No, l'INPS non è uno schema Ponzi

Summary

TLDRThe speaker discusses the nature of the pension system, refuting the claim that it is a Ponzi scheme. They explain that pensions are funded by workers' contributions and are designed to provide a modest return in retirement, based on life expectancy and social contributions. The speaker argues for a more transparent system, like the Swiss second pillar, where individuals can see their balance and receive a pension directly related to their contributions.

Takeaways

- 🤔 The speaker expresses skepticism about the characterization of the pension system as a Ponzi scheme, arguing that it is not inherently bad and is based on the concept of contribution and benefit.

- 💡 The pension system is described as a mechanism where contributions are made by workers, and benefits are drawn from the system by those no longer in active employment, aiming for a balance between equity and sustainability.

- 📉 The speaker acknowledges that the traditional pension model was based on assumptions that are no longer valid, such as a stable ratio of workers to retirees and a fixed life expectancy.

- 👴 The aging population and increased life expectancy are highlighted as significant challenges to the sustainability of the pension system, which were not accounted for when the system was established.

- 💰 The transition from a retributive to a contributive system is discussed, where the focus shifts from a direct correlation between contributions and benefits to a more complex system influenced by life expectancy and social factors.

- 🌐 The speaker mentions that the pension system is not just about retirees but also serves to provide for those who have never worked, suggesting a broader social safety net function.

- 📊 The concept of a 'second pillar' in the pension system is introduced, hinting at the existence of alternative models such as the Swiss pension system, which might offer a more individualized and transparent approach.

- 💼 The idea of a pension system being managed by the state is challenged, with the speaker expressing a preference for a system where individuals have direct control over their contributions and future benefits.

- 📈 The speaker discusses the potential benefits of deferred taxation in the pension system, where contributions are made tax-free and taxed later at withdrawal, possibly at lower rates.

- 🚫 The speaker criticizes the inefficiency and high administrative costs of the pension system, suggesting that a simpler, more direct system might be more effective and less costly.

- 🌿 The notion of self-sufficiency in old age is briefly considered, with the speaker expressing a personal preference for a system where individuals are responsible for their own financial security in retirement.

Q & A

What is a pension system?

-A pension system is a structure where individuals contribute in some way and later withdraw benefits, typically from those who are working. The contributions are made by active workers who allocate a portion of their compensation into a fund from which retired individuals, who are no longer able to work, draw money.

Why was the old pension system considered unsustainable?

-The old pension system was considered unsustainable because it was based on a society with a high ratio of workers to retirees, around 1 to 3. It did not account for increased life expectancy and the aging population. The system was flawed from its inception as it assumed constant parameters, such as people retiring at 60 and dying at 70, with many young workers and few elderly people, which is not the case today.

How did the pension system transition from a retributive to a contributive model?

-The pension system transitioned from a retributive model, where the elderly received an amount close to their last salary, to a contributive model. In the contributive model,理论上, individuals have a 'drawer' where they put money and later receive a monthly pension or annuity, the expected value of which corresponds to what they have contributed, minus a social quota.

What is deferred taxation in the context of the pension system?

-Deferred taxation in the context of the pension system refers to the fact that the money individuals contribute to the pension system is not taxed at the time of contribution. Instead, the state graciously does not tax these contributions, but they are taxed later when the individual starts receiving their pension benefits.

How does the speaker feel about the need for a pension system?

-The speaker expresses a personal opinion that a pension system is not strictly necessary and that they would gladly do without it. However, they acknowledge the social aspect of pensions, which also serve to provide for those who have never worked, and recognize that a system is needed to avoid individuals becoming a social burden.

What is the speaker's view on the Swiss second pillar pension system?

-The speaker views the Swiss second pillar pension system as the only one that makes sense. They prefer a system where they can see their balance and, in old age, receive benefits based on clear formulas, similar to the Swiss pension fund system.

What is the speaker's stance on the idea that the pension system is a Ponzi scheme?

-The speaker refutes the idea that the pension system is a Ponzi scheme. They explain that a Ponzi scheme promises exceptional returns not generated through investments but solely from new entrants' money. In contrast, the pension system does not promise absurd returns; instead, it provides benefits that are generally less than the contributions made.

How does the speaker describe the accounting aspect of the pension system?

-The speaker describes the accounting aspect of the pension system as a fungible process where the money contributed today is used to pay the pensions of others. It is not a direct return of the same money but rather an accounting entry where the contributions are matched with the benefits payable to retirees.

What are the speaker's thoughts on the role of general taxation in funding pensions?

-The speaker suggests that pensions could be funded through general taxation instead of specific contributions to the pension system. They question why the INPS (Italian National Institute of Social Security) needs to pay pensions and considers that the system could be funded with general taxes.

How does the speaker view the social aspect of pensions for those who have never worked?

-The speaker acknowledges that pensions also serve a social purpose by providing a pension to those who have never worked. However, they question whether this should be specifically funded through the pension system or could be covered by general taxation.

What is the speaker's opinion on the management of the pension system?

-The speaker criticizes the management of the pension system, mentioning the high number of employees and the associated costs. They suggest that these costs could be reduced and that the system could be more efficiently managed.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Pyramid Schemes and Ponzi Schemes Explained in One Minute

Why Bitcoin is a Scam

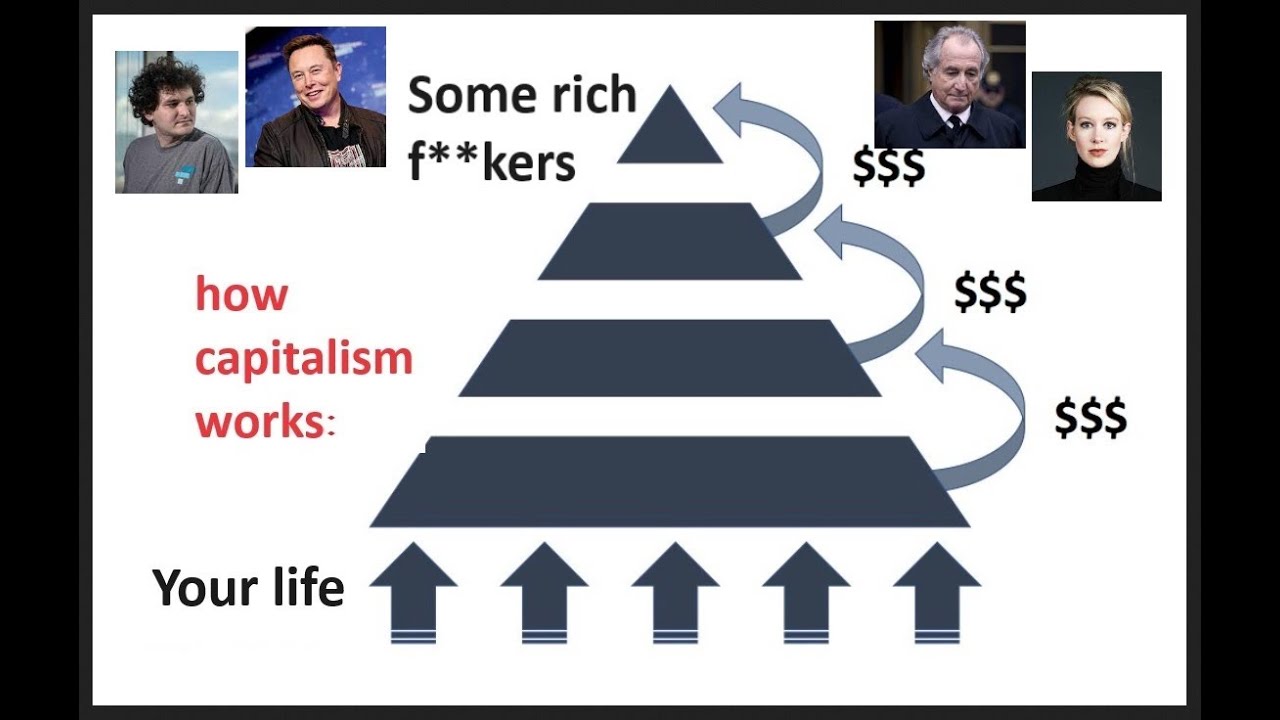

It’s all a Ponzi scheme: why scams, grifts and cons are everywhere under capitalism

Why India dependent on Pension? | National Pension Scheme | Family Pension | UPSC GS2 GS3 | StudyIQ

Does science prove everything?

Modi Takes Action on Anti-National Elements: विदेश यात्रा से लौटते ही दिखाए कड़े तेवर | Sanjay Dixit

5.0 / 5 (0 votes)