Mark Douglas 10 Principles For Trading Consistency Trading Psychology

Summary

TLDRThe video script delves into the concept of probabilistic principles in trading, emphasizing the importance of treating every trade as a unique event with no connection to past outcomes. It discusses the psychological challenges traders face, such as the tendency to assume patterns in randomness, and the necessity of disconnecting from the illusion of certainty. The speaker advocates for self-talk to reinforce the understanding that each trade is an independent event, influenced by diverse and unpredictable market factors. The script also highlights the importance of having a robust trading system with a good edge and the need for traders to internalize this probabilistic mindset to improve their decision-making and avoid common trading errors.

Takeaways

- 🎯 Embrace the probabilistic nature of trading: Every moment and trade is unique, with no certain outcomes based on past results.

- 🧠 Recognize the importance of core beliefs: Beliefs like 'anything can happen' and 'every moment is unique' are crucial for consistent trading results.

- 🔄 Disconnect from past outcomes: Even after consecutive wins or losses, maintain a probabilistic perspective to avoid biased decision-making.

- 💡 Understand the limitations of analysis: While analysis can inform predictions, the reasons behind correct predictions are often unknown, emphasizing the guesswork inherent in trading.

- 🚫 Avoid money management errors: Do not let the illusion of certainty from consecutive outcomes lead to larger positions or poor risk management.

- 📉 Accept the unpredictability of market events: External events, like unexpected company announcements, can impact trades and are beyond a trader's control.

- 🤔 Practice self-talk for reinforcement: Use affirmations to internalize the principles of probabilistic trading and counteract ingrained beliefs.

- 💼 Be prepared for the cost of discovery: Be willing to spend the necessary amount to determine if a trade is a winner, as dictated by your trading edge.

- 🔄 Acknowledge the diversity of market participants: The intentions of other traders submitting orders can lead to any outcome, reinforcing the uniqueness of each trade.

- 📈 Execute trades based on your edge: Regardless of the market's unpredictability, stick to your trading signals and manage potential wins and losses accordingly.

- 📝 Write down key principles: Having these principles visible can help to reinforce the right mindset and prevent cognitive biases from influencing trading decisions.

Q & A

What is the core concept of 'probabilistic principles' discussed in the script?

-The core concept is the understanding that every moment in trading is unique and that outcomes of trades are independent of each other, emphasizing the importance of a probabilistic perspective over a deterministic one.

Why is it important to believe that 'anything can happen every moment is unique' in trading?

-It's important because it helps traders to avoid the cognitive bias of assuming that a series of wins or losses will continue, which can lead to poor money management and trading decisions.

How does the script suggest traders should react when they experience a series of winning trades?

-The script suggests that traders should consciously disconnect the outcomes of each trade, recognizing that each trade is an independent event with no relationship to the previous or next trade's outcome.

What is the potential risk of not operating from a probabilistic perspective in trading?

-The risk is susceptibility to money management errors, such as placing larger positions than the account size would normally dictate, or being resistant to setting stops, which can lead to significant losses.

What does the script imply about the nature of analysis in trading?

-The script implies that even with analysis, the reasons why predictions are correct are often unknown, and thus each prediction should be treated as a guess rather than a certainty.

How does the script address the unpredictability of market outcomes?

-It addresses it by emphasizing that the diversity of intentions of other traders and the unknown nature of market orders make it impossible to predict the exact outcomes of trades.

What is the purpose of the self-talk statements provided in the script?

-The purpose of the self-talk statements is to help traders internalize the probabilistic principles and to guide their behavior in a way that aligns with these principles, ensuring a consistent approach to trading.

What is the significance of the coin flip exercise mentioned in the script?

-The coin flip exercise is used as an analogy to illustrate the concept of maintaining the odds in one's favor despite a series of unfavorable outcomes, highlighting the importance of sticking to a strategy based on probability.

How does the script suggest traders should handle unexpected market events, such as a sudden announcement affecting stock prices?

-The script suggests that traders should accept the unpredictability of such events and continue to execute their trading signals based on their edge, being prepared to either profit or incur expenses without letting emotions dictate their actions.

What does the script recommend for traders to make the probabilistic principles 'real' in their trading practice?

-The script recommends writing down the principles and self-talk statements, and reviewing them before executing any trade until it becomes a natural part of the trader's mindset, helping to override any entrenched beliefs that may conflict with these principles.

What is the underlying message about beliefs in the script, and how are they related to trading behavior?

-The underlying message is that beliefs exist as structured energy that influences our perception and behavior. In trading, it's crucial to recognize and replace any beliefs that are inconsistent with the probabilistic principles to ensure rational and effective trading decisions.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Mark Douglas Trading Psychology 6/7 Probabilistic Principles

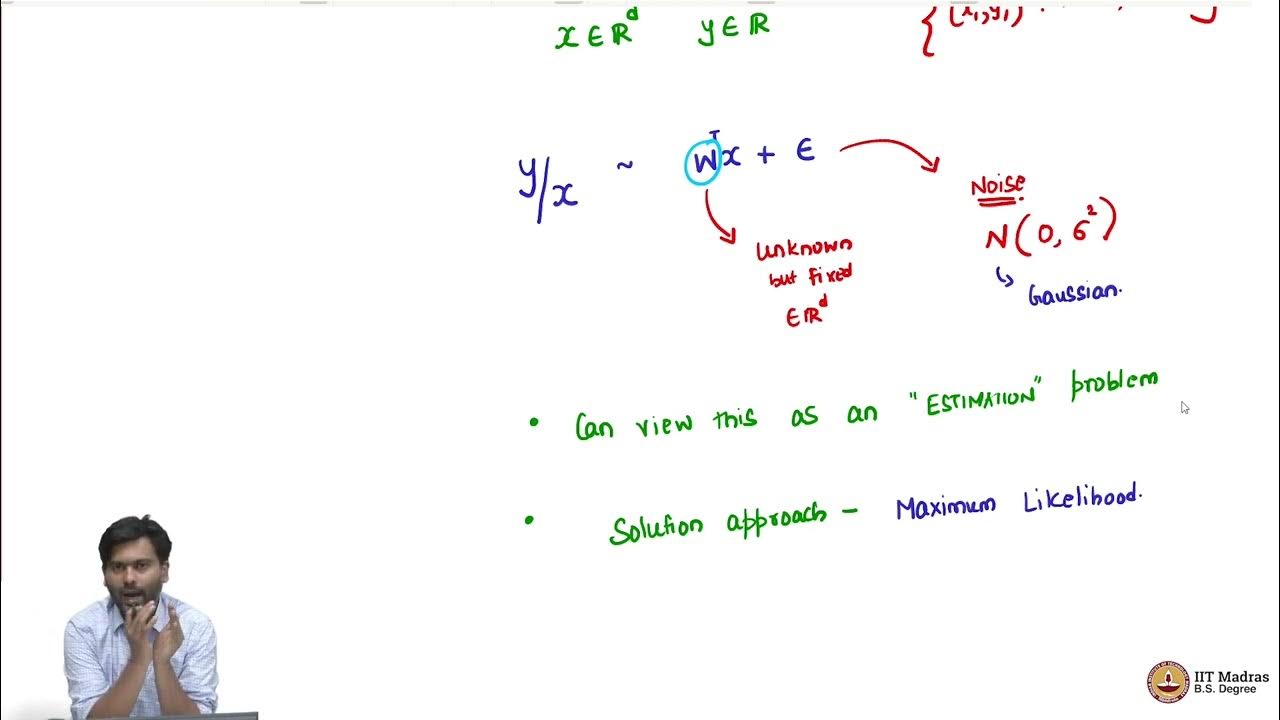

Probabilistic view of linear regression

Macro 1.3 - Comparative Advantage & Gains from Trade - NEW!

Mark Douglas के 15 Secret Rules जो 95% ट्रेडर्स को नहीं पता | Trading in the Zone Summary in Hindi"

How to use Time & Price (ICT Macros)

Master Order Blocks to Trade like Banks (no bs guide)

5.0 / 5 (0 votes)