been steadily declining, reaching its lowest point in over 25 years during the fourth quarter of 2020, partly due to the rise of alternative currencies like the euro and renminbi.

What are some alternative currencies that have been chipping away at the dollar's role as a reserve currency?

-Currencies like the euro, the Chinese renminbi, the Japanese yen, the British pound sterling, as well as smaller reserve currencies like the Canadian and Australian dollars, have gradually gained ground, reducing the dollar's share.

Why do some experts believe the US dollar’s decline is unlikely in the near future?

-Many experts argue that there is no realistic alternative to the US dollar at present due to factors like deep and liquid US bond markets, a strong independent central bank, and the global demand for safe assets in times of financial turmoil.

How does the strength or weakness of the US dollar affect the US economy?

-A weaker dollar can make US exports more competitive, potentially boosting the economy, but it can also lead to inflation by making imports more expensive. A severely weakened dollar could lead to higher borrowing costs and economic instability.

What could happen to global markets if the US dollar were to collapse?

-A collapse of the US dollar would create turmoil in global financial markets, potentially causing higher interest rates, falling commodity prices, and disruptions in economies that depend heavily on US dollar assets and exports.

What makes it difficult for other currencies, like the euro or the Chinese renminbi, to replace the US dollar as the world’s reserve currency?

-The euro's debt markets are fragmented, and the Chinese renminbi is subject to capital controls, making it less freely convertible. Additionally, these currencies lack the scale, liquidity, and deep financial markets that the US dollar offers.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Kenapa Dolar AS Dijadikan Uang Internasional?

How America Made The Dollar A Global Benchmark | Epic Economics

Saudi Arabia Just Ditched The US Dollar (How This Affects You)

Why China Can't Quit the US Dollar

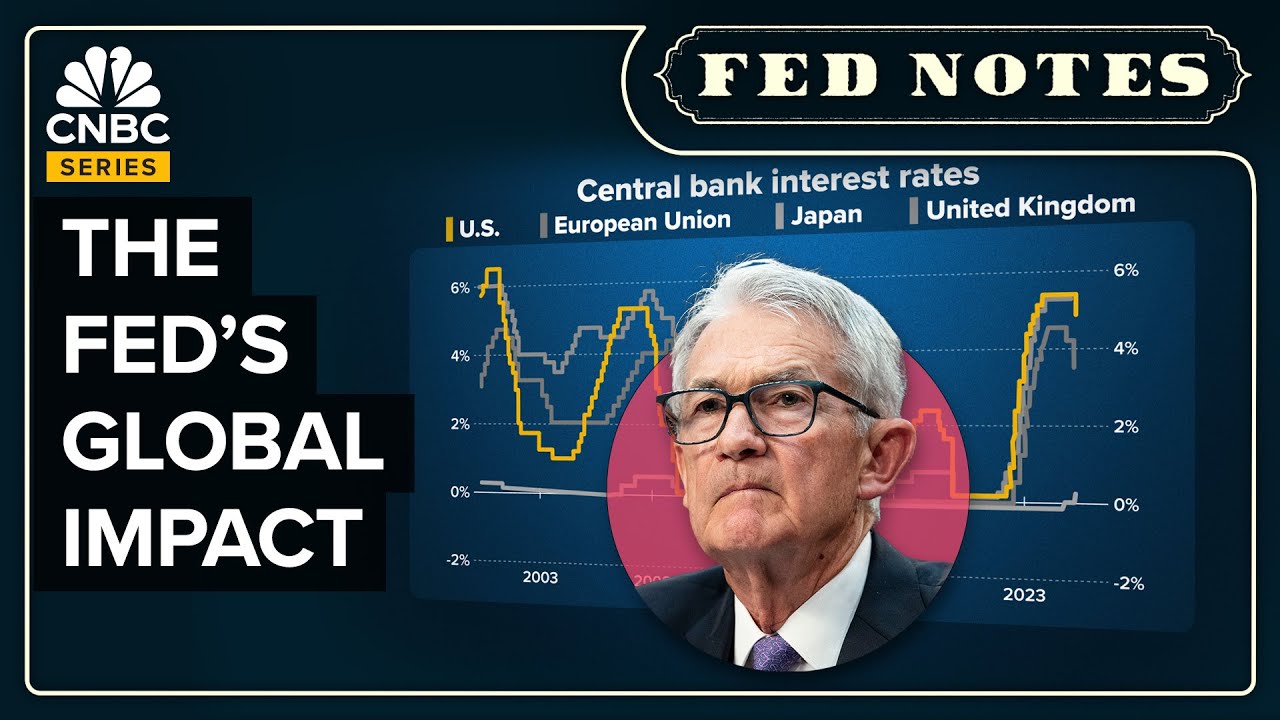

How Fed Rate Cuts Affect The Global Economy

It Started: China Just Dumped The US Dollar (Ray Dalio’s Final Warning)

5.0 / 5 (0 votes)