Доллар 110! Ставка 23! Курс доллара. Девальвация. Прогноз доллара. Российская экономика

Summary

TLDRIn this video, Alexander discusses the impact of the rising U.S. dollar and Russia's key interest rate on the country's economy and financial markets. He highlights the possible hike of the key rate to 21-23% and the recent surge in the dollar, driven by various factors like geopolitics, export policies, and oil prices. Alexander advises viewers to stay cautious about inflation, the potential weakening of the ruble, and the interconnected effects on stocks, bonds, and personal finances, urging them to be mindful of the growing risks.

Takeaways

- 📈 The current financial situation in Russia is strongly influenced by both the dollar and the key interest rate.

- 🔮 Predictions suggest that the key interest rate may rise to 21%, and possibly even 23% by the end of the year or early next year.

- 💵 The dollar has shown noticeable upward movement recently, potentially breaking the 100 ruble mark soon.

- 🤔 Several factors could be driving the dollar's rise, including global geopolitical tensions and manipulations by financial authorities.

- 📉 Despite the increasing dollar value, the Central Bank is expected to intervene if the dollar rises too much, especially beyond 110 rubles.

- 💡 Analysts warn against following emotional reactions to currency market changes fueled by uninformed bloggers.

- 🏦 The Central Bank's decisions on selling yuan and currency interventions will have limited impact on the ruble in the short term.

- 🚨 A rise in the key interest rate will impact the currency, stock, and credit markets, as well as broader economic processes.

- 💰 The financial sector in Russia is facing significant risks due to inflation, geopolitical tensions, and uncertainty in oil prices.

- ⚠️ Investors and individuals are advised to balance risks, especially regarding the possibility of further interest rate hikes and currency devaluation.

Q & A

What is the main focus of the video?

-The video focuses on the dollar exchange rate and the key interest rate in Russia, discussing their impact on the stock market, economy, and individual financial well-being.

Why does the speaker believe the key interest rate may be raised to 21% or even 23%?

-The speaker believes the key interest rate may be raised due to rising inflation and financial instability in Russia. There are numerous forecasts predicting this increase, and the financial authorities are considering it to manage inflation and economic pressures.

What factors have contributed to the recent rise in the dollar's exchange rate?

-The rise in the dollar's exchange rate is attributed to several factors, including increased demand for foreign currencies, financial authority interventions, geopolitical tensions, and exporters delaying currency sales. Additionally, the Central Bank's policies, like reducing foreign currency and gold purchases, have played a role.

How do higher oil prices relate to the ruble and dollar exchange rates?

-While higher oil prices usually support the ruble, the dollar's recent rise has occurred despite increasing oil prices. This suggests other factors, such as geopolitical events and financial policies, are currently having a stronger impact on the ruble's weakness.

What is the speaker’s stance on experts and bloggers claiming that the Central Bank will sell 25 times more currency in October?

-The speaker dismisses these claims as exaggerated and misleading. He explains that while there will be an increase in currency sales, especially in yuan, the volumes are not large enough to cause a significant impact on the ruble.

What is the connection between the dollar exchange rate and the Russian stock market?

-The connection lies in the fact that many companies listed on the Moscow Exchange are exporters, primarily of oil and gas. A weaker ruble tends to benefit these companies as their revenues in foreign currencies increase when converted to rubles, leading to positive stock market performance.

What potential risks does the speaker foresee in the currency market?

-The speaker mentions several risks, including geopolitical instability, global economic recession, and fluctuations in oil prices. These factors could push the dollar above 100 or even 110 rubles, depending on the severity of external shocks.

How does the key interest rate affect the economy, according to the speaker?

-The key interest rate influences various economic sectors, including the credit market, the stock market, and inflation. A higher rate usually results in slower economic growth, higher borrowing costs, and potential negative effects on consumer demand and business investments.

What is the speaker’s prediction regarding the Central Bank's actions on the key interest rate?

-The speaker expects the Central Bank to make a balanced decision, possibly raising the rate to 20% in the next meeting. However, if inflation continues to rise, the rate could go up to 21%, but he believes the increase will be carefully calculated to avoid unnecessary economic harm.

What advice does the speaker offer to individuals regarding rising risks in the economy?

-The speaker advises individuals to consider rising risks, such as currency devaluation, inflation, and geopolitical tensions. He emphasizes the importance of managing personal financial risks, especially for those with debts or mortgages, and adjusting investment portfolios to balance potential losses.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Rising Gold Prices Have Enabled Customers To Borrow More From The Same Collateral Gold: Muthoot Fin

Pemain Diaspora Turun! Sangarnya Starting XI Timnas Indonesia di Piala AFF U-23

Timnas Indonesia U-17 Lolos Piala Dunia, Evandra Top Skorer Sementara | iNews Siang | 08/04

Pyrrhic War - First Greco-Roman War

For Oom Piet - Poem Analysis

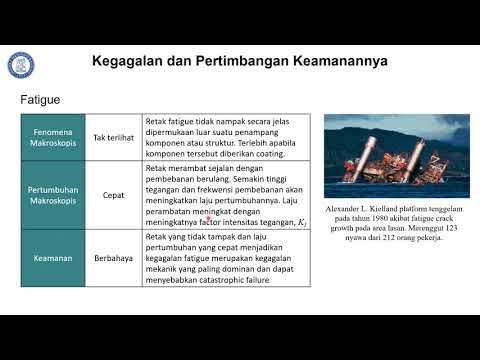

Analisis Kegagalan Logam: Modul 1 Segmen 4 (Pertimbangan Keamanan dari Kegagalan)

5.0 / 5 (0 votes)