How To Use Balanced Price Range with IPDA Times

Summary

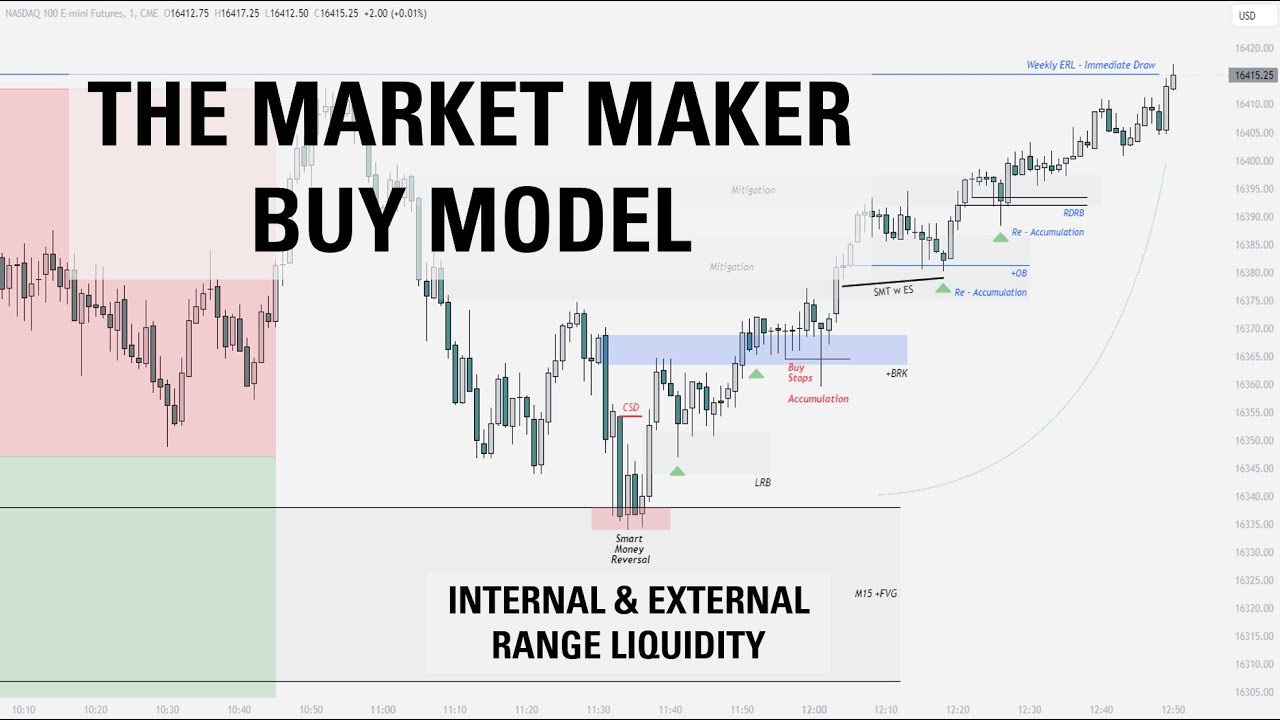

TLDRIn this trade breakdown, the instructor shares their process for executing a successful NASDAQ trade during the AM session. The strategy revolves around understanding order flow, market maker buy models, and key components like drawn liquidity and points of interest. The lecture covers higher and lower time frame analysis, explaining how to identify market reversals, use time and price alignments, and execute trades with precision. The importance of confirming entries, setting targets, and managing stop losses based on price action and time-based patterns is also emphasized.

Takeaways

- 😀 Order flow is a crucial factor in identifying market maker models. If order flow is bullish, you can expect to frame buy models on lower time frames, and if bearish, you frame sell models.

- 😀 A market maker buy model involves price expanding higher, retracing lower, and expanding higher again. Understanding this pattern is essential for trading in line with market order flow.

- 😀 Identifying key liquidity levels is vital for framing trades. Liquidity is drawn towards certain price levels, and this becomes your target for price action.

- 😀 The point of interest (POI) is where price is expected to reverse, and it must be validated by price action before moving forward with trades.

- 😀 A change in market delivery (CSD) is essential for identifying reversals. A bullish breaker pattern signifies the shift from a sell program to a buy program.

- 😀 Smart money techniques (SMT) are used to spot divergences between correlated markets (e.g., YM vs NASDAQ) that confirm reversal points.

- 😀 Time plays a critical role in aligning with price. Specific times (like 3, 6, or 9) add significance to price action, making time and price converge for successful trading decisions.

- 😀 The concept of 'time is price' is key when the reversal occurs at times that sum to 3, 6, or 9. This confirms alignment between time and price for accurate predictions.

- 😀 The first target for a trade should always be the original consolidation level, and the final target should be the drawn liquidity.

- 😀 Entries are confirmed by observing price interaction with key levels like imbalances and order blocks. Once a key level is validated as support or resistance, entries should be made accordingly.

- 😀 Stop-loss placement is logical when considering price action and the rebalancing of imbalances. A low that forms at a specific time and price level suggests the swing will not be broken, reducing risk.

Q & A

What is the main focus of the trade breakdown presented in the script?

-The main focus of the trade breakdown is explaining a market maker buy model trade on NASDAQ, including how the trade was framed, executed, and the rationale behind it using both higher and lower time frames.

How does the concept of order flow impact the ability to frame market maker models?

-Order flow helps determine the direction of market delivery. A bullish order flow indicates that the market is in a buy program, which allows the trader to frame lower time frame buy models based on price expansion, retracement, and further expansion.

What is the significance of a point of interest (POI) in market analysis?

-The point of interest (POI) is where price is expected to reverse and begin expanding toward a draw liquidity. It represents the origin of a market maker model’s expansion, and identifying it correctly is crucial for framing a trade.

Why is the liquidity level of 25,150 important in this trade?

-The liquidity level of 25,150 is important because it is the midpoint between two price levels (25,100 and 25,200). This price level is where liquidity is drawn from, and it plays a role in determining the market’s direction as part of the market maker model.

What does the term 'CSD' (Change in Safe Delivery) refer to, and why is it important in trade execution?

-CSD refers to a shift in market delivery from a sell program to a buy program. This change is crucial as it signals the potential start of a new market expansion, providing a framework for when to enter a trade.

How does the concept of SMT (Smart Market Timing) help in validating a trade reversal?

-SMT refers to a divergence between correlated markets, signaling a reversal. For instance, if one market fails to break a certain level while another does, it can indicate a reversal in the price action of the primary market.

What role does time play in aligning with price to confirm a trade setup?

-Time aligns with price by focusing on specific time windows (like macro windows or IPA times) to confirm when a reversal is likely. If a price reversal occurs at a time that adds up to 3, 6, or 9, it suggests a strong alignment between time and price, increasing the reliability of the reversal.

What is the importance of the 'original consolidation' when setting targets in a market maker buy model?

-The 'original consolidation' is important because it represents the first significant price level or region that price tested during the trade. This consolidation forms the basis for the first target when trading in line with order flow.

Why is the stop loss set below a specific swing low, and what logic justifies this placement?

-The stop loss is set below a specific swing low because it is based on a price level that has already rebalanced an array (a key price level), ensuring that the price has done its job and won’t revisit that low. This provides confidence that the price will not drop further, limiting the risk of the trade.

What is the significance of the time 9:33 in relation to the swing low, and how does it factor into the trade's execution?

-The time 9:33 is significant because when you add the digits (9 + 3 + 3), you get 15, which then adds up to 6 (an IPA time). This time alignment, in combination with the price action at that point, helps confirm that the swing low will not be broken, reinforcing the trade setup and allowing the trader to enter with confidence.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

The Market Maker Buy Model | Full Trade Breakdown $NQ

Smart Money NY Session Trade | ICT Concepts + FVG + Order Block Precision | BREAKDOWN

2022 ICT Mentorship Episode 22

2022 ICT Mentorship Episode 21

2022 ICT Mentorship [No Rant] ep. 11 - Reinforcing Past Lessons & Trading Executions

Start Day Trading Right Now

5.0 / 5 (0 votes)