Is there a Bubble in Defence Stocks??

Summary

TLDRThe video script offers an in-depth analysis of the defense industry, focusing on market trends, business nature, and valuation perspectives. It discusses the cyclical nature of the sector, the impact of government policies on import substitution and exports, and the financial performance of key players. The speaker also explores investment strategies, emphasizing the importance of understanding market sentiment, growth rates, and technical analysis to identify entry and exit points for investors in the current bullish market.

Takeaways

- 😀 The script provides an overview of the defense industry, discussing its current state and future prospects.

- 📈 The defense industry is characterized by cyclical growth phases, including early-stage business valuations and sentiment-driven market movements.

- 💡 The speaker emphasizes the importance of understanding the nature of the defense business, which is capital-intensive and often dependent on government orders.

- 🌐 The discussion includes insights into the global market, referencing the growth and valuation of the sector from 1992 to 2000 and the learnings from that period.

- 🔍 The script mentions the importance of technical and psychological aspects of the market, and how they can provide hints about the growth story of the sector.

- 🇮🇳 It highlights India's defense expenditure, which is around 1.81 to 1.82 billion USD, and its growth in the last few years.

- 🚀 The Indian government's policy changes have led to a trend of import substitution and an increase in defense exports, which have grown nearly 10 times in the last nine years.

- 🛠️ The script identifies various players in the defense sector, each with their own specializations, such as aircraft manufacturing, electronics, and shipbuilding.

- 📊 The importance of monitoring the order book and P/E multiples of companies in the sector is discussed, as these can indicate the potential for growth and valuation.

- 📉 The script warns about the risks of investing in the defense sector, such as delayed payments and the impact of government fiscal health on company cash flows.

- 📝 Finally, the speaker suggests that investors should have a clear understanding of the sector's dynamics, company fundamentals, and market sentiment before investing.

Q & A

What is the main focus of the industry analysis presented in the script?

-The main focus of the industry analysis is the defense industry, providing an overview and discussing various aspects such as the total addressable market, the nature of the business within the sector, and the different players involved.

What are the stages of earnings and sentiments typically observed in any sector or industry in the stock market?

-The stages typically include an initial stage where businesses are cheap but show no growth, a second stage of growth revival within businesses, and a third stage where full bloom momentum occurs with full earnings and valuation growth. This is followed by a potential correction in stage four, where earnings correlate with price and stocks may enter a free fall.

What does the script suggest about the importance of starting valuations in the context of the stock market?

-The script suggests that starting valuations matter significantly because if growth rates slow down, it can lead to a significant re-rating of the stocks. Understanding the sentiment and growth sector at all times is crucial for investors.

How has the Indian defense sector evolved in terms of import dependence and export trends?

-The Indian defense sector has evolved from being heavily dependent on imports to a trend of import substitution and an increase in exports. Policy changes by the Indian government have encouraged domestic manufacturing and export of defense equipment.

What policy changes have significantly impacted the growth of import substitution and exports in the Indian defense sector?

-Policy changes such as the introduction of the 'Indian Design' and 'Indian' categories, which mandate a certain percentage of indigenous design and manufacturing, have significantly impacted the growth of import substitution and exports in the Indian defense sector.

What are the different types of players in the defense sector as mentioned in the script?

-The different types of players in the defense sector include companies specializing in military aircraft, helicopters, aerospace structures, radar, communication systems, electronic warfare systems, explosives, munitions, destroyers, frigates, merchant ships, and anti-submarine warfare.

How does the script describe the nature of the defense industry in terms of dependence on government orders?

-The script describes the defense industry as a 'but for' business, which is dependent on government orders. The industry's nature involves a cyclical pattern of order booking, inventory building, order execution, and payment collection from the government.

What factors affect the cash flow of companies in the defense sector according to the script?

-Factors affecting cash flow in the defense sector include delayed payments from the government and the capital-intensive nature of the business, which involves investing in inventory and trade receivables.

How does the script analyze the valuation of companies in the defense sector?

-The script analyzes the valuation of companies by looking at the price-to-earnings (P/E) multiple, the order book, and the conversion of profits into cash flow. It also considers the government's balance sheet strength and its willingness to spend on capital expenditure.

What warning signs does the script suggest for investors in the defense sector?

-The script suggests that investors should be wary if payment from the government starts getting delayed or if companies' cash flows become negative for two to four years, as this could indicate a potential issue with the growth story within the industry.

How does the script discuss the importance of tracking order books and growth rates for companies in the defense sector?

-The script emphasizes the importance of tracking order books and growth rates to understand the potential for companies to secure more orders and to assess whether the growth rates will continue, which is crucial for value investors in the sector.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Complete Guide for Writing a Market Analysis—With Templates!

I'm Investing now as 20% Market Fall looks Impossible - Rahul Jain Analysis #marketcrash #portfolio

Strategic Management Procter and Gamble

🔴 הפד לא יציל את השוק | טראמפ ממשיך להיאבק | המדדים ממשיכים ליפול | עד מתי?

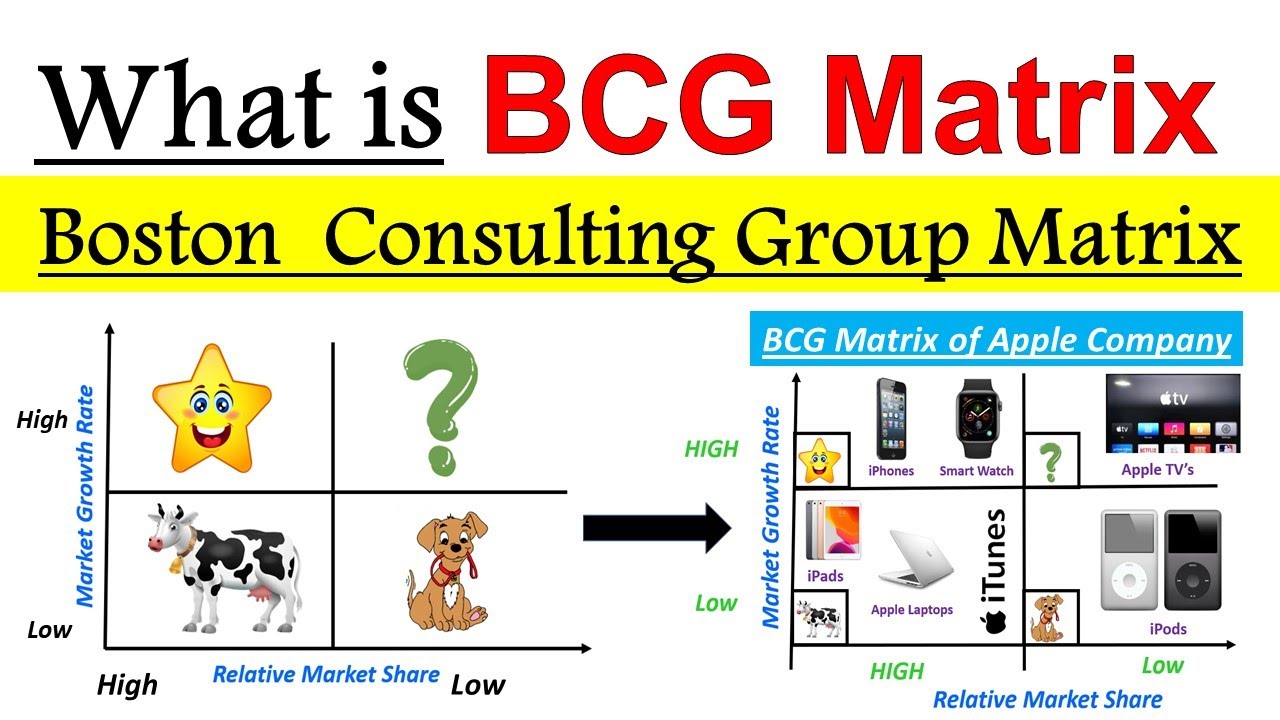

BCG Matrix in Stratergic Management | Boston consulting group matrix | BCG matrix with example

The Charts Bears Don't Want You To See

5.0 / 5 (0 votes)