Gold Outlook

Summary

TLDRIn this video, the speaker discusses the outlook for gold, comparing its historical trends to current performance. They highlight how gold tends to break out before rate cuts and continues to rally over long periods, often lasting a decade. While acknowledging that gold generally underperforms the S&P 500 over time, the speaker emphasizes its potential as a hedge, especially during economic downturns. They also caution against short-term flipping, noting that gold's movements are typically slow and deliberate. The overall message is to use gold as a signal and hedge rather than a primary investment.

Takeaways

- 📈 Gold has historically shown strong rallies before rate cuts, as it did in 2019 and 2024, often following a similar pattern.

- 💡 In March 2024, gold's performance signaled a mid-cycle top for Bitcoin, offering crypto investors valuable market insights.

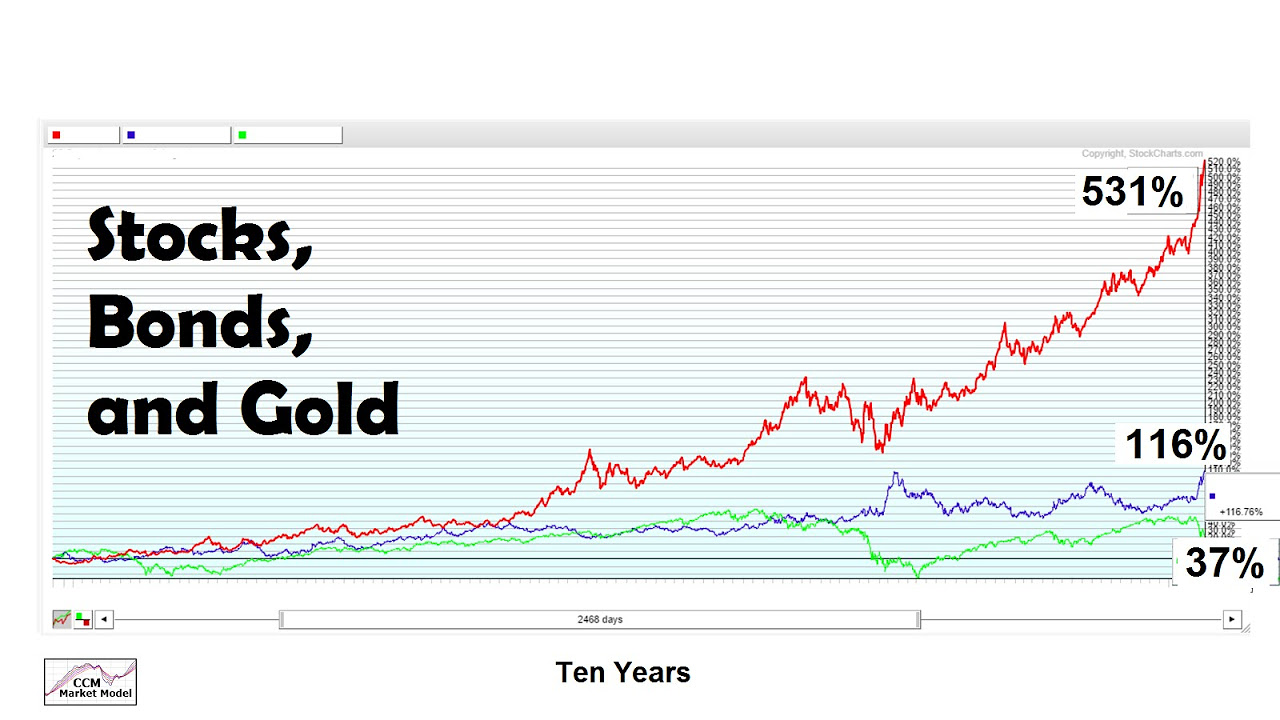

- 🛑 Over the long term, gold tends to underperform the S&P 500, but it serves as a useful hedge during times of economic uncertainty.

- ⏳ Gold's bull markets tend to last over a decade, in contrast to faster-moving assets like Bitcoin or altcoins.

- 📉 Significant pullbacks are expected during gold's bull runs, but historically, gold has always found support at key moving averages.

- 🏦 Even during the financial crisis and major downturns, gold typically experiences temporary drops before resuming its upward trend.

- 🚀 While gold has rallied about 27% from its last breakout point, it may continue moving toward higher targets like $3,500 depending on future market conditions.

- 🔄 Gold's movements can be slow and steady, with long periods of consolidation and occasional pullbacks before resuming its upward trajectory.

- 📊 Many investors remain bullish on gold as a hedge, despite its longer-term underperformance compared to stock indices like the S&P 500.

- ⚠️ The speaker emphasizes the importance of viewing gold as a long-term hedge rather than a short-term flip, cautioning against making short-term trades based on brief price movements.

Q & A

What is the main focus of the video?

-The main focus of the video is providing a general market outlook on gold, discussing its past performance, and making predictions based on historical trends.

What was the price of gold the last time the video creator discussed it, and what prediction did they make?

-The last time the video creator discussed gold, it was priced around $2,000 per ounce. They predicted it would rally to around $2,500, which has since happened.

How does the video creator compare gold to Bitcoin in terms of market cycles?

-The creator compares gold's breakout before rate cuts in 2019 and 2024 to Bitcoin’s midcycle top, suggesting that observing gold’s performance can serve as a signal for Bitcoin’s market trends.

What does the video creator suggest about gold as a long-term investment?

-While the creator acknowledges that gold tends to underperform the S&P 500 over a long enough time period, they suggest it can serve as a hedge during times when the S&P is flat or underperforming.

How does the video creator describe the gold market's pace of movement?

-Gold moves very slowly compared to assets like Bitcoin. Its bull markets can last for a decade, and its daily or monthly price movements are often minor compared to cryptocurrencies.

What key indicator does the creator use to assess the strength of gold’s bull market?

-The creator uses the 20-month Simple Moving Average (SMA) and the 21-month Exponential Moving Average (EMA) as a bull market support band for gold, indicating its long-term trend.

What comparison does the creator make between gold’s performance in the 2000s and the present day?

-The creator compares gold’s performance during the 2000s bull market, where it rallied 600% from 2001 to 2011, with its current performance, suggesting that it is once again in a slow, long-term uptrend.

Why does the creator believe gold is a useful signal for crypto investors?

-The creator believes gold serves as a signal for crypto investors because, historically, its breakouts have coincided with significant moments in the crypto market, such as Bitcoin’s midcycle tops.

What does the creator say about potential pullbacks in gold’s price?

-The creator expects occasional pullbacks to the bull market support band but advises against selling in anticipation of these pullbacks, viewing them as buying opportunities instead.

What is the creator’s outlook on gold's future performance?

-The creator expects gold to continue rallying, with occasional pullbacks, and speculates that its bull market could last for several more years, potentially reaching new highs between $3,100 and $3,500 by 2025.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Gold Can Add Value To A Stock/Bond Portfolio

DİNLEMEZSEN ELİNDEKİNİ ALIRLAR! / BUNLAR YÜKSELECEK!

JETZT!!! AUF DIESES BITCOIN BREAKOUT HABE ICH GEWARTET! [ERST schauen, DANN Handeln!]

Silver Stackers: "China Has Your Back" - Mike Maloney

【利確】ビットコイン・イーサリアムも利確しました!3月相場はネガティブに見ていますが1回転アルトの上昇に期待します【最新の仮想通貨分析を公開】

Bitcoin Marktupdate: Crash überfällig + Infos zur Altcoin-Saison 👀

5.0 / 5 (0 votes)