Weighted Moving Average Explained - Calculation, Formula and Tips for Traders

Summary

TLDRIn this video, Chris delves into the weighted moving average (WMA), a vital tool in technical analysis for traders. He explains the WMA's significance, how it differs from the simple moving average (SMA), and its ability to weigh recent price data more heavily to identify trends. Chris walks through the calculation, provides examples, and highlights how traders use the WMA to detect trend directions, support, and resistance levels. He concludes by encouraging viewers to apply the WMA in their trading strategies, especially when taking on challenges like the Gauntlet Mini.

Takeaways

- 📉 The weighted moving average (WMA) is a key technical analysis tool used by traders, which gives more weight to recent price data compared to past data.

- 📊 WMAs help traders identify trends and provide trade signals, offering a more accurate picture than simple moving averages (SMA).

- 📅 WMAs date back to the early 1900s, with P.N. Haurlan first using them to track stock prices and referring to them as 'trend values' for smoothing data.

- ⚙️ To apply a WMA on a chart, traders can select the indicator options and adjust settings to match their preferences.

- 📈 The WMA helps traders by showing trend direction: prices above the WMA indicate an uptrend, while prices below suggest a downtrend.

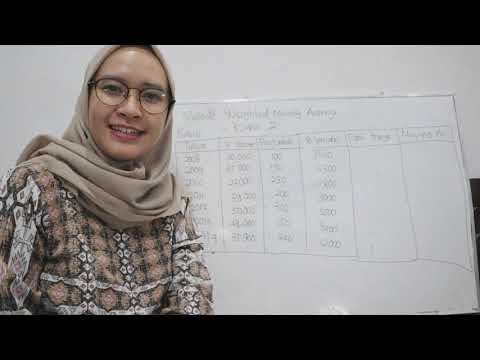

- 🧮 The WMA formula multiplies recent prices by a weighting factor, and these values are summed to calculate the moving average over a specific period.

- 📉 WMA is more sensitive to price changes compared to SMA, which can be advantageous in identifying trends earlier but may also result in increased volatility.

- ⚖️ WMAs provide a dynamic indication of support and resistance, with prices often bouncing off the WMA during strong trends.

- 📈 In a strong uptrend, traders may use the WMA as a signal to buy when prices are near the rising WMA line; conversely, they may sell during downtrends when prices approach the falling WMA.

- 🛠️ Despite its complexity, platforms usually calculate WMAs automatically, making it accessible and easy to apply for traders.

Q & A

What is the Weighted Moving Average (WMA) in technical analysis?

-The Weighted Moving Average (WMA) is a technical analysis tool that gives more importance to recent price data by assigning greater weights to the most recent prices. It helps traders identify trends and potential trade signals.

How is the WMA different from the Simple Moving Average (SMA)?

-The WMA differs from the SMA in that it assigns greater weight to more recent price data, making it more responsive to changes in market trends. In contrast, the SMA gives equal weight to all data points over a given period.

What is the formula to calculate the WMA?

-The formula for the WMA is: WMA = (P1 * W1 + P2 * W2 + ... + Pn * Wn) / (W1 + W2 + ... + Wn), where P represents price values, W represents weights assigned to each price, and n is the number of periods.

Why is the WMA considered more accurate than the SMA?

-The WMA is considered more accurate because it reacts faster to recent price changes, providing a clearer reflection of short-term market trends compared to the SMA, which treats all data points equally.

What is the historical background of moving averages in technical analysis?

-Moving averages date back to the early 1900s. P.N. Haurlan was one of the first to apply moving averages to stock prices, originally calling them 'trend values' or 'exponential smoothing.'

What are the two primary functions of the WMA for traders?

-The two primary functions of the WMA for traders are: 1) Identifying trend direction by weighing recent price data more heavily, and 2) Generating trade signals based on price movements relative to the WMA line.

How can the WMA be used to signal potential trade opportunities?

-If the price moves above the WMA line, it can signal a potential price drop, suggesting a time to exit a trade. Conversely, if the price dips below the WMA line, it might signal a good time to enter a trade, as the price is near the historical average.

What is the importance of weighting recent prices more heavily in the WMA?

-Weighting recent prices more heavily in the WMA allows traders to focus on the most current market trends, making the WMA more responsive to short-term fluctuations compared to other moving averages.

What is one of the limitations of the WMA compared to the SMA?

-One limitation of the WMA is that it is more sensitive to price volatility, which can lead to more frequent signals and potential false alarms compared to the SMA, which is more stable due to equal weighting.

How can the WMA help determine support and resistance levels?

-A rising WMA can indicate a potential support level for price action, while a falling WMA can indicate resistance. Traders use this information to place buy or sell orders based on the direction of the WMA.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)